Out With The Old Bull, In With A New Bull

Bull markets are like rivers, the saying goes. Most begin small, quiet trickles that build to a stream long before bursting open with impressive size and power. Go with the flow, we also say. I am no market sage, but I’m seeing one bull running out of steam while another river is building. And I’m on mission to ride that wave…..

The epic bull of 2009-2022 flooded portfolios with gains unlike anything in modern time. Rushing out of the gloom following the Financial Crisis, the early flows were strong – a sign perhaps of the historic gains ahead.

Stock Prices: The Bigger They Are, The Harder They Fall

On March 6, 2009, the Dow Jones bottomed at 6,469.95. Here at Labor Day 2022, that familiar market index rests above 31,000 – a 5X gain even after the inflation correction from 36,952 in the first week of this year…and whatever is happening now. That first correction was about 20% across the market – a “normal” event in our capital markets bible – and we have a nice bounce this summer that has restored some confidence the bull has room to run.

Top advisors know better. They have seen this movie before – 1987 in bonds, then stocks, the shock to the 10 year in 1994, the Tech Wreck in 2000-2001. And the Financial Crisis, when values fell in half.

Protect My Income Please

If you were contemplating retirement in 2007, exiting the market at the same time would have been a good short/intermediate term call. Waiting a few months crushed your account value. And this is the moment we often misunderstand as an industry. We are quick on the trigger to say, “Stay the course, you have decades to live!”. And that may be true, but it’s a tough call for someone not in our world who may not believe they have that generous time horizon. When you are no longer drawing a paycheck, a 50% drop in your retirement account is financially and emotionally devastating.

Chances are you know one of the lucky ones – and also one of the less fortunate. My late father surprised me by saying he had fully annuitized his modest retirement account when the Dow hit 13,000 – with no knowledge or expertise. He thought it was just “enough”. He passed away in 2016 never regretting his move – as well as the decision to convert all of his retirement annuities (he was an academic physician) to two life annuities that my mother relies on today at 88. His primary objective was to protect – to protect his family, his lifestyle, my mother. No amount of potential opportunity was worth the risk. He shared stories with me about friends of his with far more assets that were investors and loved the “action”. He never had any interest – neither does my mom.

A Little Empathy Goes a Long Way, and it Starts with Clarity

Regular readers know that I rail about our industry’s obtuse language, awkward procedures and regulation-driven communications. Our Executive Board at Next Chapter recently met and the directors unanimously accepted the challenge posed by Ken Dychtwald and seconded by John Thiel that we have to clean up our act – and language matters. More to follow for sure, because the admonition is not just to deal with current friction points, it is to help the industry prepare for the future. A glorious one at that – if we can pivot.

There’s A New Bull Market in Town

The OBM (Old Bull Market) was a historic opportunity to grow assets. The New Bull Market (NBM) is about protecting those gains. The winners in the OBM ignored market volatility and rode on. Many of the top OBM advisors kept clients invested to max out the market’s advance.

In the New Bull Market, many of the winners will have to ignore the anxiety of retirement and live on. The best advisors will now keep clients on track to max out their accumulated assets. In the Old Bull Market, you could get away with leveraging bullishness with options and margin. In the New Bull Market, you need to explore protecting client assets with insurance, annuities and credit.

The Old and New Bulls require a different perspective. In the Old Bull, you focused on the future. In the New Bull, you focus on today—and maybe tomorrow. In the Old Bull, you were a guide and a coach, leading the team. In the New Bull, you are still leading, but now you are more of a problem solver and a therapist. And the clients are mostly the same clients, though the typical one is now surrounded by three generations of family members you need to include.

A New Bull Market for a New World of Advice

The opportunities of the New Bull Market were created by the changing priorities, objectives and concerns of today’s investors. You know about the age wave of retiring baby boomers departing the workforce at 13,000 per day. They tell researchers they worry about five things:

- Paying for healthcare

- Outliving their money

- Falling markets

- Unexpected big bills

- Remaining independent (with a healthy brain and body)

These concerns form the basis of a New Bull Market advisory practice. In the old market, you were helping clients grow assets for unknown future costs. In the new market, the costs are increasingly known and you may have to stretch clients’ assets to meet those costs. In the OBM, you made investments and hoped they worked out. In the NBM, you create solutions that have to work out.

The winning advisors in the new market will earn their success. There are new tools they need to use to help clients through those five worries. New Bull Market winners will know the answers. They will be able to rattle off their most common solutions quickly and with confidence. That confidence will be a welcome contrast to advisors stuck in the Old Bull Market mindset. The leaders are now sharing their perspective with clients—on retaining assets, consolidating assets and earning referrals.

Industry veteran Tim Seifert, head of Retirement Solutions Distribution at Lincoln Financial Distributors, makes the business case for protection. He points out that we look to “planning” to establish the basis for a relationship with clients and their families. And that is the bedrock for sure. So much easier to confront falling account values in the context of their actual impact on a retirement plan. Seifert quotes data showing dramatic increases in asset consolidation for advisors that plan.

Don’t Underestimate the Value of a Good Protection Plan

Seifert’s point – echoed by top advisors I have interviewed recently – is that adding “protection” to that financial plan is a critical, additional step to locking in those relationships. The bull market in retirement is creating a new bull market in strategies designed to protect clients by leveraging their assets to better meet the as yet unknown demands of stuff that just happens – to most everyone. And protection pays, according to Seifert, who again shows data proving that “protection” added to “planning” is near fool proof practice management to retain and grow client relationships, assets and referrals.

With a protection focus, you will be talking about these opportunities – and solutions:

- long-term care strategies

- Longevity protection

- Protected income sources

- Liquidity through security-based lines of credit

- Financial wellness

Advisors who solve for the five needs will then face a second dimension of opportunity created in part by the bull market—scale. The Pareto principle is alive and well in financial advice: Fewer than 20% of clients will receive “full service” and even fewer will get complete financial plans. Clients are typically scattered across four to six providers—another outcome of the Old Bull Market. I’m betting that some clients really like their investment advisor. And why not? A 5x gain investment gain? Woo-hoo!

I have an even more sure bet that both clients and their families whose advisors also offer protected income, protection of liquidity, protection of long-term wellness and stay vigilant about those concerns will love their advisors and reward them with their assets, their family assets and their referrals. And that is a Bull Market I’d like to see!

Pareto’s Revenge

25 years ago in Indianapolis a simple question asked by a 21 year old sales assistant awakened an at-scale industry to the benefits of high touch - and set the stage for that scale opportunity to return in 2022.

Way way back in 1997, I met a terrific Merrill Lynch advisor and his young sales assistant who found that 88% of their practice’s revenues were created by just 12% of their clients. “Why do we do so much for people who don’t pay us?”, was her naïve query.

Sharing their discovery with supportive local management, the pair shrunk their book to just 35 households while increasing proactive engagement with each family. The results were staggering. Share of wallet soared as assets were consolidated, significantly boosted their revenues and driving a crazy level of referrals. I captured the story in a 2001 book with Evan Cooper, Attract and Retain the Affluent Investor. But the real traction occurred with the practice management concept of Supernova, followed by a new service model I was privileged to help build - Merrill Lynch Private Wealth.

High touch with fewer clients was not a new concept. Goldman Sachs and most private banks were already reaping the benefits, including high share of wallet, intergenerational wealth transfer and valuable referrals of similar clients. The nuance was acceptance at a “scale” player known at the time for bringing “Wall Street to Main Street”. At the time the average Series 7 registered representative had 500 accounts scattered across 125 households. Applying that 88/12 - or the more familiar 80/20 Pareto principle - meant that most of an advisor’s revenue was earned from just 25 of those households. Skeptics demanded more data - but the facts confirmed the harsh reality.

The march continued - wealth management was an exclusive offering and personal attention was available - to the wealthiest clients.

Fast forward to Fidelity in late 2009. Net outflows to competition spurred analysis that revealed to our new team that even longtime clients were looking for “planning” and “relationship” - and willing to pay more. SOW of high value clients had slid below 50%. A bold new strategy to turn the tide was ultimately successful, driving AUA from $850 billion to now well over $4 trillion and establishing Fidelity’s retail division as the largest Fidelity business unit.

But what about Pareto?

A closer look at the Fidelity retail engagement strategy shows the firm actually embraced Pareto by separating clients by service model. A new advice offering was provided to clients seeking high touch (and willing to pay), while enhanced DIY digital tools created the industry’s biggest robo. In the middle floated the ad hoc offering, the Private Client Group, with the on-call availability of human advisors. So there was respect for 80/20 - at both ends.

The key of course was client segmentation - with service models to match client preferences. Target client personas humanized efforts to better connect with clients. Having an Active Trader offering and a High Net Worth Bond Desk drove more self-directed client engagement and recaptured assets that had decamped for other firms. Buying a bond online became as easy as picking a stock. Many client households had accounts in multiple service models for different purposes and often for different family members.

Results tell the story. Net flows turned positive as Fidelity’s Private Client Group net promoter score soared from 8 to 63. Advice and guidance efforts expanded to include retirement plan participants.

Fast forward again to today. Bull market confidence has helped scatter client assets across the industry to an array of providers. We see wire house numbers averaging 50% SOW - with higher rates among top advisors but the same stubborn 80/20 rule across the board. The “moveable middle” advisor population tops 60% in many firms, according to one IBD CEO and confirmed by others. Typical HNW households are working with 4-6 providers.

Money is on the move - still seeking more “relationship” and “planning” - and the inevitable post-bull consolidation. Add in the march to retirement by the Boomer age wave and you have the makings of a serious battle for assets. Without a better strategy for segmenting and servicing clients, the lack of industry capacity to engage with human advisors will lead to serious losses among “scale” firms dependent on human advisors for coverage.

The biggest players are on it. Morgan Stanley and UBS acquired robo/DIY capabilities. Empower is angling in from the plan participant side, plus Personal Capital and Morgan bought Soliam and also offers Graystone advisors. Merrill is now a bank and touts Merrill Direct. All great additions with significant long-term promise. And therein lies Pareto’s revenge.

80% of financial industry consumers are unaware of these innovations because they don’t see the benefits. They are waiting and wondering - increasingly anxious about their retirement accounts. Annuity sales in the second quarter of 2022 were the highest ever. Securitized lending has soared. Peace of mind, wellness, protected income, certainty - all great objectives but hard to achieve if you don’t have a lot of dough. Add a historic level of advisor retirements and you have even fewer available trusted professionals.

The parts are there, the execution is not. Buying a capability is not the same business as integrating and connecting the capability, aligning it with the delivery mechanisms and then driving adoption among both advisors and consumers. Imagine your new big screen TV without a power cord…..

Meanwhile, Pareto’s Revenge awaits the firms that cannot reach the unengaged clients. FinTech entrepreneurs are salivating over the gaps they can fill with capabilities that work 24/7/365. Imagine the fate of the human advisory firm that misses a client’s window for selecting their Medicare plan, and the robot gets there on time.

Digital journeys, next best actions, client data mining and better segmentation are all in flight, but the number of impacted clients indicates we are still in the very early innings of a long game. At The Execution Project, this is our world. At-scale engagement using client segmentation, advisor coaching, scale plays with targeted offerings using both advisors and direct-to-consumer lead generation in support of advisors. The upside is extraordinary but the work of adoption is dullingly old school. Companies holding on to bull market profits hope the 20% can keep producing but Pareto is on the rise.

Steve Gresham is ceo of The Execution Project, LLC, a consulting firm driving adoption of wealth management innovations, and managing partner of Next Chapter, an industry effort to reimagine “retirement” across 60 affiliated companies. From 2009-2017, he was executive vice president and head of Fidelity’s Private Client Group.

Chart of the Decade

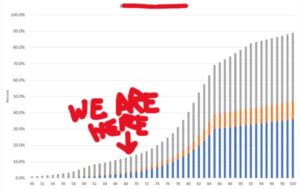

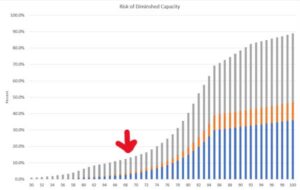

At a recent meeting of top advisors hosted by education innovator Wright State University (where flight was born), I shared this chart under the guise of “opportunity”.

What’s the subject?, I asked. Tesla stock price? Bitcoin projection? Spending on FinTechs? Nearly a perfect S-curve, which favors the early adopters. And the best news, we can catch this one just before the S takes flight – note the arrow.

The big reveal caused a mixed reaction. The majority of the audience reacted thoughtfully, many nodding heads. These advisors see the landscape – every day – through the lives of their clients, their friends and families. The chart is a propensity chart, depicting the likelihood of experiencing some level of incapacity due to one of the three most common health events to cause incapacity – Alzheimer’s, other forms of dementia, myocardial infarction (heart attack).

The savvy advisors know from experience that each of these ailments presents a life change – to the client/patient and to the family. The impact is both immediate and ongoing. Nothing is ever the same. Priorities change. In the world of financial and retirement advice, advisors are needed more than ever and for more complex services.

Our response is critical. We have to react with empathy, engage professionally and with confidence. We become the financial emergency room, transitioning to long-term care. And not just for our primary, affected client – we have to be there for perhaps three generations of family members who are now also affected. Everyone needs to know we have this, we can help.

We don’t have much time before these conditions accelerate in frequency. The current overall propensity rate is 1 in 8 for people age 68 but more than doubles by 78 – and 6X at 88. Over the next ten years, nearly 1 in 3 people we now serve are likely to become incapacitated themselves, and a great many more will be impacted by someone in their life who becomes incapacitated.

For advisors and their firms serving the Baby Boomer age wave of 76 million people, this transition has been looming…but preparation is still light. Every firm and every advisor will need policies, procedures and supportive tools to:

- Identify incapacity for the protection of the client, her family and the firm

- Protect clients and their families from the threats of incapacity, including identity theft, fraud and elder abuse

- Engage families in support of incapacitated clients – as well as clients without family support

- Adjust to the needs of a family of three generations or more and help optimize finances for risk, tax, income and long-term care

Don’t Ignore This Moment

If you are winding down your advisory career, you might be doing the math and saying that in ten years you will be on a beach living the vida mas fina. That’s probably pretty well known by your clients and their families. As Accredited Investor co-founder, Ross Levin said so well at our Next Chapter Rockin’ Retirement event on May 24, top firms are winning clients and keeping clients because they have a “contract” with clients and their families that the firm will be there for them. Another speaker, veteran Tom Bradley of Schwab noted that aging clients – and aging advisors – are now important measures for the valuation of an advisory practice (get the whole program here ADD LINK to NEXT CHAPTER MEMBERSHIP).

One very interesting aspect of this chart is that it is also a good picture of the demand for pretty much everything associated with the historic demographic cohort. If they will need it, you name it and the growth curve will be similar. Demand for in-home caregivers, Medicare counselling, pickleball courts, assisted living facilities…they’re all here at the same time. Consider…..

The Price of Ignorance – Five Risks Ahead

I’ve also spent a lot of time worrying about this issue on behalf of big company clients and I see five significant risks of keeping our heads in the sand:

- We lose current clients and their assets

- We lose the potential consolidation of assets held by our clients elsewhere – that’s a pretty similar number to the total in 1 above

- We lose the client’s family – if we don’t take care of the primary client, the family won’t stick around. Surviving spouses and adult children have no affinity for our failure to act.

- We risk increasing scrutiny as fiduciaries or service providers that do not sufficiently “know your client” – an area of growing interest to state consumer protection regulators. Get ready also for a return of active arbitration in this area as we return to in-person activity after a pandemic slowdown.

- Finally, a firm that does not do well by its aging clients is exposed to significant reputational risk. Poor experiences might be contained in the complaint process, but some of the more colorful cases will doubtless make headlines – electronic or otherwise. I expect a lot of interest in these stories.

Other Than That Mrs. Lincoln, How Was the Play?

Every corner of the financial advice and investment management industry has benefited handsomely, unexpectedly from the historic demographic wave and the power of that wave to lift all economic boats. Now it’s time to repay some of that value by meeting the needs of our loyal clients and their families – all of whom will be encountering their longevity for the first time. Our ability to serve is a function of both will and skill. I’m completely confident we have the skill. Do we have the will?

Steve Gresham is on a mission to improve longevity and “retirement”. He leads an industry initiative, Next Chapter, and is ceo of consulting firm, The Execution Project, LLC. He is also senior educational advisor to the Alliance for Lifetime Income. Formerly head of Fidelity’s Private Client Group, he is the author of five books about wealth management including The New Advisor for Life. He also served for eight years on the faculty of Brown University where he taught the impact of an aging population.