FinTech vs FinTalk

I marvel at the brilliance and passion of inventors. Today’s FinTech pioneers have that stuff and challenge convention with ideas that shame our legacy systems. These geniuses cannot understand why clunky incumbent “tech” persists when better ideas are here for the taking.

And yet most of the inventions never get commercial traction. Demos aplenty and lots of “great meetings” raise hopes that slowly drain away. A sort of “innovation expiration” sets in as the effort loses momentum - and funding - and the innovators retreat to ponder their next move.

Don’t Leave - We NEED You!

We just don’t know it most of the time.

I’ve seen five different causes of the disconnect between much needed innovation and actual success. They are all related and therefore can be either be the spark of rejection or the nail in the coffin of failure.

Numbers - Houston, We Have a Proliferation Problem

@MichaelKitces and team are just brilliant. One of their first great works was the now widely known FinTech Industry placemat of capabilities - all on one page. Innovation has forced some font size shrinkage but that single sheet still captures the landscape. And what a roster it is:

- 186 capabilities in 29 categories

- 24 portfolio reporting applications

- 14 financial planning packages

Daunting.

By comparison, there are a lot of stocks and many more bonds but their world is simplified into S&P’s 11 sectors and the bond world’s 14.

Consumer products are more disciplined - consider the five categories of toothpaste. Even cars sport only 12 categories according to JD Power (though mechanics claim 20 - innovators are everywhere).

I know some CIOs at big companies. They cannot begin to understand the number of offerings. But most also fail to investigate. Do they have active efforts going to find new ideas? More on that in a minute.

Priorities - If Everything is Important, Nothing’s Important

A recent report from a top consulting firm outlines the top most important trends in tech for 2022: 14!

I’ve been in a lot of strategic planning sessions over the years and I’ve not yet seen or given a presentation about 14 trends. And I’ve never seen any successful corporate plan with so many objectives. I know that’s not the point of the work but who and how and where do executive teams find their target?

Corporate focus is a process - it has to have an objective easily conveyed to the full team but also must emerge from the company’s capabilities and values and existing foundation of success. A true company success is a build - not of an entirely new house on raw land but rather improvements to an existing structure.

Don’t view that foundation as a constraint, view it as the solid base on which to grow. Call that a Kodak moment - since Kodak had it and lost it.

Breaking Through - The Pursuit of Acceptance

Another top consulting executive was asked recently about InsurTech and brilliantly observed that most die on the runway having spent most of their venture backing on buying awareness they hope will translate into acceptance. He laments the spend of up to 80% on promotional web search. “The only people making money on that innovation are Facebook and Google”. Wow.

He went on to say the industry needs to work harder to identify emerging technologies and the entrepreneurs behind those innovations. Allianz is one of the firms that has stepped up - creating their Onramp Insurance Accelerator with Securian as well as making investments in capabilities such as LifeYield.

ROI - Why Should I Buy?

This one is on the FinTech firms. Without a clear connection to the buying firm’s bottom line, I cannot imagine any real company writing a real check. And I’ve sat in that chair.

A burden carried by many (most?) FinTechies is that they are unapologetically Techies. But the buyers are business people too often of a totally different background, orientation and personal motivation. One of the most entertaining moments in corporate life is gathering the senior team with a FinTech innovator team and watching the awkward proceedings. Nothing in common - even the lunch selections can be odd as they reinforce the differences.

Integration - Don’t Be an Island, Join an EcoSystem

No company is buying any application for an open hole. There is something there already and it is connected to a bunch of other stuff. None of it might be good. Some of it could be - but you don’t know. And you don’t know what they know or think. Connectivity is all that matters and the ability to connect is as important as the capability. Don’t be the only grounded three prong plug in a workshop full of two prong outlets.

How do you connect??

Adoption - A Problem of Design

My favorite for last. This element is owned jointly by buyer and seller of FinTech capabilities.

First we pick on the seller - did you design your product to be excellent or to intuitively and naturally solve a problem? The sale of “better” is a lot more difficult than “easier”. Most adoption of everything is a function of greater ease along with improved results - so adoption is a function of the DESIGN. The owner’s manual is history - don’t force it on an already busy FinServ.

But don’t walk away Buyer. How many enterprise software purchases have failed to attach a full budget for training and integration?? “We can figure it out and save…” is one of the most devious enemies of corporate success. A race car in the hands of a driver who can’t drive is a …. stupid waste of money. But you get to say you own one….I guess…. IT procurement checks a box and gets to blame the business for failure to drive.

So with admonitions to all sides of the FinTech movement - let’s all just get along and start working together. The upside is worth the effort.

Give me call - we can help.

The Client is Not Always Right

It was one of those “Hello McFly” moments (if you remember the iconic line from Back to the Future with Michael J. Fox). On stage at a national retirement income industry summit featuring brilliant scholars and company CEOs. A panel of confident, self-directed investors said they felt they didn’t need any help (this is before the recent 20% sell off, BTW). “I feel like advisors are trying to sell me something”, each of them remarked. The line of the day came from a top advisor with an insurance company parent that started off replying, “If you feel like you are being sold something, maybe you need something!” Drop the mic – a subdued chuckle rolled through the room.

Perspective is Personal, and Preparedness is a Preference

I’m fortunate to work a lot with the Alliance for Lifetime Income (protectedincome.org), a not-for-profit group dedicated to championing retirement income – supported and funded by 24 of the biggest companies in financial services and retirement. The summit organized by ALI and roundly attended by industry leaders sought to expose all perspectives. The confident over-confidence of investors sounds familiar to those of us who have been around for awhile. If you’ve lost 50% of your account value in a “correction”, you have perspective. That would be most Baby Boomers – the dominant client cohort today and for the forseeable future. The Alliance and its educational arm, the Retirement Income Institute, keep tabs on consumer views with terrific studies like the most recent work, Protected Income and Planning Study with @Cannex - https://www.protectedincome.org/news/in-the-face-of-a-potential-recession-americans-feel-unprepared-for-retirement-and-are-looking-for-protection/

The work of the ALI and the RII shows that people do know better – and they are learning more every day about how little they know.

Welcome to the Curveballs of Retirement

Navigating retirement is a bit like batting in a baseball game against a wild pitcher. You expect the fastball down the middle – the cost of living, healthcare, et al. You prepare for those pitches. But life sometimes gets in the way of the expected and it’s really hard to prepare for the inevitable curveball – like an illness – or a wild pitch like your only home being wiped out by a hurricane. My 88 year mom was standing tall at the plate for the first 25 years of her retirement. My dad set up four two-life annuities from his universities and had a New York State pension. Mom gets five checks a month since he passed away in 2016 - and can’t spend the income. And then Hurricane Ian blew up her idyllic Sanibel Island world. Safely evacuated by my nearby sister, she is crushed but grateful to also own a share in a continuous care retirement center on the mainland where she can live safely and close to both professional care and longtime friends. She no longer remembers how she fought that idea….

Helping Clients Learn How to Hit the Curve

I continue to fear that most people are not prepared for retirement. That’s a big statement, but understand the perspective. Most people don’t have the cash to survive a protracted retirement. Longevity will suck up their savings. Especially if markets and interest rates don’t cooperate. And especially when big expenses, aka curveballs, are added into the mix. A very interesting interview I conducted recently with a terrific advisor revealed his approach to longevity education and planning. He navigates clients through the regular planning process with Money Guide. He congratulates them and thanks them for their patience. Then he says, “And now we do it again – with the ‘what-ifs’ included”. Time to learn how to hit the curve.

That Wild Pitch Just Might Hit Your Head

More and more smart thinkers are talking about the non-financial issues of retirement, or what my ALI colleague Mike Harris calls, “emotional finance”. Your client might have money for retirement but an undeveloped sense of what you will do in retirement to avoid isolation, boredom, lack of purpose. I see those forces eating away the spirit of friends and relatives. Another great industry colleague, Eric Sutherland of PIMCO rescued his mother from her retirement paradise but she lost her friends as they fled to disparate locations. And don’t try to tell me that pickleball is enough to engage a Type A businessperson at the same level. Silver lining: my aging orthopedist stays young fixing those folks.

Practice Management Pandemonium

The bottom line is that there is now building a slowly moving conveyor belt of pre-retirees, new retirees and wannabe retirees, all in various stages of education, realization and comprehension. Unlike the relative order associated with investing for the future when everyone is equally impacted by markets and news – this lineup is all over the place. If I stretch that baseball analogy, we have an unlimited roster of players (clients) of varying abilities facing an equally prodigious pitching staff firing pitches (life events) of all kinds at all of them at once. And that is now the typical advisor’s practice – a free-for-all of issues and events across multiple generation families scrambling to adapt. You will be tested as never before by the sheer volume of activity. Organization, teamwork, digital support all play a role.

Objective: Be Worthy of Being Consulted

Master the madness. Help people face the curveball and at least deflect its damage. Listen to them explain what happened. Listen more. Ask questions. Only then can you provide some perspective, some education. And then listen some more to reactions. There is plenty of time to suggest actions to prevent but seldom any time to linger over an unexpected head shot. Sooth, calm and balm. The best advisors know these events happen, they know how to handle them and that the most important step is listen well. That’s what defines a great advisor in this crazy land of retirement – a listener who has been there and can project their professionalism through their confidence.

Your Retirement Needs an Eco-System

Wikipedia says an ecosystem is “a community made up of living organisms and nonliving components.” A digital ecosystem is a “distributed, adaptive, open socio-technical system with properties of self-organization, scalability and sustainability.”

Welcome to the cutting edge of retirement planning.

In my retirement utopia, clients know the answers to important questions. How much will I need in retirement? How will I pay for healthcare? Can I safely age in my home? They have confidence in the answers to those key questions – and others. Collectively, we call that “wellness”. They call it “peace of mind”.

In my utopian world, financial professionals are able to provide those answers. They are challenged by the underlying complexity that is most often lost on the clients. Effective and reliable solutions are the common objective of clients and financial pros, but there are a lot of moving parts to accommodate, including vagaries of health, financial markets, the penalty of taxes and the longevity of the clients themselves. The questions are simple, the answers not so easy.

Enter The Eco-System

Creating a solid retirement solution involves several asynchronous variables – the Rubik’s Cube of planning objectives. Investment management plays a role, actuarial science has a view, client behaviors and preferences weigh in. Information flow is critical. Financial planning software collects data and mixes scenarios. And all of these capabilities have to talk to each other or the result is a jumbled mess of one-off “answers”. The music store instead of an orchestra.

I like the ecosystem definitions above, especially when they are combined. The interplay between “living” and “nonliving” is elegant science-speak for the dual and complementary roles of technological efficiency and human touch. Financial services technology in the retirement planning utopia is not a replacement for advisers; it’s a tool set that creates capacity and better service. The second definition — the digital ecosystem — goes further: adaptive — open — self-organization — scalability — sustainability. The ecosystem is less a collection of parts than it is a dynamic combination of elements that evolve with changed conditions. Orchestra-like.

No Retiree Left Behind

Competitive retirement planning offerings should have the same flexibility – and efficiency. Can we really say that every client feels covered for healthcare costs, protected income and has adequate liquidity for big expenses in retirement? We will be judged at some point not just by the quality of our solutions but for the ability to reach all of the clients in our care.

We can debate the key parts of a retirement planning ecosystem, so I will start the dialogue with my top ten observations:

- Wellness. Wealth without health or health without wealth? Each is half a loaf. Retirement planning without integrating health care funding and longevity planning is just malpractice. Wellness is highly subjective but assumed by our clients. Read more https://theexecutionproject.com/the-business-of-wellness/

- Taxes. The second issue uniting all the world’s clients is taxation. If we can’t talk about the impact of taxes — all kinds of taxes — then we can’t really say we have a comprehensive plan. In retirement, taxes are especially significant. Knowing which retirement account to draw down remains among the very top client concern.

- Regulation and its impact on client engagement and risk. A mouthful for sure, but the shorthand is that “best interest” is table stakes and most consumers would be horrified with anything less. The world’s fiduciaries are increasing in presence and power. Doing good and doing right are pillars for running a good advice business. Do we really need the federal government to design our business strategy?

- Digital investment services. So far beyond the label of “robo,” these capabilities are a godsend for busy advisers working with multiple family generations. It’s now time to reverse the order of their introduction. First design everything we can to be delivered through the 24/7/365 machines and save the humans for only the most essential work of understanding and translating client needs and concerns.

- Automation of client data and adoption of centralized data management. Will this generation of advisers be the first to eliminate Excel and the Post-it note? Adoption of powerful tools lags way behind their creation. Give that CRM company a chance to prove it’s not just good for mailing lists.

- Communications. Three principles here: how, when and why. Flexibility in the ecosystem customizes your outbound messaging by sharpening the content and its delivery. But our language has to improve. It’s not just jargon – it’s volume. Applications and prospectuses raise more concerns among most consumers, defeating their intent. We must do better. Language is the fastest way to change perception.

- Security, Created by Protection. Three perspectives here. The first is to ensure protection and integrity of client information. Attackers abound. The second is to increase focus on the vulnerability of people as they age. We are still in the lip-service stage here. And finally, we have to include “protection” in our lexicon of solutions. Every client has a balance sheet and all but the most wealthy will need to leverage their assets to provide protection against the risks of living too long, costing too much or needing liquidity for big expenses. Where to start? How about a retirement paycheck?

- The risks of an aging population. Doubling down on “security”, take a lesson from the historic collapse of the Big Three automakers: Demographics matter. The baby boomers own the market for financial advice and pay most of the bills for years to come. Their median age is 66 and they likely trail two attached generations with them, along with a myriad of accounts and complexity and risk. Read more: https://theexecutionproject.com/chart-of-the-decade/

- Adviser hiring, training and retention. Where to start? Surveys suggest top advisers average age 55-plus, and very few young people seem to be entering the industry. ‘Nuff said perhaps – but what to do? We can spend a lot of time here. Financial professionals still in the game have the best opportunity in decades to build a fantastic business. But it will be different from the job of the past 30 years. Getting through a retirement is different than saving or investing for one. Different skills, different systems, different leadership. Older advisors are partnering with younger folks with complementary skills. Real retirement advising needs a team.

- Integration. The inability to see all of your accounts and all of your investments makes clients crazy and prevents financial professionals from providing an effective retirement strategy. Annuities have to be included on the custody platform along with managed accounts and individual securities. Everything has to be in the planning software as well. And then we need to optimize – truly - across the household for risk and tax liability. The very best advisers do this today with heroic effort that begins with integrating systems not easily connected.

Winners Connect the Dots

Onward. The true north for retirement is simple, intuitive experiences for both advisers and clients focused on achieving better outcomes. Industry leadership has shifted to players creating supportive ecosystems that optimize the best of people and machines. The firms that can integrate the great FinTech inventions and product solutions with simple client communications are winning.

Yet despite the appeal of a unified approach, the status quo is a formidable obstacle to change — most advice firms are experiencing record results consistent with record markets. A deeper look reveals structural weakness in many advice offerings that stand in the way of providing a seamless, flexible and compelling client experience. Let’s see who wins the war for net new assets and share of wallet. The path to success is paved with ….simplicity.

Let’s keep this dialogue going. Check out this summary of the forces now transforming “retirement”. Check out the resources for both consumers and financial professionals at the Alliance for Lifetime Income, https://www.protectedincome.org/, and join the industry leadership in the quest for better retirement solutions, Next Chapter, https://theexecutionproject.com/community/

The Business of “Wellness”

Supreme Court Justice Potter Stewart famously remarked about pornography, “I know it when I see it”.

Unfairly perhaps, “financial wellness” - or just “wellness” to her friends – is suffering a similar condition by defying consistent description by a notoriously analytical financial services industry anxious to connect better with clients. “Wellness” is fancied by CMOs and some CEOs for its promise of delivering enduring client value, but how do you introduce a concept that many clients might already be expecting – and not receiving?? I mean, isn’t the point of our advice and solutions to make clients financially “well”?? Awkward…

Nail That Jello to the Wall

The squishiness of “wellness” lies in the highly subjective benefits of being well. Not surprising when you consider the nearly infinite array of client situations and family dynamics where healthcare issues alone often disrupt even the most detailed financial plans. There are foundational elements – health, finance, security, wealth transfer – but no easy map to follow, no standardized answer. And that makes trouble for advice providers that don’t listen well or that cannot be both empathetic and purposeful in providing the needed guidance and solutions. “Wellness” doesn’t fit in a product box.

Peace of Mind

“Wellness” is most basically “peace of mind”. That’s how Frank McAleer of Raymond James defines it - he’s the leader of their effort with plenty of experience translating “wellness” into a business plan. That peace of mind includes financial, health and family needs that require preparation. More clearly, “What is the list of stuff you most worry about or that could go wrong as you live longer?” And what about family members for whom you could become responsible? Those lists are different for a 26 year old DC plan participant than they are for a 60 year old pre-retiree or a 75 year old with dementia. Or any of their family members. But the concerns are very tangible to all. Though the inevitable issues of longevity are tough to confront, there is a calm achieved by being ready.

Get Ready for the Wellness Experience

Wellness is the objective of planning - it is both a noun and a verb. An assessment at a single point in time of conditions that are guaranteed to change. Issues of wellness so pervade real life that calling out “wellness” as a concept separate from a plan, even in addition to a plan, seems superfluous. Do clients and retirement plan participants really need to be told we are working to help you achieve “wellness”? Or are we talking to ourselves again, to our advisors and product teams and marketers that we now have a higher calling than investing?

This is the conclusion reached by our Next Chapter study group on Financial Wellness. Wellness is a more catchy, benefit-sounding label than “success”, which is the presumed objective of planning. But clients don’t benefit from the words, they expect the results. I get the same weird feeling when I fly and a flight attendant calls out today’s opportunity to have the Airline X “Experience”. The what? Can we just land on time please? There is nothing outside of a first class pod that is worth calling out as an in-flight “experience”. Marketing overreach.

I’ll Take a Little Empathy with that Investment Portfolio, Please

“Wellness” and in particular “financial wellness” are internal design directives given to financial companies and advisors to make sure they don’t overlook the requirements of “wellness” in the solutions being created for and delivered to plan participants and advisory clients. To wit, the Next Chapter team, including the RJ longevity program leader, Amanda Stahl, named “empathy” as the leading design principle of “wellness”.

A Slogan in Search of a Business Plan

Integrating “wellness” into financial services is necessary to establish and sustain the value of the product/service offering. If the end beneficiaries don’t achieve peace of mind from their retirement plan, benefits offering or the services and solutions offered by their financial advice provider, they can be lured away by an offering that promises that peace of mind. Nothing motivates action more than fear – and there is genuine fear that manifests when you think you will run out of money or have to sell your home and move into assisted living. The reality of this vulnerability is becoming of greater concern to advice firms and plan sponsors who are not actively engaged with most of their clients (see Pareto’s Revenge https://theexecutionproject.com/paretos-revenge/ ).

The Business of Wellness – Five Levers Drive Results

My research and business experiences (successes and many failures) suggest that the most common and most impactful business growth objectives of broker/dealers - net new assets, consolidated assets and client household share of wallet - can be achieved with these actions based in “wellness”. Five levers in rough order of max impact/min effort. Intermediate measures like NPS (we used at Fidelity) can provide earlier confirmation of momentum:

Lever One: Words Matter – The Value of Common Sense Language

even very analytical services like asset allocation and investment policy can be made much more user friendly when rewritten from the perspective of conveying “peace of mind” instead of purely technical concepts and - essential - compliance disclaimers (Big fund companies are the frequent violators here). Language use is the fastest way to change perceptions of a firm, plan sponsor or advisor. Our Next Chapter Executive Board has been adamant on this perspective of improved language – stay tuned.

Lever Two: Design for Better Outcomes instead of “Best Efforts”

Most retirement solutions in place today are market dependent. Results can be impacted by market risks well known to the designers but not so familiar to the investors. The designers rely on their knowledge of capital markets research and the known risks are further mitigated by assuming a long-term time horizon to smooth variations. That’s a rationale, objective approach intended to work across a broad population – and generally it does.

But even the brainiacs will admit to “terminal point risk” that awaits unsuspecting retirees rolling out or annuitizing after a significant correction. Today’s retiring clients and plan participants have seen down markets – big ones – in 1987, 2000-01, 2007-09 and some sharp corrections in between. My late father knew nothing about markets or investing, but he knew when the stakes were too high for his peace of mind. He worked for universities his entire career and earned the negotiated benefits of retirement annuities. He surprised me by sharing that he had converted his 50-50 plans to 100% annuities with my mother as second life. He never looked again at the market. He cashed the checks, and she does to this day at 88. My parents’ definition of “financial wellness” was not having to worry about the markets, their income level, their ability to finance healthcare and the ability to age in their home. Done.

Once again, we are in the way of “wellness”. The best efforts approach undermines peace of mind by not providing a certainty of outcome. A risk matrix offering a percentage likelihood of success is great for analytical clients whose peace of mind is satisfied by data, but I don’t believe that represents more than a fraction of clients - especially when “client” is defined as a retiring couple and their family. In most client households there is someone who values protection and guarantees over potential returns or capital market theory, so why not at the same time (go to #3..)

Lever Three: Redefine the Client as a Family and a Household..and Engage

Most advisor engagement remains with a typically male and financially confident head of household. Firms are aware but not yet effective in providing (requiring??) more direction to advisors for supporting the family across today’s most common HNW construct of three generations - aging parents and adult children surrounding a Baby Boomer couple. This demographic sandwich will drive more than 80% of advice industry profits through at least 2030 and success is dependent on retaining existing clients and consolidating their not-held assets from competitors gearing up to mount a similar effort.

At Fidelity we sought the identity of other family members and developed simple communications to be more inclusive of less financially savvy relatives. We created a specific design target - a Baby Boomer wife and mother - to guide the design of the branch office right down to the furnishings and colors. But the operationalizing of “family” means some serious additions to CRM and data stores as well as some much needed training and coaching of associates that talk to clients. Peace of mind is different for different age groups and levels of financial literacy. Today’s Boomer retirement plans are providing real time education for their children and grandchildren. Some positive, some not so much.

Lever Four: Service Models for Everyone

Fresh off the summer vacation season, we are reminded of the challenges of bringing everyone together. Each family member has their quirks. Separately identifiable service models provide family members with options for engagement - especially with respect to communications, pricing and product options. “Separate” provides space and identity and satisfies each individual’s peace of mind. And that’s financial wellness. Because peace of mind for one client may be the reliability of a paper account statement - for another it may be the immediate transparency of a mobile app. The ability of an advisory firm, plan sponsor and plan administrator to offer a choice of service models - including in-plan advice and fiduciary wealth management (including trust) is fast becoming the expectation of HNW families - and history indicates those expectations roll “downhill” quickly to the mass affluent and beyond. Separate service models allow the advisor/firm/sponsor/platform owner to more easily and consistently focus on improvements for unique cohorts. Each needs to know we care enough to know and deliver against their preferences.

Lever Five: Adoption is the New Innovation

Last for a reason, “adoption” here refers to the integration of “wellness” principles into the delivery of services and solutions. There is both a “will” and a “skill” perspective to adoption. Financial advisors may or may not have the skill to help clients plan with the full empathy needed to anticipate the needs of an aging parent or pay off a child’s college loan. That’s a management problem for an advisory firm to make sure empathetic advisors are in place. Bull market success further reduces the incentive to engage - the “will” - as well as the energy to reach all of the clients in a given advisory practice. This failure to engage creates real risk for firms with low share of wallet - as we saw with Fidelity in 2009. Especially if their engagement is wholly dependent on the will of the human advisor and does not - as we did at Fidelity - complement busy advisors with consumer outreach in support of advisors to drive warm leads. But wait a minute, Merrill Lynch did the same with Total Merrill 20 years ago. The future of large scale client engagement is to provide some level of lead generation and direct-to-consumer outreach on behalf of advisors and not rely on human advisors to fully shoulder the burden of optimizing the opportunity of the full client roster.

Discovery: We Can Design for Adoption

Adoption is also a challenge to the operational eco-system of the advisory firm or plan administrator. Call it “ethos” or values or customer centricity, the issue of wellness adoption by the eco-system is simultaneously an issue of empathy and humility and the willingness to invest. Removing friction from systems benefits consumers and delivering associates. But it needs a vigilant champion empowered to take action. And budget to improve system effectiveness.

The reality of adoption is that it is seldom achieved because of either will or skill. Adoption of the complex array of anything - including the myriad “wellness” measures needed to produce human peace of mind - is most often the product of DESIGN. The most adopted products and procedures lend themselves to adoption because adoption was one of their creators’ key design principles. In the popular consumer view, if I need an owner’s manual to understand a product, I might not want it. Financial firms seeking better and more comprehensive engagement of plan participants and advice clients will increasingly have to facilitate that engagement, not hope that if they build “wellness”, people will clamor for it.

The Business of Wellness: The State of Mind to Create Peace of Mind

The bad news for companies is that “wellness” is not a widget they can attach to their existing offering. That approach has been attempted with the best of intentions by retirement income product providers who developed myriad riders and benefits aimed at specific consumer objectives and concerns, like combatting inflation or funding long-term care. In the hands of good advisors during the planning process, these products and their capabilities can provide invaluable peace of mind. But complexity of the products and their sometimes inconsistent availability (and pricing) are barriers to more consistent use in planning - and adoption by more advisors. These barriers are beginning to fall as demand for peace of mind – protection, security – rises and firms respond.

“Wellness” Requires Technology, Humans Alone Can’t Ensure Peace of Mind

To achieve its true potential as the True North of retirement solutions, “wellness” has to be integral to the language and the systems and the solutions of the firm. Despite the good intentions of many service contacts and financial advisors, the human resources of the industry don’t have the capacity to accurately record and maintain full engagement with clients, participants and their families. There are too many people to track, to proactively provide information and to be available to help establish and maintain “peace of mind”. I will never forget the call from a seasoned advisor who had completed his outreach to a HNW family, with the help of the head of household. “I now have nine clients instead of one!” He was only partially kidding. It’s a lot of work to track the needs of families and you don’t want to be the advisor who missed a Medicare election, a life event or the 21st birthday of a beneficiary. The solution is a combination of proactive systems leveraging data, simple tools that can be accessed by consumers and help self-actualize their needs, along with old school training, coaching and learning for all human associates for how they can best succeed in a company dedicated to “peace of mind”. This is the Village of Adoption needed to establish human leaders and delivery champions, DIY options for consumers and data-based processes to ensure the reach and consistency of engagement. And that is the #1 job of today’s financial firm CEOs, creating peace of mind – aka “wellness” – for BOTH their clients and associates.

Three Blind Wealth Management Execs and the Demographic Elephant

“Uncertainty” is an interesting condition that vexes human beings. Most of us like certainty – we want to know what’s going to happen. Young adults heading off to colleges right now run the emotional gamut from excitement to fear. Politicians are anxious – what about those mid-terms? Investors are anxious – is the bull ending? Investors hate uncertainty.

And yet uncertainty – or more accurately, the reaction to uncertainty – is the stuff that real leadership is made of. The adage remains that we share with those college-bound kids, “You cannot control what happens to you, but you can control your response”. That’s what growing up is all about – learning to cope, learning to take advantage, learning to take control of what you can control.

The Uncertain Future of the Financial Advice Industry

The advice industry faces an uncertain future. A retiring age wave of Baby Boomers built the industry into its current form, focused primarily on investing. And wow, what a run – boosted by historic gains in both stocks and bonds.

But now that demographic wave wants to spend their gains, live their lives in different and more relaxed ways – and the industry stumbles to provide the solutions with a level of clarity and certainty our clients seek. But what exactly does that mean for each company, each advisor? What are those steps each has to take now to ensure client retention as competitors home in on our blind spots??

The famous parable of the elephant and the blind men is worth revisiting. The narrative depicts three men confronting an elephant for the first time. Being blind, each man feels for clues about the enormous creature. They share their perceptions, but their accounts are wildly different for each has grabbed a different part of the elephant. One feels a leg and “sees” a tree. One feels the massive body and “sees” a wall. Another feels the trunk and “sees” a snake. The differing accounts and the ensuing acrimony about the “truth” spurs a fight among the men. In “Coping with Negative Life Events,” authors C.R. Snyder and Carol Ford explain the moral of the parable as the tendency for humans to claim absolute truth based on their limited, subjective experience as they ignore other people’s limited, subjective experiences, which may be equally true. Sounds like 2020 presidential politics to me.

Take Off Your Blindfolds – Elephant Approaching!

New conditions challenge everyone. The tendency is for managers and leaders to depend too heavily on the experiences and perspective they earned on their way to the top. But in times of unprecedented change and uncharted waters, all that “experience” can be a blindfold. The three men in the Hindu parable aren’t stupid – they just can’t see. What they all have in common is the inability to see the total picture and to fully understand what is – literally – right in front of them. And the fact that all three are stuck on their separate perceptions makes it impossible for them to work together.

For leaders of the wealth management industry, the aging demographic is our elephant. It is planted right in front of us, everywhere and every day. And yet it is hard to see it, as well as all of its implications for our business, in its entirety. Depending on the primary focus of your day job, you may have one perception of “aging” that is quite different from that of another leader whose primary focus is elsewhere.

It's 1946: Your Warning is Here

For example, if your firm manages separate accounts and mutual funds, your portfolio managers can be happily beating the market while you might be frustrated by redemptions. Upon closer examination, the redemptions are skewed to clients over 70. We hear a lot about 10,000 baby boomers turning 65 every day. Some of them have been investing for retirement – and that retirement has arrived. Surprised? Really?

More subtle are some other “parts” of the elephant. Stay with the daily flow of boomers but now focus farther downstream on the 9,500-plus who turn 74 every day. Nine years deeper in that classic retirement zone come more problems – dementia, other forms of diminished capacity and death. Thousands of clients are losing their ability to safely manage their accounts every day. And more and more clients are dying every day. Clients know about these conditions – there is no reason to tip toe.

Compliance is On The Phone – It’s About Those Aging Clients…Again

Ask the compliance department of any big firm about the growing challenge of protecting aging clients. Ask the investor services groups about the spike in reregistrations due to death or disability. Check in with sales teams, advisers and customer service reps about the scramble to locate responsible family members because clients haven’t shared that information (or we haven’t asked). What does legal see on the litigation and arbitration calendar? Government affairs can tell you a lot about growing regulatory scrutiny – especially from the states.

There are lots of legs and tails and tusks on the demographic elephant that have been there all along. What has changed is the size of the animal. For years, the aging demographic wasn’t an elephant, it was a poodle. Or a golden retriever. It had legs and a tail, but it was smaller and softer, and more friendly. But now we have an elephant in the room. Adjustments have to be made.

Grab A Tusk, Any Tusk

And we cannot fully enjoy the parable without pointing out that not only has the size of the animal changed but so has the environment. All of these elephant parts were solidly attached before the market correction. Stretching our story a bit, imagine the blind men trying to identify the elephant during a stampede. The guy holding the trunk might have a grip but the one on the leg is a casualty. Hang on tight, the “stampede” makes all these issues more acute, and more complicated, and harder to resolve under the pressure of rising volumes.

Unfortunately, we’re not going to cage this elephant anytime soon. There is a reason great friend and Next Chapter colleague, Ken Dychtwald coined the term “age wave” (in 1989!) – this phenomenon is still in the early stage. Its roughest effects are growing and will continue to grow at an increasing pace through 2035. That time period captures pretty much all of the current wealth management industry leadership, so best we get started. Future industry leaders are the ones who will pull off their blindfolds and demand the same of their colleagues. They will understand their business just might be defined by how they respond to the elephant…and the stampede.

This is Us

Mention “financial wellness” to 10 attendees of a FinTech conference and you might get 15 definitions. Ask 10 clients and you might have the same result. The label is intriguing and appealing, but there’s an onion here that needs peeling. Leave out the “financial” angle for a moment and consider that wellness can be evaluated through the different dimensions of:

- Physical wellness

- Emotional wellness

- Social wellness

- Intellectual wellness

- Spiritual wellness

- Environmental wellness

- Occupational wellness

Credit: blog.bestself.co

“Wellness” is a noun – but also a verb. Webster says that wellness is “the state of being in good health, especially as an actively pursued goal (emphasis mine), …as in.. “measures of a patient’s progress toward wellness”. So wellness is also a process in pursuit of the goal of wellness.

When we combine these perspectives, “financial” wellness is easier to define, but harder to accomplish. Money is relevant to all seven of the dimensions listed above. Having money can help fund solutions and opportunities to improve most aspects of wellness. In addition, wellness is dynamic – changing as we age, rising and falling in importance. What jumps out to me is the complexity of achieving “wellness” – and the opportunity to employ both digital and human support to finance wellness.

Many top advisors – and clients -- characterize financial wellness as “peace of mind”. And when you unpack the headline you locate the dimensions listed above, as well as the process of ongoing contact, review and reinforcement that describes the best advisor/client working relationships in wealth management. At minimum, the industry needs to support a holistic approach to clients’ new found longevity to help them discover and address their growing and changing needs for “peace of mind”. It is critical to appreciate that we are all traveling together on a journey none of us has completed before – growing awareness of our own longevity and how our world view is changing. “Aging” clients and advisors are not abstract population cohorts – they’re us!

So the key to “financial wellness” is the entirely subjective definition of “personal peace of mind”, as well as the recognition that it’s also a process that will evolve as the different dimensions listed above present themselves at different times. A more broadly aging society led by the massive Baby Boomer cohort is discovering the importance of life balance as the median hits 66 this year – and the oldest are 76. At those ages, our clients (and some of our advisors!) have growing awareness and appreciation for the value of emotional, spiritual and intellectual wellness. Their need for mobility supports physical wellness. Being relevant and engaged keeps many working for occupational wellness. And perhaps most important in later ages is the importance of social and environmental wellness – to be with others and to live safely and independently. If we are paying attention, financial wellness is already teed up for us to hit head on.

And that’s the real point of financial wellness. Financial industry leaders that talk about financial wellness are declaring the path forward for the industry -- the objective of the advisor/client/digital working relationship. They are challenging us to align in support of the clients’ personal peace of mind and the growing, shifting aspects of wellness as they discover more perspective. And it’s the moment of truth for financial advisors, many of whom are challenged to muster the empathy and insight needed to fully support the clients, as well as the flexibility and interest to engage effective technology to help them deliver more effectively across their entire clientele.

Financial wellness is becoming the True North of the wealth management industry, and it’s a journey we are all taking. Together.

Follow the White Flags – To Success

Streaming one of those endless crime series recently, I watched the lead investigator offer bad news at a press conference - “The rescue mission has now shifted to a recovery effort”. A little dramatic for our mundane world of retirement planning - but maybe not. I wrote awhile back that most of us heading toward our next chapter have made mistakes in our preparation

https://www.fa-mag.com/news/the-oh-sh-t-moments-of-retirement-planning-67066.html

Many of those mistakes are financial miscalculations - I know I will need to seriously restrict my spending. Some are investing errors – taking too little risk or too much. The most impactful seem to involve family and healthcare when the inevitable but still unexpected impacts of longevity take their toll. And even the lucky few not derailed by financial, investment or family issues may be weighed down by the importance of living a meaningful life. That’s a lot of potential planning potholes to navigate. Every family will fall into one or more – and most will need help to recover. The markets are not helping. Neither is the stubborn pandemic or global instability or domestic politics. Most people are worried about a lot of things.

So get ready for the equally inevitable shift in the retirement planning profession from a mission of funding a “next chapter” to recovering a failed retirement plan. Our observations in the Next Chapter industry initiative (https://theexecutionproject.com/community/)

are clear – the industry is not ready for this job. The contrast I’d offer is that we will be shifting from mostly selling new cars to fixing them when they’ve broken down. Complementary roles for sure in my car dealerships, but not the same.

I’ve long advocated for a more realistic view of retirement planning that tracks with the experiences of leading advisors and how they help real clients with real life. Those pros tell us over and over about clients hoping to stretch savings to cover a preferred lifestyle instead of first determining the level of their retirement paycheck. They repeat stories of life events and healthcare “surprises” that are really only surprises if you think you are immune to the impacts of aging. I will never forget an interaction with the ceo of a global financial firm who called wondering if he should be added to the accounts of his father….now that Dad turned 91. I wonder what precautions are used at his company for millions of people vulnerable to mistakes and exploitation in their later years - long before 91 – especially since 25% of people aged 65+ have dementia of some kind. Common sense is a great ally when planning…..

The implications of “retirement recovery” begin with a few very uncomfortable conditions among advisors, their firms, the supporting cast of product companies - and the clients themselves. Each plays a part to right the ship. The inconvenient truth is that of course each has contributed in some way to the problem of unpreparedness. To really help Americans have a fighting chance, each will have to own their role in the current state and prepare recovery tactics. That’s now. Each actor will also have to adjust their approach to younger clients and make sure the lessons learned are applied to the future. This is not about organizational CYA – though too many advisors and firms will worry about this angle and their “liability” for confronting the truth - this is about a genuinely human concern to improve the situation. It is less important to rehash how we got here, it is more important to show our genuine commitment to recovering the plan.

Personal health care offers a good example of this “recovery” pathway. When you have a medical issue, the first step is to deal with the current symptoms - reduce pain, improve comfort. Focus on what to do now. Only then can we look more closely at the cause(s) of the problem. Required skills here are listening and empathy. Are we really good at those?

I’m pretty sure Retirement Recovery will soon become the #1 driver of referrals and new clients. Most of the new opportunities will flow from the wreckage of plans gone off the rails. You will confront more people who are surprised, concerned, mad at their prior advisors, mad at themselves - and embarrassed. Job 1 for us is to acknowledge and normalize their condition. They are not alone - they are actually reflective of the vast majority of retirement plan clients.

Before you dismiss that last line, which will stand in our way if we don’t accept it, is to fully comprehend the full needs of “retirement” (https://www.fa-mag.com/news/where-are-the-retirees--yachts-66565.html)

Three conversations help organize the process of recovery – financial issues, investment decisions and family concerns (mostly about health and care). Back to those top advisors who remind us that retirement is a family affair and that one or more of the family members do not really understand the multiple moving parts. True financial literacy is rare enough – how the sometimes complex and arcane concepts apply to them is even more elusive.

The core strategy of a recovery strategy is simple but not easy, as Buffett famously observed about investing. So channel common sense and consider:

- Empathize to normalize – no matter the client situation, “you are not alone, everyone has issues”. Actually, multiple issues. So let’s first get a complete inventory of what you worry about. We may not be able to solve them all, but let’s get a total checkup of the car and not just fix the flat tire. A top advisor tip – start fixing the “tire” quickly, confidently and at a very reasonable price in order to set the stage for the bodywork and new transmission to follow.

- Educate to remediate – are we confident in the investment choices and solutions – do you know the role of each solution you own and are their better options? A tip – make sure you know where each product came from and who was involved before making any judgments. We don’t need client defensiveness in the way of building trust.

- Is everyone on board? Do all family members understand the plan and the underlying choices that really determine success – such as the choice of where to live and the expectations for providing care when you need it? A tip – probe about those family dynamics – and keep probing. Fewer than half of clients with advisors told a national IWI survey their advisor does not include the spouse in planning, let alone aging parents or adult children. And we wonder why 70% of widows nuke the advisor?

- Keeping the lines of communication open and active as the next chapter unfolds – there will be changes needed and more decisions. That’s life. But this aspect of staying current is where the robos are killing advisors. Failure to keep up with specific, totally predictable life events is probably the most critical need of retiring families and the best entry point for earning referrals. An advisory firm I met with recently sets the stage for what they do by first asking any new prospect about the elections they’ve made for Social Security and Medicare – and what happens to their estate if they (a couple) were hit by a bus tomorrow. No investment or performance discussion, no tax returns – just showing their interest in the decisions that are must-make for us all that reveal their level of preparation. The robo does not forget a date, does not tire of sending reminders (though only by text or email), and will keep getting smarter as it learns more about the client. If Google News, Amazon and Nordstrom can suggest what I want to read or buy with the accuracy I’ve seen so far, the most feared new advisor in town is an avatar.

Only the Outcomes Matter

While many – most – retirement plans will at some point be shifted to a “recovery” effort, we can always share our learnings with other clients. The first opportunity of the “white flags” by clients willing to accept help is the mindfulness of those clients. Saving someone’s retirement plan is not about producing financial rabbits out of a hat – it is mostly about helping the clients accept their condition and making the best of it. As we guide our own children by saying, “You cannot control what happens to you – but you can control your response”, we have a similar moment with white flag retirement realists. And that word will spread rapidly. First to the heirs, and then on to the peers and colleagues. Get ready for the line around the block to your door.

Adoption is the New Innovation

Every day, there are hundreds of news items extolling the virtues of new fintech. There is a dizzying array of tools flooding the advisor market. I am envious of those who can choose wisely among them.

And yet this software doesn’t quite capture the feel and efficiency of the advisor-client experience. Is that a problem with the software? Or with the users?

I don’t want to discourage innovation—bring it on! But I wonder if we have truly learned how to use the amazing apps and software we already have, or if we keep jumping on emerging fintech as if it were the new iPhone version X.X before we’ve figured out half the functionality of the old models.

The center of any technology should be the advisor-client relationship. That’s the utopian vision, anyway, one that should prompt simple and easy solutions. Software providers should be enabling your digital relationships, and thus improving your volume of activity, as well as the consistency of your results. When you can string your software together into a customer experience, you see the potential contribution from tech adoption—and wasteful gaps when the tech is not deployed.

When you’re starting to deploy your technology, start with a daily plan and see how it affects your overall results. Your CRM software should have all your client’s information loaded and your activities log should show that every day you have “calls to action.” The average book for every advisor is 125 families. Your CRM should include three to four nuclear family members but also aging parents and adult children for a total potential “household” of 30 to 40 accounts with several custodians. Without good software, that’s a lot of Post-it notes.

It's time to think of your expectations for the customer experience. How many of those households receive a solid annual review? A midyear review? How many times do you follow up on the actions you’ve taken? If the industry standard is two meetings a year, can you be sure all 125 families got theirs? That’s 250 appointments with just two meetings for three generations and 30 to 50 accounts. What if more meetings were needed? If the accounts are for retired people, would that not mean more complexity?

I remember visiting with one of the country’s top wirehouse advisors a few years after managed accounts became mainstream. One of the pillars of this advisor’s offering was a quarterly performance and holdings report and a quarterly review with the clients. People loved the transparency and accountability—and consistency.

Walking into the advisor’s office, I noticed a flurry of activity in the office next to his. “They’re stacking our quarterly reports,” he explained. “We had to get another office to hold them.”

The advisor’s practice became buried in meetings with clients. He made changes to balance the load—like setting annual reviews by the client’s birthday instead of trying to squeeze everyone into the calendar at the quarter’s end. He also merged some account reviews by inviting multiple family members. Both steps opened additional opportunities, but the initial motive was just to save time.

The discipline required for the regular client meetings was an eye-opener to him. “We had no idea of how little we were talking to clients—and how narrow the conversations were,” he observed.

This is Practice Management 101: Our client communication is lacking, and that means there’s opportunity if we improve it. The average wealth management client is about 67 and has accounts with four to five firms, but no one firm usually has more than half those assets. Until that reality is altered, advice providers are battling each other in a zero-sum game with really significant implications. “Share of wallet” is the new battleground.

As aging clients consolidate their assets, there will be winners and losers among financial services professionals. Morgan Stanley has said for five years that it’s actively seeking the nearly $3 trillion it doesn’t have from the clients already on its books. In pursuit of that goal, the firm booked $438 billion in net new assets in 2021.

This is a big game with a lot on the table. If you think you’ll achieve organic growth that miraculously springs from this aging investor population, forget it.

Keep in mind the reality. Most advisors don’t regularly reach out to clients with tailored information. They just don’t have the time. This applies to RIAs, wirehouse advisors, regional brokerage advisors, independents and direct providers. Ironically, it’s the AI-powered robos that have upped the game for proactive outreach, not the humans. Robots are pretty organized and work 24/7.

Tech tools can indeed help you, however—help you manage opportunity and remember all kinds of important business issues: the clients you haven’t seen for a while and the meetings you meant to set and birthdays and retirement dates and RMDs and bond maturities and graduations and all the stuff clients told you in meetings that they hoped you’d remember.

Tech helps you manage opportunity by managing volume. Most advisors have all the clients they need—especially when you consider each client’s extended family, friends and business associates—but they are not organized well enough to get there.

Remember Warren Buffett’s line: “Investing is simple but not easy.” The same goes for advisors in the business of details—the excruciating details they must remember, like accurate beneficiaries and powers of attorney and cost bases and the names of the children (and pets!) Everybody knows this, you might say. But the industrywide data tell the story—they don’t do it. Otherwise why would the average client have four to five different firms? Are they really meeting a couple times a year with each?

His colleagues were soon consolidating assets, and their work set the stage for the evolution of the business into Merrill Lynch Private Wealth, a new step in client service.

As it was starting up, data again revealed reality. A very simple exercise we did with the top advisors globally showed that there was potential to serve even the best clients even more.

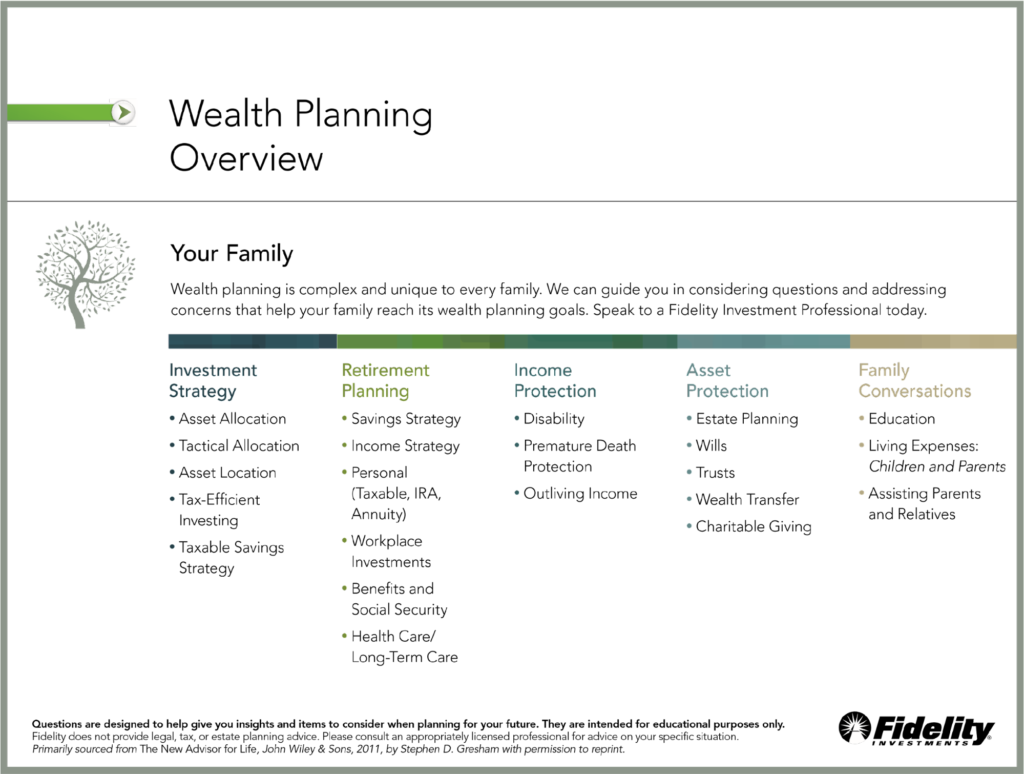

The advisors reviewed their top 20 households against a list of the seven most common financial products (such as managed accounts, for instance) and eight of the most common financial strategies (asset allocation, estate planning, etc.). The gaps found among just the top 20 households were alarming (or exciting, if you like opportunity). Each of those gaps opened a door of access for a competitor—and that became the basis of the wealth management game plan of driving consolidation and referrals (by closing that door to competitors).

Simple, right? It should be. All the best strategies are simple, and understandable to clients. But they require organization and attention to detail, and you cannot achieve that level of efficiency with Excel spreadsheets and Post-it notes. And that is where a lot of the advisory world remains, trapping frustrated clients with them.

Consider that in 1997, the time when Merrill Lynch took that step, there were just a few client households to reach, and the client population was not nearly so close to retirement. The oldest baby boomer was only 51.

Now there are some 10,000 people turning 65 every day. The Great Retirement and Great Resignation together suggest the number leaving the workforce exceeds 12,000.

The good news is that if your marketing and relationship skills haven’t atrophied after 156 months of bull markets, you’ve got a historic chance to win new clients and assets from less ambitious advisors—potentially doubling your business, or more. The flip side of course, is that you are surrounded by competitors who might do the same to you.

Let me know how it’s going—call me on my Razr flip phone or email my BlackBerry.

Let Them Eat Calamari!

When my son was about 2, we lived in a New York City apartment near an awesome Italian family restaurant. He loved calamari over linguine. One day another much older patron asked him how he liked his “squid.” “It’s calamari,” replied the confident tot. “Yeah, calamari is squid,” pressed the other diner. “Well,” my son explained (dismissively), “I like it anyway.”

A historic generation of 76 million people with a median age of 66 are rolling out of the workforce at 12,000 per day (a number that’s climbing). They need to replace paychecks from work and secure their healthcare. And survive their longevity. Sounds like a job for an annuity with a cost-of-living adjustment and a long-term care rider.

You mean a squid?

When I first earned my Series 7 license, I was a stock analyst. But at that ancient time, the Dow was 800 (just two zeroes) and investors were gun-shy, preferring to invest in 9% munis and 15% T-bills (when inflation was 13%). And why not? As you know, their preferences changed, but not overnight. Both bonds and stocks began an epic climb together, and an entire generation feasted on the returns from funds and managed accounts—initially opposed by a legion of stockbrokers who scoffed at the transparency and “risk-adjusted returns.”

Not so fast-forward to today, when commissions are free and managed assets are $40 trillion.

Those same clients are now facing the expenses of retirement. So when the Dow fell 10% and the Nasdaq tumbled 22%, retirees who remember losing half their account values from 2007 to 2009 (not to mention the first tech wreck 20 years ago) became justifiably concerned.

In a recent Financial Advisor flash poll of advisors, Evan Simonoff asked what advisors would do if clients said they wanted less risk. Eighty-five percent opted to “change asset allocation” instead of turning to income strategies and annuities. Another way to look at it is that they are defending capital market theory as an intellectual response to an emotional condition. But it’s getting well-intended advisors in trouble with clients who think they are being ignored—or dismissed.

“Retirement planning is like building a family dinner with multiple, complementary ingredients,” says a well-respected head of annuity and insurance solutions for a national advisory firm. Having just one dish—even with underlying components like a managed portfolio—should not be expected to satisfy everyone. The menu makes sense of it all.

That’s a terrific perspective for both advisors and clients. There is complexity—inherent complexity—in building solutions to fund a 30-year retirement. The portfolio can be the entrée, but what about the side dishes, the salad, the appetizers, the dessert, the wine? To some people, the wine is the highlight. But too much might ruin the meal (and the next day). And anyone with a big family can tell you that it is important to recognize that every member has different preferences.

Watching advisors and their clients wrestle with the myriad needs of retirement, we see their frustration at the lack of certainty. And we see their anxiety. Most of the success factors, like longevity, are unknown. But we cannot and should not allow the unknown to stoke unease. There are other things important to clients: such as peace of mind, comfort and confidence. And these are things they are willing to pay for.

As several smart behavioral experts have said, human brains do not naturally process abstract, long-term planning. But we all love short-term comfort, and advisors need to offer some of it. Sometimes it is OK to add some mac and cheese or dessert to the healthy table. It doesn’t mean you’re promoting chocolate cake instead of a stuffed turkey.

There’s been enough research showing the value of certain annuity products in retirement. But this article is not about solving that problem in a left-brained way. I’m talking about connecting with clients in a very human way.

Annuities face criticism, but some of that is based on folklore from long ago. Anyone lamenting the products’ “high cost” should apply the same test to most alternative investments. Or to “no load” mutual funds, with their 4% back-end cost or their forebears, whose cost was 8.5% up front. Demand drives innovation that results in better solutions. That innovation has been taking place in the income product world for years—and there’s more room to run. Check it out.

It is simply ridiculous to turn a blind eye to an entire category of potential investment solutions that can give value—peace of mind—to a generation of investors who have earned our respect by supporting us for decades. Especially if there are solutions that can leverage limited assets—something that’s true for most clients. Such strategies will appeal to both their brains and their emotions and finally acknowledge that their peace of mind is a valued objective. If we insist instead on promoting what we think is “good for you” over what people say they want, without regard for alternatives, we will drive away our core clientele when a disruptor offers what they want—and it works. Consider the impact of target-date funds as the retirement plan default in lieu of guaranteed interest accounts.

We are watching a new role emerge in the retirement advice marketplace. Let’s call them “Next Chapter advisors” instead, people who specialize in helping individuals and their families fund that next stage of life. They are often in the same phases of life with their retiring clients, so they can use their own expertise with accumulation and investing. But now they can focus—on now. That’s a different mindset that requires an empathy clients will embrace. These advisors will use planning and products for multiple objectives and help families prepare for those inevitable things that happen in life.

So get everyone to the family retirement table and pass the calamari. Who cares if it’s really squid?

Steve Gresham is on a mission to improve “retirement.” He is CEO of the consulting firm the Execution Project LLC and leads Next Chapter, an active think tank of 50-plus leading financial companies. He is also the senior educational advisor to the Alliance for Lifetime Income. Steve was previously head of Fidelity’s Private Client Group and retail strategy.

Chasing the Other 80%

In the Blogosphere, April 11, 2022

Every day it seems like dozens of news items extol the virtues of new fintech – product announcements, funding efforts, PE acquisitions. A dizzying array of tools floods the advisor market. I am envious of those who can choose wisely among them. The @Kitces chart of company logos – brilliant. I wonder how many of these companies will survive. Does the world really need 26 portfolio management systems?

I don’t want to discourage innovation—bring it on! But do we truly learn how to use the amazing apps and software we already have, or do we jump on emerging fintech as if it were the new iPhone version X.X before we’ve figured out half the functionality of the old models? Do we have a product innovation challenge – or an adoption challenge? My guess is that adoption is the new innovation.

Chasing the Other 80%

Simple questions of even the best advisors reveal opportunities. Ask advisors if they deliver a list of ten wealth management services to their clients and the answer is invariably “yes”. But then ask how many of the (average) 100 households have actually received all ten services from their practice and the response is different. Serious truncation takes place after households #10-20 to prove Pareto alive and well.

The practical reality is that today’s advisors can do very well with that 20% of engaged clients. A robust bull market tide since March 2009 has lifted most all the advisory boats while reducing incentives for “completeness”. The industry is not so much focused on making sure everyone is cared for – the focus is more on satisfying the financial objectives of the industry. This delivery gap is a wide open door for serious competition – a door being accessed now by ambitious scale players eyeing the prize.

Invention vs. Innovation

My view of “innovation” has been formed by years of watching the energy of brilliant minds pursue a new capability without first testing for effectiveness – or impact. Seemingly small steps applied at large scale can easily outweigh unique inventions. Consider the time savings and customer satisfaction of improved money movement – remote check deposit, the ability to send wires – vs. the more limited but more exciting investment product builds.

Simplicity, ease and control are powerful design elements the advice industry has room to exploit. As long as CRM use remains below 50% of active advisors and fax machines support any part of FinServ, we have work to do.

Path Forward: Divide and Conquer

The advice industry is maturing into a more organized product and delivery phase. We know that many consumers need help with retirement advice, they want information about healthcare solutions, protected income and liquidity. We know that too few advisors provide that array of essential services – and that the industry does not strive to get those services to all of the clients.

Some firms are stepping into the “80%” gap by providing advisors with ideas for “next best actions”. Others are beginning to mimic the direct marketing behemoths Fidelity, Vanguard by making offers to clients and encouraging them to then engage an advisor for follow up. Still other efforts will allow clients to take action without need of an advisor. This segmentation is the future.

Our economy long ago eclipsed the need to depend on humans for delivery and effectiveness of most services and products. Even personal health care today has filled in huge gaps with transparent reporting, electronic records and partnerships with local for-profit chains like CVS. Amazon removed the need to depend on the local store. Gaps in delivery will be filled by innovators not focused on inventing some super silver bullet but instead focused on how to get us what we think we want when someone else cannot.

Disruption Is Invited

Several brilliant innovators have declared their best works were not even imagined by the consumers that love them. True enough. But some of the greatest commercial successes have been created by providing access – simpler and easier – to capabilities or products consumers asked for and could not get. And while it is fashionable to have a new invention, it is more powerful to be effective.

Focus on Effectiveness and Client Success

The much hyped “customer experience” needs an upgrade to “customer success”. Firms and advisors already on this bandwagon are the leaders. The myriad challenges of retirement planning require real answers, not best efforts. This standard of success is growing fast and will soon reward providers who can meet expectations.

A second and equally important aspect to “success” is the shifting of roles among providers. An advisor focused on investments that tries to add healthcare and longevity planning is taking on a significant effort. Creating successful retirements will mean transitioning to a new definition of success – a retirement manager or “next chapter” facilitator. Just like the industry move made years ago in favor of professionally managed accounts, the true consultants emerged and flourished. The true “stockbrokers” withered from the competition.

There is new opportunity for advisors and service providers to each take on components of “client success” and work together in complementary service models. Delivery needs to focus more on completeness and less on satisfying the requirements of a select few clients. Digital capabilities leverage the effectiveness of humans, and can also help reach people who need help. As we learned with COVID 19, there is both a need for effective treatments but also the access to those treatments. Innovation looms large in both perspectives.

Steve Gresham is on a mission to improve “retirement.” He is CEO of consulting firm the Execution Project LLC and leads Next Chapter, an active think tank of 50-plus leading financial companies. He is also the senior educational advisor to the Alliance for Lifetime Income. Join Steve at Next Chapter 2022: Rockin’ Retirement on May 24-25!