The Silent Risk In Your Book: Cognitive Decline And Why Advisory Firms Must Act Now

By Steve Gresham and Suzanne Schmitt

As the U.S. population ages, the risk of cognitive decline among clients is emerging as one of the most urgent—and underestimated—threats to wealth management firms, financial advisors and employers whose peak earners are apt to become parental caregivers. The numbers are stark: nearly one in three clients over the next decade will face some form of incapacity, and the likelihood of cognitive impairment doubles every decade after age 68, reaching six times the baseline by age 88 (Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC). For baby boomer clients, this is not a distant concern, but an imminent reality.

The Five Risks Of Ignoring Cognitive Decline

Failing to address cognitive decline exposes advisory firms to five critical risks (Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC):

• Loss of Client Assets: Without proactive engagement, clients experiencing cognitive decline may move assets elsewhere or fall victim to fraud.

• Family Attrition: If a firm fails to support an incapacitated client, their family-often the next generation of potential clients-will likely take their business elsewhere.

• Missed Consolidation Opportunities: As clients approach retirement and face health challenges, they often consolidate assets. Firms unprepared for these transitions risk losing out.

• Regulatory and Legal Exposure: Fiduciary obligations now extend to protecting vulnerable clients. Firms that do not have robust protocols risk regulatory scrutiny and litigation.

• Reputational Damage: High-profile cases of elder abuse, fraud, or neglect can quickly tarnish a firm’s reputation, with long-lasting business consequences.

Why This Is A Strategic Imperative-Not Just A Compliance Issue

The wealth management industry is at a demographic crossroads. With 74% of AUM held by clients over 60 (median age 77), and only 11% of clients under 40, the client base is aging rapidly (Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC). At the same time, $100 trillion is set to transfer between generations in the next two decades, yet 70% of heirs leave their parents’ advisors after inheritance (Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC).

Cognitive decline is the silent disruptor in this landscape. It can erode trust, trigger premature asset outflows and sever relationships with families and heirs (Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC). Moreover, cognitiveimpairment often manifests first in financial decision-making, putting advisors on the front lines-sometimes before families or physicians notice.

What Advisory Firms And Advisors Must Do

1. Start the conversation early. Discuss cognitive decline as part of standard retirement and estate planning, ideally when clients are in their 50s or early 60s—before any signs appear. Frame it as risk management, akin to insurance: you hope it’s never needed, but you’ll be glad you planned if it is.

2. Formalize protocols and documentation. Implement industry best practices such as:

• Durable powers of attorney

• Trusted contact forms

• Incapacity letters authorizing communication with designated family or professionals if red flags arise. Ensure clients’ share their decisions—and documents—with successor decision-makers.

3. Engage the family. Build relationships with spouses, adult children, and other trusted contacts. This not only protects the client but also increases the likelihood that assets remain with your firm across generations (Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC).

4. Train and empower advisors. Equip advisors to recognize warning signs of cognitive decline-such as forgetfulness, confusion,or unusual financial activity,but caution them not to play practitioner. When in doubt, involve compliance and legal counsel.

5. Prepare for the “moments that matter.” Recognize that life events—health crises, caregiving, widowhood—are inflection points that drive client decisions and loyalty. Firms that support clients and families during these times can dramatically improve retention and growth (Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC).

How NextChapter Can Help

NextChapter is uniquely positioned to help advisory firms and advisors turn this challenge into a strategic advantage. Their proprietary Moments That Matter framework identifies nine pivotal life events—including cognitive decline and caregiving—that create natural opportunities to deepen relationships and demonstrate value to both clients and their families (Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC).

NextChapter’s Approach Includes:

• Turnkey Engagement Programs: Tools and training to help advisors proactively address cognitive decline with empathy and professionalism.

• Family-Centric Strategies: Programs like The Family Conversation to retain and grow relationships with spouses and next-generation heirs.

• Practice Management Solutions: Integrated protocols for risk mitigation, client analysis and compliance support.

• Digital Enablement: AI-driven analytics to identify at-risk clients and engagement opportunities, ensuring no client or family falls through the cracks (Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC).

By embedding these strategies into your firm’s DNA, you not only protect your clients-you protect your business, your reputation and your future growth.

The Bottom Line

Cognitive decline is not just a client risk; it’s a business risk. The firms that act now—by planning, engaging families and leveraging partners like NextChapter—will not only fulfill their fiduciary duty but will also secure their place as trusted advisors for generations to come(Source: The Next Chapter of Wealth Management, NextChapter Innovation LLC).

“Our ability to serve is a function of both will and skill. I’m completely confident we have the skill. Do we have the will?” —Steve Gresham, NextChapter

Don’t wait for the crisis. Prepare your clients, your firm and your future-now.

Steve Gresham is the managing principal of NextChapter, a leadership community dedicated to improving retirement outcomes for everyone. Suzanne Schmitt is the managing director of NextChapter Innovation, leading their NextGen engagement and growth strategies.

The Next Chapter: Why Wealth Management's Biggest Challenge Might Not Be Talent

By Steve Gresham and TJ Gresham

The Wealth Management Generation Gap

The wealth management industry is facing a pivotal moment. The Great Wealth Transition—a $100+ trillion shift in assets from older to younger generations—is already underway, challenging us with both the greatest growth opportunity in decades and the need to redefine our services[1]. And while much attention has been paid to the looming advisor talent shortage, the conversation must also expand to include how digital capabilities and self-service models can redefine engagement with NextGen clients[1]—creating the potential for a new generation of industry leaders.

The Talent Challenge: Shrinking, Aging And Underprepared Workforce

Nearly 40% of financial advisors, who collectively manage over $10 trillion in client assets, are expected to retire within the next decade[1]. The average advisor is now over 50, and only 11% are under 30, forecasting a projected shortfall of 90,000–110,000 advisors by 2034[1]. Compounding this trend, the industry faces a high attrition rate: between 72% and 90% of new advisors fail or leave within their first three to five years, with more than 72% of trainees dropping out before becoming full-fledged advisors in 2023 alone.

NextGen Talent + NextGen Thinking = NextGen Success

The barriers for new advisors are as much about perception and process as numbers. Onerous licensing, misaligned compensation structures and unclear career progression deter young professionals[1]. The traditional “eat what you kill” mentality and the expectation to build a book from scratch clash with Gen Z and Millennials’ desire for purpose, flexibility and collaboration[1]. The reality of today’s wealth management is that most advisors have been hired, trained and grown up in a culture of sales.

Many successful practices are taking their cues from the potential NextGen hires and realizing their existing approach to clients may also feel outdated to a rising clientele of similar age. Fee options and planning services made more accessible can start new, younger clients who don’t have significant assets to fund an AUM compensation model. Beyond simply matching younger advisors to younger clients, the new wealth management model is changing its look and feel.

The Great Wealth Transition: A Bonanza for NextGen Focused Firms

Powering NextGen organic growth of wealth management is the transition of industry assets. The $100+ trillion moving from baby boomers and the silent generation to Generation X and millennials is not a single event, it is most often a dynamic process that begins in most families with a life event impacting Generation 1. For example, an unexpected health event triggers the need to respond and draws in Gen 2/ Gen 3 family. Response by the advisor is critical—and the family is watching. Incumbent advisors often lack meaningful relationships with their clients’ heirs—and research confirms 70% of next-generation families and widows leave their parents’ advisor after inheritance[1]. This vulnerability is magnified at the margins of a practice where the tendency among aging advisors is to focus increasingly on the most valuable client households, leaving the “forgotten 80%” unengaged and at risk of attrition[1]. If the client and family are not fully engaged, they may not even contact the “advisor.”

These life event triggers—what we at NextChapter call The Moments That MatterSM—drive money in motion, and money in motion is responsible for two-thirds of new advisor hires. The ability to respond to the Moments is a new business boon to nimble advisory practices.

Digital and AI: The NextGen Engagement Imperative Is Also Good News For Profits

The rise of NextGen clients—digital natives with different expectations—presents a profound opportunity for the industry to redefine “wealth management” to a generation of clients who expect DIY options. Digital-first engagement, seamless online experiences, self-service tools and AI-powered planning are now the norm for younger investors[1]. Robo-advisors and digital platforms have commoditized basic portfolio management, and AI is automating compliance, surfacing client insights and personalizing advice at scale[1]. These powerful capabilities are actually preferred by NextGen clients—and NextGen associates—with important cost savings for advisory firms relative to the costs of human engagement.

But what of the human advisors? The good news/bad news is that while only a third of Gen X use financial advisors, both Gen X and millennial clients say they highly value personal service and consultation from a professional. The bad news is that they are not sure where to find those pros and are often at odds with advisor compensation models dependent on AUM (which they don’t always have).

In our experience, advisors combining digital tools with human advice—hybrid—increases client engagement fourfold compared to either approach alone[1]. By leveraging digital capabilities, advisors and firms can scale their services, reach more NextGen clients, and deliver personalized, on-demand advice that aligns with the expectations of younger investors[1]. AI-infused options are actually better and more reliable agents to track the myriad needs of family engagement across a practice clientele growing quickly with the introduction of G2/G3. Proactive offers can be delivered across more clients, allowing them to select items of interest and “ask your advisor about XYZ” becomes a driver of demand.

Why Digital Matters For NextGen Clients—And Advisors

• Scalability: Self-service models and digital platforms enable firms to serve more clients efficiently, regardless of geography or advisor headcount[1].

• Personalization: AI-driven insights allow for tailored recommendations and proactive engagement, deepening relationships with NextGen clients[1].

• Accessibility: Digital tools lower barriers for clients to access advice, fostering engagement with the “forgotten 80%” and younger, tech-savvy households[1].

Impact Play: NextGen Succession And Valuation

Succession planning remains a critical vulnerability when we look forward to NextGen. Only 20% of advisors believe their next-generation leaders can afford to buy their practice, and 25% of retiring advisors have no clear successor[1]. Without proactive digital engagement and succession strategies, decades of client trust and value are at risk.

Valuation measures are catching up to the demographic impacts. Consider the perspective provided by age-weighted revenues (practice revenues sorted by age of clients):

Industry averages peg revenue weighted client age at about 65 years with 81% of revenues earned from boomer and Silent Gen clients. Savvy buyers are reluctant to pay top dollar for an old and aging revenue base that doesn’t have a strong bench of younger clients.

NextGen engagement is fast becoming a priority for advisors and firms seeking future organic growth and sustainable valuations. According to a Fidelity survey of advisory practices, firms with revenue weighted age below 63 years have 20x the organic growth of firms where the age is greater that 69. And engaged families generate 1.6X the revenue and 2.4X the profits of G1 only clients.

Five Imperatives For Industry Leaders

1. Reimagine Talent Recruitment And Development

Expand recruitment beyond traditional channels and invest in mentorship, rotational training and clear career paths. NextGen employees can inject original, creative thinking—and can be internal champions for NextGen clients.

2. Build Digital Bridges, Not Moats

Deploy AI and digital tools to enhance—not replace—advisors, and train advisors to work alongside technology[1]. Digital tools leverage human associates, making them more productive and more free from mundane tasks. Leverage CRM for client experience “journeys” to augment human interaction.

3. Win The Family, Not Just The Client

Engage spouses and heirs proactively, and expand service offerings to include family financial education and support[1]. Make sure CRM and other service support capabilities can scale to meet the total demand of family engagement.

4. Reverse The Pareto Principle, And Mine The Forgotten 80%

Use digital tools to identify and engage less-active clients, preventing attrition and expanding the firm’s reach[1]. Add DIY service models including brokerage and ROBO to engage NextGen clients more efficiently.

5. Rethink Succession And Practice Management

Make succession planning a core part of every advisor’s journey and shift to team-based approaches for scalable growth[1]. Examine age weighted revenues and solve for sustainable growth in valuation. And remember that leadership won’t be replaced by AI – and we have to invest both our money and our focus to set the pace.

The Road Ahead: From Erosion To Expansion

The next decade will reward those who act decisively. While workforce challenges are real, they should not be the sole lens through which the industry views its future. Firms that invest in both talent and technology—and view NextGen clients as a catalyst for digital transformation—will be best positioned to thrive. The $100 trillion Great Wealth Transition, the rise of AI and the evolving needs of multi-generational families create a once-in-a-generation opening for growth[1]. The future belongs to those who build bridges—between generations, between humans and technology, and between today’s challenges and tomorrow’s possibilities.

Steve Gresham is founder and managing principal of NextChapter, a consulting firm driving organic growth of wealth management. TJ Gresham is a Gen Z business intern at NextChapter. See more at nextchapterinnovation.com and order your copy at info@nextchapterinnovation.com.

Bridging the Gap: Next Chapter Summer 2025 Newsletter

What is the Next Chapter for Wealth Management?

NEW WHITE PAPER CAPTURES THE TRENDS – NOT THE FADS – AND THE SOLUTIONS FOR GROWTH

WARNING: DON’T CONFUSE “TRENDING” WITH A REAL TREND

COVID beards were the rage in the early days of the pandemic. Mine got well deserved bad reactions, like that of my colleague, Jean Chatzky. The “trend” slipped away quietly, though some aficionados persist.

By comparison, real trends are here to stay. They often start slowly, but gain momentum and may catch even thoughtful leaders by surprise with their power.

SIX TRENDS ARE SHAPING WEALTH MANAGEMENT – AND MOST OF FINANCIAL SERVICES

• First consider the Aging Client Demographic – 75+% of wealth management AUM is held by clients 60+ with a median age of 78. Retaining them – and their high margin assets – will depend on serving them in retirement, dealing with their infirmities and connecting with their children, so..

• Welcome The Great Wealth Transition. $100+ trillion up for grabs, but slowly sliding across families, businesses, real estate and not in a single event. And this one rolls for decades as boomers age and Gen X/Millennials enter the picture, pulling digital and AI solutions forward.

• Get ready for the Risks of Cognitive Decline. Our increasing longevity brings heightened vulnerability to cognitive impairment, creating challenges to client retention as well as legal and business risks. And this one isn’t entirely about clients – aging advisors bring risk as well, which….

• ..Tees up The Talent Pipeline Shortage. McKinsey forecasts a 100,000 advisor shortfall, but is the “shortage” a talent crisis – or the forcing mechanism to change an outdated service model? Only 1/3 of Gen X say they use advisors. Check out the 4X gains made by “hybrid”.

• Extend that generational view to the Digital Disruption Acceleration. Democratizing technology would be easier and faster if company leaders would learn to partner with data and trust delivery. AI has a lot to offer, but most of the market is still learning CRM.

• Don’t forget about Market Volatility. An AUM dominated industry is dominated by the behavior of markets. With forward valuation measures above the historic norm, the 16 year old bull market may be getting a bit tired.

FIVE STRATEGIES TO DRIVE ORGANIC GROWTH

• Winning the Family – proactively engaging the family helps retain G1 clients, consolidate G2/G3 and grow forward with all. Focus here on reducing revenue weighted age of the business, our new favorite success and valuation metric.

• Winning the Family – proactively engaging the family helps retain G1 clients, consolidate G2/G3 and grow forward with all. Focus here on reducing revenue weighted age of the business, our new favorite success and valuation metric.

• Move Beyond 60/40 – not just alts and privates, all advisors should consider the leverage of protection products including annuities, life insurance and long-term care insurance. Very few HNW families have outsaved their objectives. Real wealth management is liability focused as well.

• Mine the Forgotten 80% - aging advisors tend to work with fewer, larger clients so the “reverse Pareto” kicks in to reveal enormous opportunity with clients who haven’t yet consolidated – or emerging clients who have less to invest now but may have a lot later including their retirement plan.

• Build Digital Bridges – earn that 4x multiple of engagement results over human or digital alone by working on the “connections” that benefit both clients and client-facing associates. No matter the service or provider, making engagement simpler and easier will always win raving fans.

• Developing NextGen Talent – wealth management in particular has an identity crisis with younger people. Opaque services, lack of clear career tracks and inconsistent compensation all feed a level of complexity and feeling of aloofness that turns off job seekers. And not just for advisory roles. Understanding how a digitally forward solution should be built and run for clients is a key need of organizations that may still have a fax machine or two.

Get your copy of the white paper, The Next Chapter of Wealth Management. Email us at info@nextchapterinnovation.com

Book our NextChapter Executive Workshop for your leadership team

NextChapter on the Move: Banking and FinTech leaders gathered at SEI headquarters in Oaks, PA in June to share innovative solutions for The Great Wealth Transfer Transition. @JAMFintop

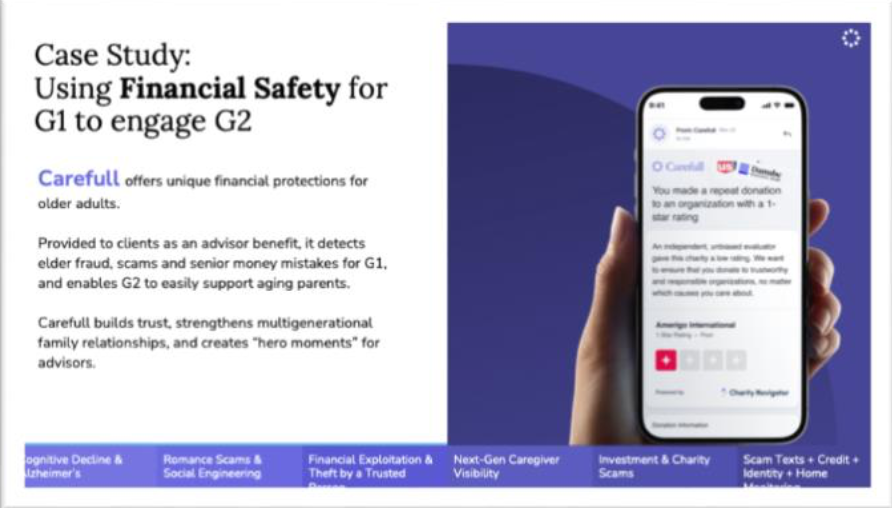

PARTNER HIGHLIGHT: CAREFULL

NextChapter works with quality firms delivering solutions to the eco-system of financial services and wealth management. There is a both a “proactive” and “reactive” path to retaining G1 clients and connecting with G2/G3 family. Carefull helps with both scenarios by providing account monitoring with a myriad of personal security features. Of special value to us have been warnings about “missed bill?” – as well as support to limit damage of a (successful) phish. Fraud – and forgetfulness – can happen. Most clients – and too many advisors - don’t like to plan for incapacity, but we know it’s a reality. Carefull is a winner for clients of all ages with a digitally savvy interface and readily available human contact.

For more information, check out https://getcarefull.com/ or email us at info@nextchapterinnovation.com

Mention NextChapter for a discounted rate.

DEEPER DIVE: NEXTGEN TALENT

One of the benefits of having a Gen Z summer intern is the unvarnished feedback. The talent discussion struck a nerve in our office, with the result being a view not just about hiring, but a re-view of what are we hiring people to do? Is the “talent crisis” really a crisis, or do we need to change our business to be attractive to potential new hires AND younger clients? A single topic transformed into a Rubik’s cube of issues that we published in Financial Advisor magazine. Read more about Why Wealth Management’s Biggest Challenge Might Not Be Talent. We have actionable strategies for “next level down” on this topic and all of the five growth strategies outlined in the white paper. “NextGen” talent is not all about hiring young advisors. Aging advisors are also part of the “NextGen” strategy. Some seek a buyout but are discouraged by the value of their aging books (revenue-weighted age as described above). Others are content to stay the course, but have allowed less engaged clients to drift away (the Other 80% above). Let’s talk about proactive book mining and the NextChapter engagement system leveraging The Moments That Matter.

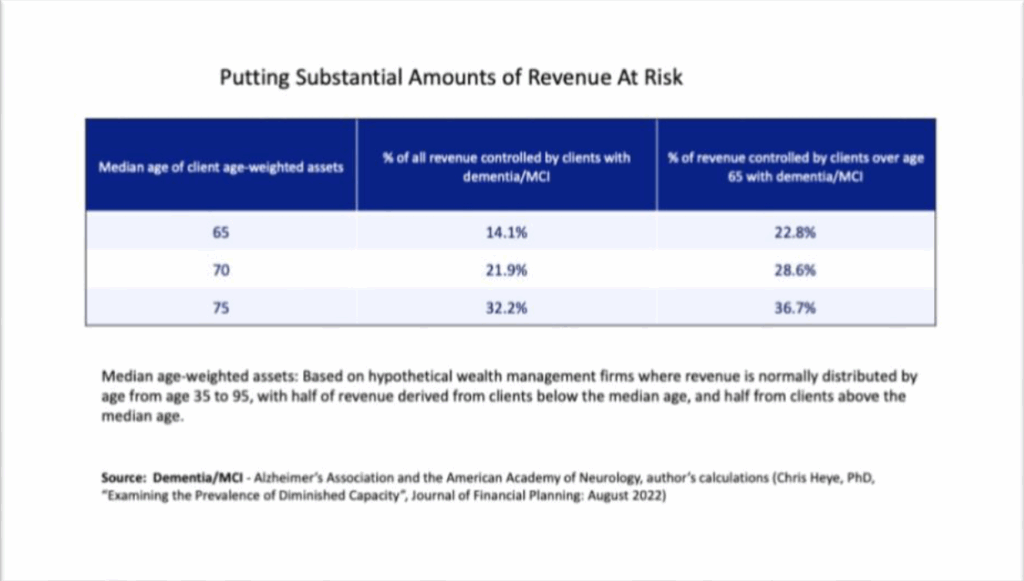

DEEPER DIVE: THE SILENT RISK IN WEALTH MANAGEMENT

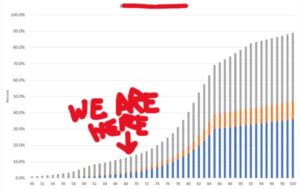

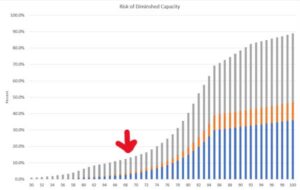

Cognitive decline represents a serious threat to wealth management and financial services overall. From the white paper, the chart below illustrates the exposure to the risks to a practice with an even distribution across all ages. Since we know revenue-weighted age is typically 65+ across wealth management, these calculations are conservative.

We continue to advocate for measures consistent with protecting clients, advisors and advisory firms. Specifically, action steps need to include:

- Training and coaching to help advisors with both proactive and reactive conditions, including key life events – The Moments That Matter

- Objective diagnosis – protocol and capability to determine a client’s level of competency. NextChapter and Whealthcare Planning LLC have a solution.

- Trusted contact and interested party designees – Proactively seeking TC or interested parties is a safe start to a broader family engagement that can both secure the G1 client but also start conversations with G1 spouse/partners and G2.

We take a deeper dive here in Financial Advisor – including the five key risks of not solving for cognitive decline.

Let us know your questions at info@nextchapterinnovation.com

On behalf of the NextChapter team, enjoy the summer!

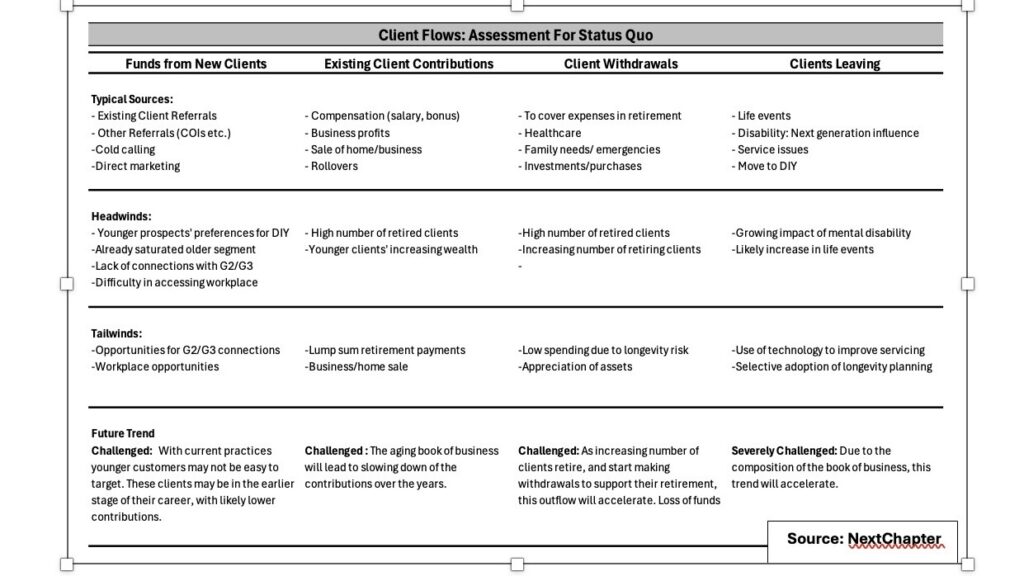

The Four Flows That Define Your Firm’s Future-and How to Turn the Tide

Steve Gresham, Suzanne Schmitt, Sharad Srivastava

The wealth management industry is at a crossroads. Record M&A activity and high valuations may suggest robust health, but beneath the surface, structural headwinds threaten the very foundation of organic growth for advisory firms. For owners and principals, understanding the dynamics of the four critical client flows-and leveraging pivotal “Moments That Matter” – now essential to safeguarding enterprise value and ensuring future relevance.

The Four Flows: A Framework for Growth or Erosion

- New Client Acquisition: Slowing to a Trickle

-

- The aging client base is creating a referral drought. As clients age, their social circles shrink, and so do referrals. Traditional centers-of-influence are retiring, and younger investors increasingly gravitate toward digital platforms and workplace retirement plans.

- Only 20% of next-generation clients retain their parents’ advisors, and with just 11% of traditional clients under 40, the pipeline is alarmingly thin.

- Existing Client Contributions: Declining

-

- With a weighted average client age over 60, recurring contributions are dropping as more clients enter retirement. Occasional inflows from events like business sales or rollovers are not enough to offset the steady decline in regular deposits.

- Withdrawals: Accelerating

-

-

Outflows are set to rise sharply as the bulk of assets are held by clients aged 60+, with a median age of 77. Healthcare costs, family support, elder care, and lifestyle purchases are driving withdrawals. Many clients underestimate these expenses, increasing the risk of even higher outflows than projected.

-

- Client Retention: At Risk

-

-

Attrition is rarely about performance or fees. Instead, it’s about relationship gaps-especially during critical life events. Approximately 70% of beneficiaries and successor decision-makers leave advisors after the death of a loved one a number that jumps to 80+% among affluent next-generation heirs (Tiburon Strategic Advisors, 2025).

-

Why “Moments That Matter” Are Your Secret Weapon

The traditional playbook—focused on investment returns and periodic reviews – is no longer enough. The NextChapter “Moments That Matter℠” framework identifies nine pivotal life events (unexpected health events, trouble making decisions, needs for caregiving, etc. ) that create natural openings for deeper engagement. These moments are when clients and their families are most receptive to advice and most likely to reassess relationships.

Firms that systematically recognize and act on these moments can:

- Retain assets as they transition from G1 clients to spouses and next-generation heirs.

- Expand relationships within client families, boosting revenue and profitability (engaged families generate 1.6x the revenue and 2.4x the profits of unengaged families)(Fidelity).

- Identify consolidation opportunities within the “forgotten 80%” of clients, who are often overlooked but represent untapped growth.

- Use technology and AI to proactively identify at-risk clients and engagement opportunities, multiplying the impact of advisor outreach.

Turning Challenges into Opportunity: Strategic Imperatives

- Win the Family

- Proactively build relationships with spouses and children before a triggering event. Firms with younger age-weighted revenues (<63 years) achieved 6.4% organic growth in 2023, compared to just 0.3% for older firms (Fidelity).

- Use family meetings, educational sessions, and planning around life transitions to demonstrate value beyond investments.

- Move Beyond 60/40 Portfolios

Address longevity and healthcare risks with protection-oriented solutions (e.g., long-term care, annuities, life insurance). These products not only meet evolving client needs but also create entry points for engaging younger family members.

- Mine the Forgotten 80%

Most firms generate up to 88% of revenue from just 10-12% of clients (NextChapter). Systematically review your book for consolidation opportunities as clients approach retirement and offer comprehensive planning to capture more wallet share.

- Build Digital Bridges

Combine AI-driven insights with digital engagement tools to connect with NextGen clients who expect seamless, tech-enabled experiences. Hybrid models (human + digital) increase engagement fourfold compared to either approach alone.

- Develop Next-Generation Talent

Invest in mentorship, career development, and technology-enabled work environments to attract and retain young advisors who can relate to and win over the next generation of clients.

The Bottom Line

The market is sending a clear signal: organic growth and enterprise value now depend on your ability to manage all four flows-acquisition, contributions, withdrawals, and retention-by meeting clients and their families at the moments that matter most. Firms that embed this approach into their culture, processes, and technology will not only survive the coming wave of demographic and digital disruption-they’ll thrive.

For advisory firm owners, the mandate is clear: act now, or risk watching your firm’s future flow away…

This column was excerpted from the forthcoming NextChapter whitepaper.

The Next Chapter in Wealth Management: Five Strategic Imperatives to Address Aging Clients, Generational Shifts, and Digital Disruption in a Rapidly Evolving Industry

For more information, contact us at info@nextchapterinnovation.com

Don’t Look Now - But Your Valuation is Slipping

An old saw claims that good wine and wisdom get better with age. But of late, that maxim does not seem to apply to the aging of typical advisory practice. At NextChapter, we observe organizations of all sizes delivering great financial results - earnings - but losing assets to the inevitable impact of an aging clientele. Left unchecked, firm valuations will continue to slide. That’s not the next chapter most ownership envisions. What to do?

We see three common scenarios - each a function of how that ownership views their situation. Let me first describe the three and then suggest remediation strategies for each.

Scenario 1 - What’s the Problem?

This is “great earnings” scenario - powered by a historic bull market, maybe some acquisitions. Earnings are great if you are an employee or a stockholder with a short term time horizon. If you plan to retire soon or sell your stock, there is no problem here. Advisor attrition is at an all time high and there is strong anecdotal evidence of record senior industry leadership departures - also well timed with a cresting wave of success. So with the benefits of good timing, we say “enjoy!”

For the other two scenarios - it’s back to reality.

Scenario 2 - What to Do?

Firms in this bucket tend are operating as usual for the most part, but have lost long-time clients here and there due to life-related inflection points like a death or significant illness.

As you know from popular industry data, advisors without a solid relationship with spouses, partners and adult children seldom hang on to those relationships. 70% departure rates are noted for the unengaged spouse, 90% for the unengaged Generation 2 children. An experienced trust and estate colleague of ours claims that when she gets involved with a competitive situation and the survivors are questioning the value of continuing with the incumbent advisor, she finds enough overlooked details to win 100% of clients away from their (typically) dad’s advisor. So there is a cost of inaction.

This scenario is mostly defined by a lack of certainty - what should we do - and not a lack of interest or willingness. The practice is challenged by new circumstances associated with aging families.

Scenario Three - Bring it On

These are the advisors and practices that are leaning in to the challenges of aging clients and seeing the opportunities with surviving Generation 1 spouses/partners and with Generation 2. This is the advisor cohort that has been including - requesting - engagement with family members before most of the “Moments” occur. This proactive effort is paying dividends as conditions develop and the family already knows and trusts the advisor and team.

This type of practice also manages more moving parts than a straight-on investment shop. We see three important attribures that define a “longevity savvy” business compared to the other two scenarios above:

Dedicated professional staff applied to the unique demands of longevity planning - including the ability to react to the Moments That Matter without significant disruption to the business.

A mindset of proactivity to engage. This practice is not just ready for action - it facilitates it. In the classic family office model or the ethos of a private bank, connecting with G1 survivors and Generation 2 is THE business objective, not an ancillary activity.

The practice measures success not by absolute financial returns, but by the percentage achievement of “opportunity”. This metric is different from most advisory practices and becomes more powerful as the size of the organization increases. Another descriptor is serving well “the other 80%” of the clients typically not the focus clients of a firm. The narrowing of engagement is a natural development over time as clients that are not ideal or not fully connected may slide off in part, attracted by other products, different ideas or lower prices. The “full opportunity” objective is a dedicated plan to earn back those “held away” assets by learning why they are not with the practice and what it would take to get them back. This is a true mindset of creating and maintaining organic growth.

So Growth Doctor - What Now?

Back to the first scenario. The perspective that there is “no problem” may be not be so accurate depending on the exit strategy. Like with the sale of your family home, your sales price has a lot to do with your view of the result. A practice that has been depleted by withdrawals from aging clients - and not replaced by engaging G2 children or new Gen X or Millennials - is truly a wasting asset. We see greater scrutiny of the “age-weighted” revenues when buyers approach practices. Organic growth is the metric — retention plus the impact of net annual flows - and this measure has become top of mind for buyers including more savvy private equity firms. Buyer education is improving, informed by some overly optimistic early acquistions, and that dilapidated house just won’t fetch the premium paid for a well maintained structure.

Scenario One invites a couple options - mostly a function of time horizon. If the owner wants to go soon, one choice is to align with another firm and help transition relationships. On a timeline with transparency for everyone. This is the best way to increase value by getting help to grow the existing relationships.

The second option takes more time but essentially recruits a junior partner to earn out the buy. One interesting take on this option we saw recently was a two year run after the hiring of the primary owner’s daughter, who refreshed most of the firm’s relationships, picked up the G2 kids and nearly doubled the practice revenue. She leveraged the G1 connections but really focused more on the kids, who she said were “learning a lot” by watching the issues faced by their aging parents. With those lessons running in real time, the new advisor got the kids to the table investing in retirement income and long-term care, with immediate bump to the firm’s margins.

Scenario Two is a bit easier - if the WILL is genuine. So many advisors and firms are running so fast that it is difficult to find the time to add longevity services. The additional needs of aging clients and their families can creep up on us - and all of a sudden everyone seems to need everything. That’s the real challenge of those “Moments That Matter” - they don’t come with advance warning.

Scenario Two firms first need a strategic “time out”. Resist the temptation to treat longevity planning as just a bolt-on to your existing capabilities. This is a different business requiring different service and - likely - dedicated personnel. The most effective model we have seen is when the practice acquires a specialist to not just meet the current expectations of current clients, but also oversees the practice “expansion” into longevity planning and the aligned capabilities, like how to refer caregiving needs, execute estate planning and mitigate risks of fraud.

Linda M, a senior advisor from a wirehouse firm, joined the existing four professional practice at a competitor in Northeast Florida. Linda says - with a smile - “I do the soft stuff”. She now oversees most of the firm’s financial planning capabilities in addition to coordinating support capabilities including fraud protection and caregiving referrals and long-term care. Linda’s four partners each focus on one other legacy capabilities - retirement plans, investment portfolios, bonds and tax management. They say, “For our clients and their families, Linda is the glue”.

The Thirty Year Flood (of New Business) - Choose a Boat

The condition of an aging demographic is so well known, the very mention of “baby boomers” creates the eye roll wherever I go — but this is more. The current state of the advisory business is being shaped by an demographic but the awareness of that force is uneven across firms either not immediately impacted by the loss of clients or complacent about their current terrific financial results. As a result, the response to the demographic changes is wide ranging.

Like most really significant trends, the impact of longevity is slowly building but will be a game changer for alert advisory practices leaning into the trend - and for companies providing capabilities and products that support higher quality longevity. Adaptable firms have an opportunity to capture market share at a rate we have not seen since managed accounts began to roll over stockbrokers. That part of the industry captured $12 trillion from a dead start. A similar path could be enjoyed by companies offering retirement solutions including protected income. Annuity sales were a record $100+ billion in the first quarter of 2024. Given the slim penetration rate of annuities within the advice industry, I can see upside that is multiples of the current run rate in order to achieve a pretty basic share of the retirement pie. The demography of the annuity buyer is getting younger - reflecting a lot of interest from Generation 2, which is learning from watching their parents. And we know that they are just getting started - this tide will lift all participating boats.

Longevity planning and solutions - stimulated by the Moments That Matter - are the biggest potential disruptors and drivers of business valuation since the move from advisors selling products to positioning managed solutions.

So what is your plan?

The Business of Financial Wellness 2.0

Written by: Steve Gresham and Suzanne Schmitt

Supreme Court Justice Potter Stewart famously remarked about pornography, “I know it when I see it.” The point was that it’s hard to otherwise put something that seems obvious into words.

We have a similar problem with the phrase “financial wellness.” Conventionally framed as managing daily finances, protecting against risks to your money and achieving goals, it’s best thought of as a journey where the destination is a state of financial well-being. Yet even the idea of being “well” can be highly subjective.

You can assess an individual’s financial health at a point in time, but their personal and familial circumstances are bound to change. Healthcare issues, for instance, can disrupt even the most thoughtful financial plans.

But if we are merely focused on investments and products we sell—as opposed to being well-being specialists—we haven’t gotten involved in those personal things. Viewed purely through a financial lens, many clients in their late fifties and sixties may be retirement ready. That instinctually leads us to jump to the conclusion they are financially healthy. We don’t lean into the messiness that is life and family financial planning.

And that could cost us.

It’s important that we prioritize well-being if we want to sustain the value of holistic, fee-for-service, fiduciary-level advice. If our clients don’t achieve peace of mind with their current advisor, they can be lured through workplace and retirement wellness offers to other firms where they think they will achieve it. Nothing motivates people more than fear—and many of our clients are genuinely afraid they will run out of money, need to sell their homes or move into assisted living.

In our personal experience (through our failures and successes), we’ve become convinced that centering our ideas on well-being can help advisors achieve their business goals (in the form of net new assets, growth in consolidated assets and increased share of clients’ wallets). Consider these five things:

Words matter. If you want the language you use to change the perception of your firm, remember that you should use words that offer peace of mind first, not technical concepts about asset allocation and investment policy.

You want better outcomes, not best efforts. Most retirement solutions in place today depend on market results and are subject to market risks. These risks are well known to the designers, who rely on their knowledge of capital markets research and dampen the risks by using long time horizons to smooth variations. While it’s a rational, objective approach that generally works for the population at large, individuals might have problems with the risks of the design and its terminal points: Today’s retiring clients and plan participants have seen down markets—big ones—in 1987, from 2000 to 2001 and from 2007 to 2009, as well as some sharp corrections in between.

The late father of Steve Gresham, one of the co-authors of this article, knew nothing about markets or investing, but he knew when the stakes were too high for his peace of mind. He worked for universities his entire career and earned the negotiated benefits of retirement annuities. He surprised Steve by sharing that he had converted his 50/50 stock-bond plans to 100% annuities with Steve’s mother as second life. He never looked again at the market. He cashed the checks, and now so does Steve’s mother at the age of 88. Their definition of “financial wellness” was not having to worry about the markets, their income level, their ability to finance healthcare or their ability to age in their home. Done.

The clients of financial advisors often are looking for a certainty of outcome. If the client is analytical and satisfied by data, they might enjoy a risk matrix offering a percentage likelihood of success. But it’s unlikely more than a fraction of our clients are like that—especially not retiring couples and their families. In most households, there’s someone who values protection and guarantees over potential returns or capital market theory.

The household is the client. Most advisors dealing with a household talk to the typically male and financially confident household head. Their firms may realize they should be dealing with multiple generations of a client’s family—including the spouses, the adult children and aging parents—but they haven’t given their advisors the direction to do it. This demographic sandwich, the generation above and below your clients, will drive more than 80% of advice industry profits through at least 2030. Our success depends on both keeping our existing clients and consolidating the assets we don’t currently oversee but our competitors do. Client relationship management software will have to accommodate entire families for this reason, and we’ll need to coach and train associates to talk about and to clients about these other family members.

Your service models will have to be for everyone. And remember, each of these different family members will have a different idea about what “peace of mind” means and whether you can offer it to them.

Frank McAleer, a senior vice president of wealth planning at Raymond James, asks clients, “What is the list of stuff you most worry about or that could go wrong as you live longer?” And “What about family members for whom you could become responsible?” The answers will be different for a 26-year-old 401(k) plan participant and for a 62-year-old pre-retiree. Different still for their families.

For this you might have to create separate service models for different family members—with different levels of communications, pricing and product and service options. One family member might want the reliability of a paper account statement; another might need the immediate transparency of a mobile app. When you have separate models, you can more easily and consistently focus on improvements for unique cohorts.

Wealthy families in particular expect their advisory firms, plan sponsors and plan administrators to offer a variety of models, including in-plan advice and fiduciary wealth management (with trust services). And if the past is any indication, those expectations will quickly spread to people in the mass affluent category and beyond.

Know how to implement. So how do you integrate “well-being” principles into your services? It’s a matter of both will and skill.

You may or may not possess the empathy you need when a client’s talk turns to the needs of an aging parent or the need to pay off a child’s college loan. If you don’t, that’s a management problem for your firm, which has to make sure empathetic advisors are in place. Your will to do this might suffer still, ironically because of your success at the markets—stock rallies likely make your work look easy and lessen your enthusiasm for harder tasks, such as mustering the energy to reach three generations of clients in a household. But if you fail at that, you risk less trust and less wallet share.

Technology’s Role

The bad news is that “wellness” is not a widget companies can attach to their existing offering. That approach has been attempted with the best of intentions by retirement income product providers. But the complexity of the products and their sometimes inconsistent availability (and pricing) are barriers to more consistent use in planning—and adoption by more advisors.

To achieve its true potential, “wellness” must be integral to the language and the systems and the solutions of a firm. I will never forget the call from a seasoned advisor who had completed his outreach to a wealthy family, with the help of the head of household. “I now have nine clients instead of one!” He was only partially kidding. It’s a lot of work to track the needs of families, and you don’t want to be the advisor who missed a Medicare election, a life event or the 21st birthday of a beneficiary.

The solution is a combination of systems for client data, simple technology tools for the clients that can be used along with the advisor’s old school training and coaching. The advisors and clients both will have to adopt the technologies to ensure the reach and consistency of engagement. And creating systems like this is the No. 1 job of today’s financial firm CEOs if they want to create peace of mind among both clients and advisory firm associates.

The Workplace

One way for a wellness specialist to connect with clients is by getting to know their workplace/benefits providers. Work is where your clients make much of their money and get basic insurance. As it happens, workers place profound trust in their employers and the service providers they offer. The public relations firm Edelman, in its 2023 “Trust Barometer,” said that workers trust their employers more than government, media, advertising or other corporate sources.

How much do you know about your clients’ benefits? Or their spouse’s or partner’s? Or the advisors who service their workplace plans?

It’s also a natural place to get more involved and introduce advice and guidance light. If we leaned in, we might find out about things like employer student loan repayments, which, as we noted earlier, could help a next-generation client who is looking at student debt as an obstacle to wealth creation early in their financial lives.

At best, you’ll find educational resources for your client. At worst, you’ll uncover risks to your relationship in the form of competing products, services and advice.

The next thing you’ll want to be on top of is your clients’ key life events—those inflection points when money is in motion. Studies suggest roughly two-thirds of consumers seek advice after a major life event (a marriage, a child going to college or a death or inheritance). These points present an opportunity for you to engage in advice and naturally place products, services and solutions. Workplace plans are getting smarter about using data to get in front of consumers in transition. How strong are your relationships and capabilities to help consumers to and through life changes? Is this a practice vulnerability for you?

Advisors focusing on wellness can also become more credible by choosing the right partners: trustworthy subject matter experts who offer you a deeper bench of knowledge. Different organizations can offer you support for issues concerning caregiving (something tackled by the National Alliance for Caregiving, for instance), general family financial health (a field covered by the Financial Health Network) and end-of-life planning (for example, the organization called Going with Grace).

How much do you know about your clients’ health, family health history and potential caregiving obligations? If the answer is “not much,” your clients may be at risk. The diagnosis of chronic health conditions is on the rise. Roughly 20% of people in the U.S. are currently acting as an unpaid caregiver—frequently to the detriment of their own health, financial security and professional growth.

Knowing more about these issues can help you retain clients. You’re also positioned for growth with the next generations.

What Advisors Get Wrong About Wellness

Remember the old saw: When you have a hammer, everything looks like a nail. The same is true with financial products. When you have one, you’re looking for a need and you do things backward.

Consumers aren’t looking for product. They’re looking for someone who deeply understands their needs; is empathetic; and offers objective, product-agnostic resources and advice.

Advisors also get things wrong if they’re not looking at the risks of a client’s entire family. After all, a client is only as financially healthy as the people who depend on them. Even if your clients seem to have their act together, how much do they know about their parents’ ability to navigate a major health setback? Or their parents’ ability to afford staying in their home as they age? How much do they know about their family’s financial plans and the impact events might have on their balance sheets?

And how well do you understand these risks your clients have taken on as you look across your book?

We also err if we forget that this is a journey. Let’s say that your clients have manageable debt, three to six months of emergency savings and are basically on track for retirement. Does that mean they are financially well? Life happens. Things change. Most advice givers think that the key is to get people to retirement, but it’s actually to get them through it. Given that most of us may live a third of our life in retirement, how exactly does that work? Our offering must also get into things like how retirees maintain independence, secure income and ensure long-term care, as well as their ability to share wealth with the next generations.

The biggest mistake is to play a short game.

The Chart of the Decade

At a recent meeting of top advisors hosted by education innovator Wright State University (where flight was born), I shared this chart under the guise of “opportunity”.

What’s the subject?, I asked. Tesla stock price? Bitcoin projection? Spending on FinTechs? Nearly a perfect S-curve, which favors the early adopters. And the best news, we can catch this one just before the S takes flight – note the arrow.

The chart is a propensity chart, depicting the likelihood of experiencing some level of incapacity due to one of the three most common health events to cause incapacity – Alzheimer’s, other forms of dementia, and mild cognitive impairment (early onset dementia).

The savvy advisors know from experience that each of these ailments presents a life change – to the client/patient and to the family. The impact is both immediate and ongoing. Nothing is ever the same. Priorities change. In the world of financial and retirement advice, advisors are needed more than ever and for more complex services.

Our response is critical. We have to react with empathy, engage professionally and with confidence. We become the financial emergency room, transitioning to long-term care. And not just for our primary, affected client – we have to be there for perhaps three generations of family members who are now also affected. Everyone needs to know we have this, we can help.

We don’t have much time before these conditions accelerate in frequency. The current overall propensity rate is 1 in 8 for people age 68 but more than doubles by 78 – and 6X at 88. Over the next ten years, nearly 1 in 3 people we now serve are likely to become incapacitated themselves, and a great many more will be impacted by someone in their life who becomes incapacitated.

For advisors and their firms serving the Baby Boomer age wave of 76 million people, this transition has been looming…but preparation is still light. Every firm and every advisor will need policies, procedures and supportive tools to:

- Identify incapacity for the protection of the client, her family and the firm

- Protect clients and their families from the threats of incapacity, including identity theft, fraud and elder abuse

- Engage families in support of incapacitated clients – as well as clients without family support

- Adjust to the needs of a family of three generations or more and help optimize finances for risk, tax, income and long-term care

Don’t Ignore This Moment

If you are winding down your advisory career, you might be doing the math and saying that in ten years you will be on a beach living the vida mas fina. That’s probably pretty well known by your clients and their families. As Accredited Investor co-founder, Ross Levin said so well at our Next Chapter Rockin’ Retirement event on May 24, top firms are winning clients and keeping clients because they have a “contract” with clients and their families that the firm will be there for them. Another speaker, veteran Tom Bradley of Schwab noted that aging clients – and aging advisors – are now important measures for the valuation of an advisory practice (get the whole program here ADD LINK to NEXT CHAPTER MEMBERSHIP).

One very interesting aspect of this chart is that it is also a good picture of the demand for pretty much everything associated with the historic demographic cohort. If they will need it, you name it and the growth curve will be similar. Demand for in-home caregivers, Medicare counselling, pickleball courts, assisted living facilities…they’re all here at the same time. Consider…..

The Price of Ignorance – Five Risks Ahead

I’ve also spent a lot of time worrying about this issue on behalf of big company clients and I see five significant risks of keeping our heads in the sand:

- We lose current clients and their assets

- We lose the potential consolidation of assets held by our clients elsewhere – that’s a pretty similar number to the total in 1 above

- We lose the client’s family – if we don’t take care of the primary client, the family won’t stick around. Surviving spouses and adult children have no affinity for our failure to act.

- We risk increasing scrutiny as fiduciaries or service providers that do not sufficiently “know your client” – an area of growing interest to state consumer protection regulators. Get ready also for a return of active arbitration in this area as we return to in-person activity after a pandemic slowdown.

- Finally, a firm that does not do well by its aging clients is exposed to significant reputational risk. Poor experiences might be contained in the complaint process, but some of the more colorful cases will doubtless make headlines – electronic or otherwise. I expect a lot of interest in these stories.

Other Than That Mrs. Lincoln, How Was the Play?

Every corner of the financial advice and investment management industry has benefited handsomely, unexpectedly from the historic demographic wave and the power of that wave to lift all economic boats. Now it’s time to repay some of that value by meeting the needs of our loyal clients and their families – all of whom will be encountering their longevity for the first time. Our ability to serve is a function of both will and skill. I’m completely confident we have the skill. Do we have the will?

Hidden Struggles: The Challenges Faced by Caregivers

Written by: Suzanne Schmitt

“The last few years really challenged me to keep two things in perspective: caring for the people I love most—with the toll it takes emotionally, physically and financially.”

As a three-time caregiver, Lisa would know.

Parenting

Lisa, a former colleague of mine at a brokerage firm, became a parent a few years ago. She assumed she could keep her job when she became a mother, and she and her husband, Jeff, secured a slot for their son, Jake, in a daycare near her office.

Things worked well, until they didn’t.

Lisa earned more than Jeff, but she had an unpredictable schedule. A couple of times, the school needed someone to pick up Jake, but nobody was around. Lisa wondered if they could keep it up, and after a few heart-to-hearts with Jeff, she left her job and stayed out of the workforce until Jake started school.

Reversing Roles

After a few years, Lisa went back to work, Jeff was promoted, and Jake went to preschool. Things seemed normal.

But then one morning Lisa got a call that her dad was in the ER after what was suspected to be a heart attack. Her mother let her know he was stable but needed cardiac rehab. Could she come? Lisa gave her team a heads-up that she’d be gone for a week. One week turned into several. After she’d exhausted her vacation time, she took a leave so she could help Mom see Dad successfully through rehab.

Aging Alone, Together

Her father’s heart attack was a wake-up call for both parents. They decided it was time to retire, albeit earlier than planned, and enjoy life. To help compensate for their retirement savings shortfall, they downsized and moved to a state with lower costs of living. While Lisa was happy to see them thriving, she missed them. And neither family anticipated the costs of traveling to see each other. On a visit, shortly after her dad’s death, it was clear the house was too much for her mother to handle. Lisa talked her into moving back to their home state. Since buying was cost prohibitive, Lisa and Jeff converted their basement into an apartment for her mother.

The Real ‘Costs’ Of Caregiving

Lisa’s laborious experience is increasingly common.

- The National Alliance for Caregiving has come up with some unsettling figures:

- The alliance says 19% of Americans provide unpaid care to an adult, and 24% of caregivers look after more than one person.

- Caregiving affects more women than men. Sixty-one percent of woman say it affects them while only 39% of men do.

- The need for caregivers cuts across the wealth management and demographic groups among your clients, with boomers, Gen Xers and millennials all being called upon for unpaid care.

- It’s also expensive to care for others. Forty-five percent of unpaid caregivers experience at least one financial impact: meaning they must stop saving, deplete their emergency funds or take on debt.

- Their work is also affected when they take on care for others. Sixty-one percent of unpaid caregivers have also experienced at least one work-related shock, meaning they have to reduce hours or pass up on a promotion.

- Caregivers’ own health is on the line, too. Twenty-three percent of caregivers say their efforts have made their health worse. If health is wealth, unpaid caregivers face additional threats to their social, emotional and physical well-being in the forms of increased healthcare costs, higher premiums, reduced retirement savings and the depletion of wealth.

A When, Not An If

For many of us, like Lisa, caregiving is a role we’ll take on repeatedly over the course of our lives.

So what can advisors do to prepare and protect their clients—and their books?

- Understand who might depend on your clients. This could include older loved ones, children, spouses, extended family, pets, even friends. Your clients’ plans are only as solid as the least prepared person in their circle.

- Get to know the people they might depend on, too. While we all hope to live happily, healthfully and independently, life happens. Do you know whom your clients would call from the ER? Have you met their trusted contacts?

- Ask about key documents. Do your clients have current and complete powers of attorney, living wills, healthcare proxies, wills, etc.? Do the people named know they are?

- Monitor your clients’ life events. When people move, change jobs or experience a serious change in their health, these things rarely occur in a vacuum. Consider asking your clients this simple question: “What’s changed in your life since we last talked?”

- Get to know their family health history. What conditions are in your clients’ family trees? How long have older relatives lived? How well? When you unpack their health issues, you can build new relationships and deepen existing ones by addressing a key financial stressor.

- Raise the subject of workplace benefits whenever it’s appropriate. Do your clients have access to caregiving support services at work, including emergency/backup care, eldercare or (increasingly) paid caregiving concierge services? Be aware that many of these workplace benefits, including most financial well-being programs, come with access to advisors.

If you don’t raise these issues with clients and their families, someone else will.

Improving Solution Efficiency and Client Confidence with Added Protection

Written by: Paul Cahill, Steve Gresham and Mike Harris

That Portfolio is Not Enough

Todd Z. has been busy acquiring new clients. “All I have to ask a prospective client working with a traditional investment advisor is whether they have any guarantees in their investment portfolio – and would they like to add a personal pension “bucket” with a guaranteed income stream for the rest of their lives”.

“Protection is gaining more and more traction in our uncertain world,” say Todd, a 35 year veteran, and part of a 125 advisor team brokering with one of the leading national IBD firms, reports that many of his competitors are making his life easy. “A new client found me after asking the advisor (from a national firm) about guaranteed income. And the advisor said he didn’t believe in annuities”.

Heads in the Sand Can’t See Changes

Our collective history working with advisors across all national firms, RIAs and IBDs has spanned the move from stockbrokers to managed account consultants and from life insurance agents to advanced planning financial professionals. Our common observation: clients lead us forward into the areas important to them, and advisors who listen take market share away from competition fighting the trend.

Paul and Steve worked to introduce managed accounts to skeptical advisors – “Why would I refer my clients assets to a third party?! What’s my added value?”. That perspective seems silly now – especially with $11 trillion in managed accounts. For Mike, an advanced planning leader, he found opposition to solutions-based sales of life and annuity products – even among advisors already using them but only for simple sales. “One and done”, Mike recalls, “They had the tools but not the patience”. Oy.

Peak65® is Here – To Stay

The shift from investing for retirement to actually funding that retirement is on, and more Americans will turn 65 this year than ever before. Peak65® is here, according to the Alliance for Lifetime Income, and Peak65® author, Jason Fichtner says that more than 11,000 people are rolling into retirement every day. We know the data, but we also see the results every day with advisors like Todd. And we are frankly baffled that many advisors are not embracing “protection”.

Are You Listening? Data Says “No”

The 2023 Protected Retirement Income and Planning Study – also from the Alliance – reveals a communication gap between retiring clients and their advisors. 77% of financial professionals say they raise the topic of protection with their clients, yet only 33% of clients surveyed say their FP has done so. This is pure communication skill – but also can be the result of advisors talking to some clients but not others. This inconsistency of solutions delivery has bedeviled the advice industry for years. Some clients get planning, most don’t. Some clients have investments and protection solutions, most don’t. With an average book of 150 households, most advisors are time challenged to keep up with the retirement needs of clients – clients that were a lot easier to care for when they were simply mailing in checks.

Use Normal Human Language, Not Financial Jargon

When investment-focused advisors interact with clients, we see semantic differences that keep clients guessing. Three risks feared by clients work against advisors devoted to portfolio management and not leveraging the power of protection:

- “Sequence of returns” risk, aka the potential for their nest egg to crash at any point in retirement makes many clients lose sleep. Why not offer a percentage of the portfolio “hedged” against a market decline by providing protected income?

- “Who will manage our retirement income” risk – a common fear for clients facing their own mortality – or cognitive ability. “I don’t want to worry my children”, said Jackie, a client. Other annuitants, like Steve’s dad, loved the idea of naming Steve’s mom as a second life on the annuity. Mom has outlived Dad by eight years – so far.

- “Longevity” risk – speaks directly to clients’ well documented fear of outliving their money. Todd highlights the concept of a “personal pension” with income guaranteed for life. “Pure peace of mind” he says.

Get Support for Your Protection Move

Mike quotes Linda, a longtime advisor colleague now with Raymond James, who joins Todd in underscoring the importance of firm infrastructure in support of protection solutions. After ignoring annuities for the first several years, a colleague showed her some basic strategies that were also soothing for clients. Her recommendations for the investment advisor transitioning to at protection:

- Start with trust – Linda cites the level of trust her clients placed in her that made the conversation about annuities an easy transition from other products.

- Explain the benefits – slowly - once clients understand the protection aspect that annuities provide through secured income, that perspective acts to solidify their trust.

- Address anxiety - using annuities with clients that seem to be a little anxious – roughly half her clients - really helps them get past their concerns.

- Set the stage ahead of time – Linda includes annuities in the retirement solution set she talks about with all clients to help smooth the path to the annuity conversation when it's time for that discussion.

Don’t Speed

Top advisor, Rick gets the parting shot. “The markets have been good to us – again! Pretty much every client knows that trees don’t grow to the sky, so taking some profits off the table and ‘banking’ them for life in a lifetime income product just makes sense”.

Paul Cahill has led distribution teams across mutual funds, ETF’s, and Separately Managed accounts for the past 25 years, including most recently as National Sales Director-Independent & RIA Division for Virtus Investment Partners. He is currently serving as a executive-in-residence at NextChapter.

Steve Gresham is managing principal of NextChapter, an industry leadership community dedicated to improving retirement outcomes – for everyone. He is also Senior Education Advisor to the Alliance for Lifetime Income. See more at: https://nextchapterinnovation.com/

Mike Harris, CFP, CLU, ChFC, led planning and protection teams for more than 30 years, most recently with Lincoln Financial Group. He is also Senior Education Advisor to the Alliance for Lifetime Income.

For more information about Peak65® - please see: https://www.protectedincome.org/ymm-peak65/

The Retirement Wake-Up Call is Here

Disruptors Paving the Way for New Competitors

In 1965, a Harvard-trained lawyer working for the U.S. Department of Labor published a book warning Americans that their cars could kill them. Unsafe at Any Speed: The Designed-in Dangers of the American Automobile by Ralph Nader (1965) rocked the Detroit auto industry, and its damning revelations prompted the federal government to act with uncharacteristic energy to implement the National Traffic and Motor Vehicle Safety Act the next year. Nader’s message was that car manufacturers knew about vehicle defects and in fact designed them that way. His moral observation: You can’t trust the maker of the car you drive.

Now let’s take another industry that’s likely to face trust issues. Tens of millions of Americans believe they are going to be fine in retirement. But those of us in the financial advice industry know better. Most of these retirees will run out of money, have significant health issues, and become unable to manage the care they need.

But have we warned consumers about this? If we cannot ensure that they thrive in longevity, aren’t we responsible for telling them? And if there is a problem for consumers, then financial advisors, their firms, and investment solutions companies will be greatly affected.

This article outlines:

- The impediments to effective consumer/client engagement for advisors.

- The structural barriers facing investment and product providers and advisory firms.

- The path forward for creating better outcomes and comparative models for success.

The need to aid an historically large generation of retiring consumers and their families is the most significant financial challenge in post-World War II America—and the current outlook isn’t good.

Retirement Challenge #1: A Lot of Unprepared Consumers

Consider that when you search Google for "retirement savings crisis" you will get 69 million results. The vast majority of our clients are baby boomers, the generation first born in 1946. That group still is 70-million strong, and together with their children and aging parents represent more than one-third of the U.S. population. They own half the nation’s wealth and represent 70 percent of its consumer spending. They currently generate 80 percent of financial advice industry revenues and will hold that spot through 2030, according to Tiburon Strategic Advisors.1

We know consumers are concerned about market volatility—and that concern becomes acute when they near retirement. According to the Alliance for Lifetime Income (2023), 43 percent of consumers believe the 2022 market setback represents a longer-term change that negatively alters their retirement outlook. They are facing a different economic and personal healthcare picture. More than half of consumers said one of the three reasons they retired was circumstances of health, job loss, mandatory age requirements, or the impacts of COVID-19.

Awareness of the risks of longevity is growing. During the boomers’ lifetimes, life expectancy at birth has increased 17 percent to 78.8 years, and life span at 65 has increased 44 percent. That longevity will demand more resources from them after they retire. Yet at the same time, the workforce supporting Social Security recipients has declined. The number of workers per beneficiary was more than 50 in 1946.2 That ratio has now fallen to 2.8 workers. Meanwhile, by 2040, the number of Americans age 65 and older will have doubled since 2000, and the population age 85 and older will have doubled since 2020.

We also know that many people don’t just ‘feel’ vulnerable. The National Council on Aging (Basel et al. 2023) said 80 percent of households with an older adult are financially struggling today or they’re at risk of economic insecurity as they age. Most Americans also said they want to live independently, in their own homes, as they age. But 60 percent can’t afford more than two years of in-home care, and 45 percent of people age 60 and older don’t have enough income to cover basic living costs.