The Client is Not Always Right

It was one of those “Hello McFly” moments (if you remember the iconic line from Back to the Future with Michael J. Fox). On stage at a national retirement income industry summit featuring brilliant scholars and company CEOs. A panel of confident, self-directed investors said they felt they didn’t need any help (this is before the recent 20% sell off, BTW). “I feel like advisors are trying to sell me something”, each of them remarked. The line of the day came from a top advisor with an insurance company parent that started off replying, “If you feel like you are being sold something, maybe you need something!” Drop the mic – a subdued chuckle rolled through the room.

Perspective is Personal, and Preparedness is a Preference

I’m fortunate to work a lot with the Alliance for Lifetime Income (protectedincome.org), a not-for-profit group dedicated to championing retirement income – supported and funded by 24 of the biggest companies in financial services and retirement. The summit organized by ALI and roundly attended by industry leaders sought to expose all perspectives. The confident over-confidence of investors sounds familiar to those of us who have been around for awhile. If you’ve lost 50% of your account value in a “correction”, you have perspective. That would be most Baby Boomers – the dominant client cohort today and for the forseeable future. The Alliance and its educational arm, the Retirement Income Institute, keep tabs on consumer views with terrific studies like the most recent work, Protected Income and Planning Study with @Cannex - https://www.protectedincome.org/news/in-the-face-of-a-potential-recession-americans-feel-unprepared-for-retirement-and-are-looking-for-protection/

The work of the ALI and the RII shows that people do know better – and they are learning more every day about how little they know.

Welcome to the Curveballs of Retirement

Navigating retirement is a bit like batting in a baseball game against a wild pitcher. You expect the fastball down the middle – the cost of living, healthcare, et al. You prepare for those pitches. But life sometimes gets in the way of the expected and it’s really hard to prepare for the inevitable curveball – like an illness – or a wild pitch like your only home being wiped out by a hurricane. My 88 year mom was standing tall at the plate for the first 25 years of her retirement. My dad set up four two-life annuities from his universities and had a New York State pension. Mom gets five checks a month since he passed away in 2016 - and can’t spend the income. And then Hurricane Ian blew up her idyllic Sanibel Island world. Safely evacuated by my nearby sister, she is crushed but grateful to also own a share in a continuous care retirement center on the mainland where she can live safely and close to both professional care and longtime friends. She no longer remembers how she fought that idea….

Helping Clients Learn How to Hit the Curve

I continue to fear that most people are not prepared for retirement. That’s a big statement, but understand the perspective. Most people don’t have the cash to survive a protracted retirement. Longevity will suck up their savings. Especially if markets and interest rates don’t cooperate. And especially when big expenses, aka curveballs, are added into the mix. A very interesting interview I conducted recently with a terrific advisor revealed his approach to longevity education and planning. He navigates clients through the regular planning process with Money Guide. He congratulates them and thanks them for their patience. Then he says, “And now we do it again – with the ‘what-ifs’ included”. Time to learn how to hit the curve.

That Wild Pitch Just Might Hit Your Head

More and more smart thinkers are talking about the non-financial issues of retirement, or what my ALI colleague Mike Harris calls, “emotional finance”. Your client might have money for retirement but an undeveloped sense of what you will do in retirement to avoid isolation, boredom, lack of purpose. I see those forces eating away the spirit of friends and relatives. Another great industry colleague, Eric Sutherland of PIMCO rescued his mother from her retirement paradise but she lost her friends as they fled to disparate locations. And don’t try to tell me that pickleball is enough to engage a Type A businessperson at the same level. Silver lining: my aging orthopedist stays young fixing those folks.

Practice Management Pandemonium

The bottom line is that there is now building a slowly moving conveyor belt of pre-retirees, new retirees and wannabe retirees, all in various stages of education, realization and comprehension. Unlike the relative order associated with investing for the future when everyone is equally impacted by markets and news – this lineup is all over the place. If I stretch that baseball analogy, we have an unlimited roster of players (clients) of varying abilities facing an equally prodigious pitching staff firing pitches (life events) of all kinds at all of them at once. And that is now the typical advisor’s practice – a free-for-all of issues and events across multiple generation families scrambling to adapt. You will be tested as never before by the sheer volume of activity. Organization, teamwork, digital support all play a role.

Objective: Be Worthy of Being Consulted

Master the madness. Help people face the curveball and at least deflect its damage. Listen to them explain what happened. Listen more. Ask questions. Only then can you provide some perspective, some education. And then listen some more to reactions. There is plenty of time to suggest actions to prevent but seldom any time to linger over an unexpected head shot. Sooth, calm and balm. The best advisors know these events happen, they know how to handle them and that the most important step is listen well. That’s what defines a great advisor in this crazy land of retirement – a listener who has been there and can project their professionalism through their confidence.

Your Retirement Needs an Eco-System

Wikipedia says an ecosystem is “a community made up of living organisms and nonliving components.” A digital ecosystem is a “distributed, adaptive, open socio-technical system with properties of self-organization, scalability and sustainability.”

Welcome to the cutting edge of retirement planning.

In my retirement utopia, clients know the answers to important questions. How much will I need in retirement? How will I pay for healthcare? Can I safely age in my home? They have confidence in the answers to those key questions – and others. Collectively, we call that “wellness”. They call it “peace of mind”.

In my utopian world, financial professionals are able to provide those answers. They are challenged by the underlying complexity that is most often lost on the clients. Effective and reliable solutions are the common objective of clients and financial pros, but there are a lot of moving parts to accommodate, including vagaries of health, financial markets, the penalty of taxes and the longevity of the clients themselves. The questions are simple, the answers not so easy.

Enter The Eco-System

Creating a solid retirement solution involves several asynchronous variables – the Rubik’s Cube of planning objectives. Investment management plays a role, actuarial science has a view, client behaviors and preferences weigh in. Information flow is critical. Financial planning software collects data and mixes scenarios. And all of these capabilities have to talk to each other or the result is a jumbled mess of one-off “answers”. The music store instead of an orchestra.

I like the ecosystem definitions above, especially when they are combined. The interplay between “living” and “nonliving” is elegant science-speak for the dual and complementary roles of technological efficiency and human touch. Financial services technology in the retirement planning utopia is not a replacement for advisers; it’s a tool set that creates capacity and better service. The second definition — the digital ecosystem — goes further: adaptive — open — self-organization — scalability — sustainability. The ecosystem is less a collection of parts than it is a dynamic combination of elements that evolve with changed conditions. Orchestra-like.

No Retiree Left Behind

Competitive retirement planning offerings should have the same flexibility – and efficiency. Can we really say that every client feels covered for healthcare costs, protected income and has adequate liquidity for big expenses in retirement? We will be judged at some point not just by the quality of our solutions but for the ability to reach all of the clients in our care.

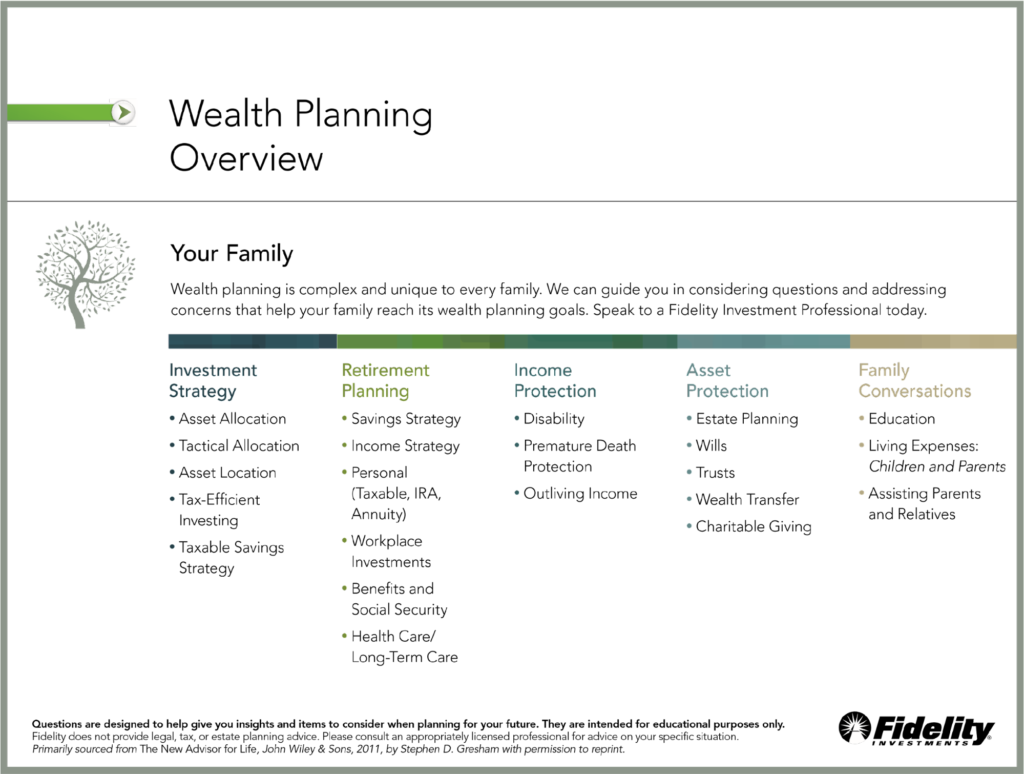

We can debate the key parts of a retirement planning ecosystem, so I will start the dialogue with my top ten observations:

- Wellness. Wealth without health or health without wealth? Each is half a loaf. Retirement planning without integrating health care funding and longevity planning is just malpractice. Wellness is highly subjective but assumed by our clients. Read more https://theexecutionproject.com/the-business-of-wellness/

- Taxes. The second issue uniting all the world’s clients is taxation. If we can’t talk about the impact of taxes — all kinds of taxes — then we can’t really say we have a comprehensive plan. In retirement, taxes are especially significant. Knowing which retirement account to draw down remains among the very top client concern.

- Regulation and its impact on client engagement and risk. A mouthful for sure, but the shorthand is that “best interest” is table stakes and most consumers would be horrified with anything less. The world’s fiduciaries are increasing in presence and power. Doing good and doing right are pillars for running a good advice business. Do we really need the federal government to design our business strategy?

- Digital investment services. So far beyond the label of “robo,” these capabilities are a godsend for busy advisers working with multiple family generations. It’s now time to reverse the order of their introduction. First design everything we can to be delivered through the 24/7/365 machines and save the humans for only the most essential work of understanding and translating client needs and concerns.

- Automation of client data and adoption of centralized data management. Will this generation of advisers be the first to eliminate Excel and the Post-it note? Adoption of powerful tools lags way behind their creation. Give that CRM company a chance to prove it’s not just good for mailing lists.

- Communications. Three principles here: how, when and why. Flexibility in the ecosystem customizes your outbound messaging by sharpening the content and its delivery. But our language has to improve. It’s not just jargon – it’s volume. Applications and prospectuses raise more concerns among most consumers, defeating their intent. We must do better. Language is the fastest way to change perception.

- Security, Created by Protection. Three perspectives here. The first is to ensure protection and integrity of client information. Attackers abound. The second is to increase focus on the vulnerability of people as they age. We are still in the lip-service stage here. And finally, we have to include “protection” in our lexicon of solutions. Every client has a balance sheet and all but the most wealthy will need to leverage their assets to provide protection against the risks of living too long, costing too much or needing liquidity for big expenses. Where to start? How about a retirement paycheck?

- The risks of an aging population. Doubling down on “security”, take a lesson from the historic collapse of the Big Three automakers: Demographics matter. The baby boomers own the market for financial advice and pay most of the bills for years to come. Their median age is 66 and they likely trail two attached generations with them, along with a myriad of accounts and complexity and risk. Read more: https://theexecutionproject.com/chart-of-the-decade/

- Adviser hiring, training and retention. Where to start? Surveys suggest top advisers average age 55-plus, and very few young people seem to be entering the industry. ‘Nuff said perhaps – but what to do? We can spend a lot of time here. Financial professionals still in the game have the best opportunity in decades to build a fantastic business. But it will be different from the job of the past 30 years. Getting through a retirement is different than saving or investing for one. Different skills, different systems, different leadership. Older advisors are partnering with younger folks with complementary skills. Real retirement advising needs a team.

- Integration. The inability to see all of your accounts and all of your investments makes clients crazy and prevents financial professionals from providing an effective retirement strategy. Annuities have to be included on the custody platform along with managed accounts and individual securities. Everything has to be in the planning software as well. And then we need to optimize – truly - across the household for risk and tax liability. The very best advisers do this today with heroic effort that begins with integrating systems not easily connected.

Winners Connect the Dots

Onward. The true north for retirement is simple, intuitive experiences for both advisers and clients focused on achieving better outcomes. Industry leadership has shifted to players creating supportive ecosystems that optimize the best of people and machines. The firms that can integrate the great FinTech inventions and product solutions with simple client communications are winning.

Yet despite the appeal of a unified approach, the status quo is a formidable obstacle to change — most advice firms are experiencing record results consistent with record markets. A deeper look reveals structural weakness in many advice offerings that stand in the way of providing a seamless, flexible and compelling client experience. Let’s see who wins the war for net new assets and share of wallet. The path to success is paved with ….simplicity.

Let’s keep this dialogue going. Check out this summary of the forces now transforming “retirement”. Check out the resources for both consumers and financial professionals at the Alliance for Lifetime Income, https://www.protectedincome.org/, and join the industry leadership in the quest for better retirement solutions, Next Chapter, https://theexecutionproject.com/community/

Out With The Old Bull, In With A New Bull

Bull markets are like rivers, the saying goes. Most begin small, quiet trickles that build to a stream long before bursting open with impressive size and power. Go with the flow, we also say. I am no market sage, but I’m seeing one bull running out of steam while another river is building. And I’m on mission to ride that wave…..

The epic bull of 2009-2022 flooded portfolios with gains unlike anything in modern time. Rushing out of the gloom following the Financial Crisis, the early flows were strong – a sign perhaps of the historic gains ahead.

Stock Prices: The Bigger They Are, The Harder They Fall

On March 6, 2009, the Dow Jones bottomed at 6,469.95. Here at Labor Day 2022, that familiar market index rests above 31,000 – a 5X gain even after the inflation correction from 36,952 in the first week of this year…and whatever is happening now. That first correction was about 20% across the market – a “normal” event in our capital markets bible – and we have a nice bounce this summer that has restored some confidence the bull has room to run.

Top advisors know better. They have seen this movie before – 1987 in bonds, then stocks, the shock to the 10 year in 1994, the Tech Wreck in 2000-2001. And the Financial Crisis, when values fell in half.

Protect My Income Please

If you were contemplating retirement in 2007, exiting the market at the same time would have been a good short/intermediate term call. Waiting a few months crushed your account value. And this is the moment we often misunderstand as an industry. We are quick on the trigger to say, “Stay the course, you have decades to live!”. And that may be true, but it’s a tough call for someone not in our world who may not believe they have that generous time horizon. When you are no longer drawing a paycheck, a 50% drop in your retirement account is financially and emotionally devastating.

Chances are you know one of the lucky ones – and also one of the less fortunate. My late father surprised me by saying he had fully annuitized his modest retirement account when the Dow hit 13,000 – with no knowledge or expertise. He thought it was just “enough”. He passed away in 2016 never regretting his move – as well as the decision to convert all of his retirement annuities (he was an academic physician) to two life annuities that my mother relies on today at 88. His primary objective was to protect – to protect his family, his lifestyle, my mother. No amount of potential opportunity was worth the risk. He shared stories with me about friends of his with far more assets that were investors and loved the “action”. He never had any interest – neither does my mom.

A Little Empathy Goes a Long Way, and it Starts with Clarity

Regular readers know that I rail about our industry’s obtuse language, awkward procedures and regulation-driven communications. Our Executive Board at Next Chapter recently met and the directors unanimously accepted the challenge posed by Ken Dychtwald and seconded by John Thiel that we have to clean up our act – and language matters. More to follow for sure, because the admonition is not just to deal with current friction points, it is to help the industry prepare for the future. A glorious one at that – if we can pivot.

There’s A New Bull Market in Town

The OBM (Old Bull Market) was a historic opportunity to grow assets. The New Bull Market (NBM) is about protecting those gains. The winners in the OBM ignored market volatility and rode on. Many of the top OBM advisors kept clients invested to max out the market’s advance.

In the New Bull Market, many of the winners will have to ignore the anxiety of retirement and live on. The best advisors will now keep clients on track to max out their accumulated assets. In the Old Bull Market, you could get away with leveraging bullishness with options and margin. In the New Bull Market, you need to explore protecting client assets with insurance, annuities and credit.

The Old and New Bulls require a different perspective. In the Old Bull, you focused on the future. In the New Bull, you focus on today—and maybe tomorrow. In the Old Bull, you were a guide and a coach, leading the team. In the New Bull, you are still leading, but now you are more of a problem solver and a therapist. And the clients are mostly the same clients, though the typical one is now surrounded by three generations of family members you need to include.

A New Bull Market for a New World of Advice

The opportunities of the New Bull Market were created by the changing priorities, objectives and concerns of today’s investors. You know about the age wave of retiring baby boomers departing the workforce at 13,000 per day. They tell researchers they worry about five things:

- Paying for healthcare

- Outliving their money

- Falling markets

- Unexpected big bills

- Remaining independent (with a healthy brain and body)

These concerns form the basis of a New Bull Market advisory practice. In the old market, you were helping clients grow assets for unknown future costs. In the new market, the costs are increasingly known and you may have to stretch clients’ assets to meet those costs. In the OBM, you made investments and hoped they worked out. In the NBM, you create solutions that have to work out.

The winning advisors in the new market will earn their success. There are new tools they need to use to help clients through those five worries. New Bull Market winners will know the answers. They will be able to rattle off their most common solutions quickly and with confidence. That confidence will be a welcome contrast to advisors stuck in the Old Bull Market mindset. The leaders are now sharing their perspective with clients—on retaining assets, consolidating assets and earning referrals.

Industry veteran Tim Seifert, head of Retirement Solutions Distribution at Lincoln Financial Distributors, makes the business case for protection. He points out that we look to “planning” to establish the basis for a relationship with clients and their families. And that is the bedrock for sure. So much easier to confront falling account values in the context of their actual impact on a retirement plan. Seifert quotes data showing dramatic increases in asset consolidation for advisors that plan.

Don’t Underestimate the Value of a Good Protection Plan

Seifert’s point – echoed by top advisors I have interviewed recently – is that adding “protection” to that financial plan is a critical, additional step to locking in those relationships. The bull market in retirement is creating a new bull market in strategies designed to protect clients by leveraging their assets to better meet the as yet unknown demands of stuff that just happens – to most everyone. And protection pays, according to Seifert, who again shows data proving that “protection” added to “planning” is near fool proof practice management to retain and grow client relationships, assets and referrals.

With a protection focus, you will be talking about these opportunities – and solutions:

- long-term care strategies

- Longevity protection

- Protected income sources

- Liquidity through security-based lines of credit

- Financial wellness

Advisors who solve for the five needs will then face a second dimension of opportunity created in part by the bull market—scale. The Pareto principle is alive and well in financial advice: Fewer than 20% of clients will receive “full service” and even fewer will get complete financial plans. Clients are typically scattered across four to six providers—another outcome of the Old Bull Market. I’m betting that some clients really like their investment advisor. And why not? A 5x gain investment gain? Woo-hoo!

I have an even more sure bet that both clients and their families whose advisors also offer protected income, protection of liquidity, protection of long-term wellness and stay vigilant about those concerns will love their advisors and reward them with their assets, their family assets and their referrals. And that is a Bull Market I’d like to see!

The Business of “Wellness”

Supreme Court Justice Potter Stewart famously remarked about pornography, “I know it when I see it”.

Unfairly perhaps, “financial wellness” - or just “wellness” to her friends – is suffering a similar condition by defying consistent description by a notoriously analytical financial services industry anxious to connect better with clients. “Wellness” is fancied by CMOs and some CEOs for its promise of delivering enduring client value, but how do you introduce a concept that many clients might already be expecting – and not receiving?? I mean, isn’t the point of our advice and solutions to make clients financially “well”?? Awkward…

Nail That Jello to the Wall

The squishiness of “wellness” lies in the highly subjective benefits of being well. Not surprising when you consider the nearly infinite array of client situations and family dynamics where healthcare issues alone often disrupt even the most detailed financial plans. There are foundational elements – health, finance, security, wealth transfer – but no easy map to follow, no standardized answer. And that makes trouble for advice providers that don’t listen well or that cannot be both empathetic and purposeful in providing the needed guidance and solutions. “Wellness” doesn’t fit in a product box.

Peace of Mind

“Wellness” is most basically “peace of mind”. That’s how Frank McAleer of Raymond James defines it - he’s the leader of their effort with plenty of experience translating “wellness” into a business plan. That peace of mind includes financial, health and family needs that require preparation. More clearly, “What is the list of stuff you most worry about or that could go wrong as you live longer?” And what about family members for whom you could become responsible? Those lists are different for a 26 year old DC plan participant than they are for a 60 year old pre-retiree or a 75 year old with dementia. Or any of their family members. But the concerns are very tangible to all. Though the inevitable issues of longevity are tough to confront, there is a calm achieved by being ready.

Get Ready for the Wellness Experience

Wellness is the objective of planning - it is both a noun and a verb. An assessment at a single point in time of conditions that are guaranteed to change. Issues of wellness so pervade real life that calling out “wellness” as a concept separate from a plan, even in addition to a plan, seems superfluous. Do clients and retirement plan participants really need to be told we are working to help you achieve “wellness”? Or are we talking to ourselves again, to our advisors and product teams and marketers that we now have a higher calling than investing?

This is the conclusion reached by our Next Chapter study group on Financial Wellness. Wellness is a more catchy, benefit-sounding label than “success”, which is the presumed objective of planning. But clients don’t benefit from the words, they expect the results. I get the same weird feeling when I fly and a flight attendant calls out today’s opportunity to have the Airline X “Experience”. The what? Can we just land on time please? There is nothing outside of a first class pod that is worth calling out as an in-flight “experience”. Marketing overreach.

I’ll Take a Little Empathy with that Investment Portfolio, Please

“Wellness” and in particular “financial wellness” are internal design directives given to financial companies and advisors to make sure they don’t overlook the requirements of “wellness” in the solutions being created for and delivered to plan participants and advisory clients. To wit, the Next Chapter team, including the RJ longevity program leader, Amanda Stahl, named “empathy” as the leading design principle of “wellness”.

A Slogan in Search of a Business Plan

Integrating “wellness” into financial services is necessary to establish and sustain the value of the product/service offering. If the end beneficiaries don’t achieve peace of mind from their retirement plan, benefits offering or the services and solutions offered by their financial advice provider, they can be lured away by an offering that promises that peace of mind. Nothing motivates action more than fear – and there is genuine fear that manifests when you think you will run out of money or have to sell your home and move into assisted living. The reality of this vulnerability is becoming of greater concern to advice firms and plan sponsors who are not actively engaged with most of their clients (see Pareto’s Revenge https://theexecutionproject.com/paretos-revenge/ ).

The Business of Wellness – Five Levers Drive Results

My research and business experiences (successes and many failures) suggest that the most common and most impactful business growth objectives of broker/dealers - net new assets, consolidated assets and client household share of wallet - can be achieved with these actions based in “wellness”. Five levers in rough order of max impact/min effort. Intermediate measures like NPS (we used at Fidelity) can provide earlier confirmation of momentum:

Lever One: Words Matter – The Value of Common Sense Language

even very analytical services like asset allocation and investment policy can be made much more user friendly when rewritten from the perspective of conveying “peace of mind” instead of purely technical concepts and - essential - compliance disclaimers (Big fund companies are the frequent violators here). Language use is the fastest way to change perceptions of a firm, plan sponsor or advisor. Our Next Chapter Executive Board has been adamant on this perspective of improved language – stay tuned.

Lever Two: Design for Better Outcomes instead of “Best Efforts”

Most retirement solutions in place today are market dependent. Results can be impacted by market risks well known to the designers but not so familiar to the investors. The designers rely on their knowledge of capital markets research and the known risks are further mitigated by assuming a long-term time horizon to smooth variations. That’s a rationale, objective approach intended to work across a broad population – and generally it does.

But even the brainiacs will admit to “terminal point risk” that awaits unsuspecting retirees rolling out or annuitizing after a significant correction. Today’s retiring clients and plan participants have seen down markets – big ones – in 1987, 2000-01, 2007-09 and some sharp corrections in between. My late father knew nothing about markets or investing, but he knew when the stakes were too high for his peace of mind. He worked for universities his entire career and earned the negotiated benefits of retirement annuities. He surprised me by sharing that he had converted his 50-50 plans to 100% annuities with my mother as second life. He never looked again at the market. He cashed the checks, and she does to this day at 88. My parents’ definition of “financial wellness” was not having to worry about the markets, their income level, their ability to finance healthcare and the ability to age in their home. Done.

Once again, we are in the way of “wellness”. The best efforts approach undermines peace of mind by not providing a certainty of outcome. A risk matrix offering a percentage likelihood of success is great for analytical clients whose peace of mind is satisfied by data, but I don’t believe that represents more than a fraction of clients - especially when “client” is defined as a retiring couple and their family. In most client households there is someone who values protection and guarantees over potential returns or capital market theory, so why not at the same time (go to #3..)

Lever Three: Redefine the Client as a Family and a Household..and Engage

Most advisor engagement remains with a typically male and financially confident head of household. Firms are aware but not yet effective in providing (requiring??) more direction to advisors for supporting the family across today’s most common HNW construct of three generations - aging parents and adult children surrounding a Baby Boomer couple. This demographic sandwich will drive more than 80% of advice industry profits through at least 2030 and success is dependent on retaining existing clients and consolidating their not-held assets from competitors gearing up to mount a similar effort.

At Fidelity we sought the identity of other family members and developed simple communications to be more inclusive of less financially savvy relatives. We created a specific design target - a Baby Boomer wife and mother - to guide the design of the branch office right down to the furnishings and colors. But the operationalizing of “family” means some serious additions to CRM and data stores as well as some much needed training and coaching of associates that talk to clients. Peace of mind is different for different age groups and levels of financial literacy. Today’s Boomer retirement plans are providing real time education for their children and grandchildren. Some positive, some not so much.

Lever Four: Service Models for Everyone

Fresh off the summer vacation season, we are reminded of the challenges of bringing everyone together. Each family member has their quirks. Separately identifiable service models provide family members with options for engagement - especially with respect to communications, pricing and product options. “Separate” provides space and identity and satisfies each individual’s peace of mind. And that’s financial wellness. Because peace of mind for one client may be the reliability of a paper account statement - for another it may be the immediate transparency of a mobile app. The ability of an advisory firm, plan sponsor and plan administrator to offer a choice of service models - including in-plan advice and fiduciary wealth management (including trust) is fast becoming the expectation of HNW families - and history indicates those expectations roll “downhill” quickly to the mass affluent and beyond. Separate service models allow the advisor/firm/sponsor/platform owner to more easily and consistently focus on improvements for unique cohorts. Each needs to know we care enough to know and deliver against their preferences.

Lever Five: Adoption is the New Innovation

Last for a reason, “adoption” here refers to the integration of “wellness” principles into the delivery of services and solutions. There is both a “will” and a “skill” perspective to adoption. Financial advisors may or may not have the skill to help clients plan with the full empathy needed to anticipate the needs of an aging parent or pay off a child’s college loan. That’s a management problem for an advisory firm to make sure empathetic advisors are in place. Bull market success further reduces the incentive to engage - the “will” - as well as the energy to reach all of the clients in a given advisory practice. This failure to engage creates real risk for firms with low share of wallet - as we saw with Fidelity in 2009. Especially if their engagement is wholly dependent on the will of the human advisor and does not - as we did at Fidelity - complement busy advisors with consumer outreach in support of advisors to drive warm leads. But wait a minute, Merrill Lynch did the same with Total Merrill 20 years ago. The future of large scale client engagement is to provide some level of lead generation and direct-to-consumer outreach on behalf of advisors and not rely on human advisors to fully shoulder the burden of optimizing the opportunity of the full client roster.

Discovery: We Can Design for Adoption

Adoption is also a challenge to the operational eco-system of the advisory firm or plan administrator. Call it “ethos” or values or customer centricity, the issue of wellness adoption by the eco-system is simultaneously an issue of empathy and humility and the willingness to invest. Removing friction from systems benefits consumers and delivering associates. But it needs a vigilant champion empowered to take action. And budget to improve system effectiveness.

The reality of adoption is that it is seldom achieved because of either will or skill. Adoption of the complex array of anything - including the myriad “wellness” measures needed to produce human peace of mind - is most often the product of DESIGN. The most adopted products and procedures lend themselves to adoption because adoption was one of their creators’ key design principles. In the popular consumer view, if I need an owner’s manual to understand a product, I might not want it. Financial firms seeking better and more comprehensive engagement of plan participants and advice clients will increasingly have to facilitate that engagement, not hope that if they build “wellness”, people will clamor for it.

The Business of Wellness: The State of Mind to Create Peace of Mind

The bad news for companies is that “wellness” is not a widget they can attach to their existing offering. That approach has been attempted with the best of intentions by retirement income product providers who developed myriad riders and benefits aimed at specific consumer objectives and concerns, like combatting inflation or funding long-term care. In the hands of good advisors during the planning process, these products and their capabilities can provide invaluable peace of mind. But complexity of the products and their sometimes inconsistent availability (and pricing) are barriers to more consistent use in planning - and adoption by more advisors. These barriers are beginning to fall as demand for peace of mind – protection, security – rises and firms respond.

“Wellness” Requires Technology, Humans Alone Can’t Ensure Peace of Mind

To achieve its true potential as the True North of retirement solutions, “wellness” has to be integral to the language and the systems and the solutions of the firm. Despite the good intentions of many service contacts and financial advisors, the human resources of the industry don’t have the capacity to accurately record and maintain full engagement with clients, participants and their families. There are too many people to track, to proactively provide information and to be available to help establish and maintain “peace of mind”. I will never forget the call from a seasoned advisor who had completed his outreach to a HNW family, with the help of the head of household. “I now have nine clients instead of one!” He was only partially kidding. It’s a lot of work to track the needs of families and you don’t want to be the advisor who missed a Medicare election, a life event or the 21st birthday of a beneficiary. The solution is a combination of proactive systems leveraging data, simple tools that can be accessed by consumers and help self-actualize their needs, along with old school training, coaching and learning for all human associates for how they can best succeed in a company dedicated to “peace of mind”. This is the Village of Adoption needed to establish human leaders and delivery champions, DIY options for consumers and data-based processes to ensure the reach and consistency of engagement. And that is the #1 job of today’s financial firm CEOs, creating peace of mind – aka “wellness” – for BOTH their clients and associates.

Three Blind Wealth Management Execs and the Demographic Elephant

“Uncertainty” is an interesting condition that vexes human beings. Most of us like certainty – we want to know what’s going to happen. Young adults heading off to colleges right now run the emotional gamut from excitement to fear. Politicians are anxious – what about those mid-terms? Investors are anxious – is the bull ending? Investors hate uncertainty.

And yet uncertainty – or more accurately, the reaction to uncertainty – is the stuff that real leadership is made of. The adage remains that we share with those college-bound kids, “You cannot control what happens to you, but you can control your response”. That’s what growing up is all about – learning to cope, learning to take advantage, learning to take control of what you can control.

The Uncertain Future of the Financial Advice Industry

The advice industry faces an uncertain future. A retiring age wave of Baby Boomers built the industry into its current form, focused primarily on investing. And wow, what a run – boosted by historic gains in both stocks and bonds.

But now that demographic wave wants to spend their gains, live their lives in different and more relaxed ways – and the industry stumbles to provide the solutions with a level of clarity and certainty our clients seek. But what exactly does that mean for each company, each advisor? What are those steps each has to take now to ensure client retention as competitors home in on our blind spots??

The famous parable of the elephant and the blind men is worth revisiting. The narrative depicts three men confronting an elephant for the first time. Being blind, each man feels for clues about the enormous creature. They share their perceptions, but their accounts are wildly different for each has grabbed a different part of the elephant. One feels a leg and “sees” a tree. One feels the massive body and “sees” a wall. Another feels the trunk and “sees” a snake. The differing accounts and the ensuing acrimony about the “truth” spurs a fight among the men. In “Coping with Negative Life Events,” authors C.R. Snyder and Carol Ford explain the moral of the parable as the tendency for humans to claim absolute truth based on their limited, subjective experience as they ignore other people’s limited, subjective experiences, which may be equally true. Sounds like 2020 presidential politics to me.

Take Off Your Blindfolds – Elephant Approaching!

New conditions challenge everyone. The tendency is for managers and leaders to depend too heavily on the experiences and perspective they earned on their way to the top. But in times of unprecedented change and uncharted waters, all that “experience” can be a blindfold. The three men in the Hindu parable aren’t stupid – they just can’t see. What they all have in common is the inability to see the total picture and to fully understand what is – literally – right in front of them. And the fact that all three are stuck on their separate perceptions makes it impossible for them to work together.

For leaders of the wealth management industry, the aging demographic is our elephant. It is planted right in front of us, everywhere and every day. And yet it is hard to see it, as well as all of its implications for our business, in its entirety. Depending on the primary focus of your day job, you may have one perception of “aging” that is quite different from that of another leader whose primary focus is elsewhere.

It's 1946: Your Warning is Here

For example, if your firm manages separate accounts and mutual funds, your portfolio managers can be happily beating the market while you might be frustrated by redemptions. Upon closer examination, the redemptions are skewed to clients over 70. We hear a lot about 10,000 baby boomers turning 65 every day. Some of them have been investing for retirement – and that retirement has arrived. Surprised? Really?

More subtle are some other “parts” of the elephant. Stay with the daily flow of boomers but now focus farther downstream on the 9,500-plus who turn 74 every day. Nine years deeper in that classic retirement zone come more problems – dementia, other forms of diminished capacity and death. Thousands of clients are losing their ability to safely manage their accounts every day. And more and more clients are dying every day. Clients know about these conditions – there is no reason to tip toe.

Compliance is On The Phone – It’s About Those Aging Clients…Again

Ask the compliance department of any big firm about the growing challenge of protecting aging clients. Ask the investor services groups about the spike in reregistrations due to death or disability. Check in with sales teams, advisers and customer service reps about the scramble to locate responsible family members because clients haven’t shared that information (or we haven’t asked). What does legal see on the litigation and arbitration calendar? Government affairs can tell you a lot about growing regulatory scrutiny – especially from the states.

There are lots of legs and tails and tusks on the demographic elephant that have been there all along. What has changed is the size of the animal. For years, the aging demographic wasn’t an elephant, it was a poodle. Or a golden retriever. It had legs and a tail, but it was smaller and softer, and more friendly. But now we have an elephant in the room. Adjustments have to be made.

Grab A Tusk, Any Tusk

And we cannot fully enjoy the parable without pointing out that not only has the size of the animal changed but so has the environment. All of these elephant parts were solidly attached before the market correction. Stretching our story a bit, imagine the blind men trying to identify the elephant during a stampede. The guy holding the trunk might have a grip but the one on the leg is a casualty. Hang on tight, the “stampede” makes all these issues more acute, and more complicated, and harder to resolve under the pressure of rising volumes.

Unfortunately, we’re not going to cage this elephant anytime soon. There is a reason great friend and Next Chapter colleague, Ken Dychtwald coined the term “age wave” (in 1989!) – this phenomenon is still in the early stage. Its roughest effects are growing and will continue to grow at an increasing pace through 2035. That time period captures pretty much all of the current wealth management industry leadership, so best we get started. Future industry leaders are the ones who will pull off their blindfolds and demand the same of their colleagues. They will understand their business just might be defined by how they respond to the elephant…and the stampede.

Pareto’s Revenge

25 years ago in Indianapolis a simple question asked by a 21 year old sales assistant awakened an at-scale industry to the benefits of high touch - and set the stage for that scale opportunity to return in 2022.

Way way back in 1997, I met a terrific Merrill Lynch advisor and his young sales assistant who found that 88% of their practice’s revenues were created by just 12% of their clients. “Why do we do so much for people who don’t pay us?”, was her naïve query.

Sharing their discovery with supportive local management, the pair shrunk their book to just 35 households while increasing proactive engagement with each family. The results were staggering. Share of wallet soared as assets were consolidated, significantly boosted their revenues and driving a crazy level of referrals. I captured the story in a 2001 book with Evan Cooper, Attract and Retain the Affluent Investor. But the real traction occurred with the practice management concept of Supernova, followed by a new service model I was privileged to help build - Merrill Lynch Private Wealth.

High touch with fewer clients was not a new concept. Goldman Sachs and most private banks were already reaping the benefits, including high share of wallet, intergenerational wealth transfer and valuable referrals of similar clients. The nuance was acceptance at a “scale” player known at the time for bringing “Wall Street to Main Street”. At the time the average Series 7 registered representative had 500 accounts scattered across 125 households. Applying that 88/12 - or the more familiar 80/20 Pareto principle - meant that most of an advisor’s revenue was earned from just 25 of those households. Skeptics demanded more data - but the facts confirmed the harsh reality.

The march continued - wealth management was an exclusive offering and personal attention was available - to the wealthiest clients.

Fast forward to Fidelity in late 2009. Net outflows to competition spurred analysis that revealed to our new team that even longtime clients were looking for “planning” and “relationship” - and willing to pay more. SOW of high value clients had slid below 50%. A bold new strategy to turn the tide was ultimately successful, driving AUA from $850 billion to now well over $4 trillion and establishing Fidelity’s retail division as the largest Fidelity business unit.

But what about Pareto?

A closer look at the Fidelity retail engagement strategy shows the firm actually embraced Pareto by separating clients by service model. A new advice offering was provided to clients seeking high touch (and willing to pay), while enhanced DIY digital tools created the industry’s biggest robo. In the middle floated the ad hoc offering, the Private Client Group, with the on-call availability of human advisors. So there was respect for 80/20 - at both ends.

The key of course was client segmentation - with service models to match client preferences. Target client personas humanized efforts to better connect with clients. Having an Active Trader offering and a High Net Worth Bond Desk drove more self-directed client engagement and recaptured assets that had decamped for other firms. Buying a bond online became as easy as picking a stock. Many client households had accounts in multiple service models for different purposes and often for different family members.

Results tell the story. Net flows turned positive as Fidelity’s Private Client Group net promoter score soared from 8 to 63. Advice and guidance efforts expanded to include retirement plan participants.

Fast forward again to today. Bull market confidence has helped scatter client assets across the industry to an array of providers. We see wire house numbers averaging 50% SOW - with higher rates among top advisors but the same stubborn 80/20 rule across the board. The “moveable middle” advisor population tops 60% in many firms, according to one IBD CEO and confirmed by others. Typical HNW households are working with 4-6 providers.

Money is on the move - still seeking more “relationship” and “planning” - and the inevitable post-bull consolidation. Add in the march to retirement by the Boomer age wave and you have the makings of a serious battle for assets. Without a better strategy for segmenting and servicing clients, the lack of industry capacity to engage with human advisors will lead to serious losses among “scale” firms dependent on human advisors for coverage.

The biggest players are on it. Morgan Stanley and UBS acquired robo/DIY capabilities. Empower is angling in from the plan participant side, plus Personal Capital and Morgan bought Soliam and also offers Graystone advisors. Merrill is now a bank and touts Merrill Direct. All great additions with significant long-term promise. And therein lies Pareto’s revenge.

80% of financial industry consumers are unaware of these innovations because they don’t see the benefits. They are waiting and wondering - increasingly anxious about their retirement accounts. Annuity sales in the second quarter of 2022 were the highest ever. Securitized lending has soared. Peace of mind, wellness, protected income, certainty - all great objectives but hard to achieve if you don’t have a lot of dough. Add a historic level of advisor retirements and you have even fewer available trusted professionals.

The parts are there, the execution is not. Buying a capability is not the same business as integrating and connecting the capability, aligning it with the delivery mechanisms and then driving adoption among both advisors and consumers. Imagine your new big screen TV without a power cord…..

Meanwhile, Pareto’s Revenge awaits the firms that cannot reach the unengaged clients. FinTech entrepreneurs are salivating over the gaps they can fill with capabilities that work 24/7/365. Imagine the fate of the human advisory firm that misses a client’s window for selecting their Medicare plan, and the robot gets there on time.

Digital journeys, next best actions, client data mining and better segmentation are all in flight, but the number of impacted clients indicates we are still in the very early innings of a long game. At The Execution Project, this is our world. At-scale engagement using client segmentation, advisor coaching, scale plays with targeted offerings using both advisors and direct-to-consumer lead generation in support of advisors. The upside is extraordinary but the work of adoption is dullingly old school. Companies holding on to bull market profits hope the 20% can keep producing but Pareto is on the rise.

Steve Gresham is ceo of The Execution Project, LLC, a consulting firm driving adoption of wealth management innovations, and managing partner of Next Chapter, an industry effort to reimagine “retirement” across 60 affiliated companies. From 2009-2017, he was executive vice president and head of Fidelity’s Private Client Group.

This is Us

Mention “financial wellness” to 10 attendees of a FinTech conference and you might get 15 definitions. Ask 10 clients and you might have the same result. The label is intriguing and appealing, but there’s an onion here that needs peeling. Leave out the “financial” angle for a moment and consider that wellness can be evaluated through the different dimensions of:

- Physical wellness

- Emotional wellness

- Social wellness

- Intellectual wellness

- Spiritual wellness

- Environmental wellness

- Occupational wellness

Credit: blog.bestself.co

“Wellness” is a noun – but also a verb. Webster says that wellness is “the state of being in good health, especially as an actively pursued goal (emphasis mine), …as in.. “measures of a patient’s progress toward wellness”. So wellness is also a process in pursuit of the goal of wellness.

When we combine these perspectives, “financial” wellness is easier to define, but harder to accomplish. Money is relevant to all seven of the dimensions listed above. Having money can help fund solutions and opportunities to improve most aspects of wellness. In addition, wellness is dynamic – changing as we age, rising and falling in importance. What jumps out to me is the complexity of achieving “wellness” – and the opportunity to employ both digital and human support to finance wellness.

Many top advisors – and clients -- characterize financial wellness as “peace of mind”. And when you unpack the headline you locate the dimensions listed above, as well as the process of ongoing contact, review and reinforcement that describes the best advisor/client working relationships in wealth management. At minimum, the industry needs to support a holistic approach to clients’ new found longevity to help them discover and address their growing and changing needs for “peace of mind”. It is critical to appreciate that we are all traveling together on a journey none of us has completed before – growing awareness of our own longevity and how our world view is changing. “Aging” clients and advisors are not abstract population cohorts – they’re us!

So the key to “financial wellness” is the entirely subjective definition of “personal peace of mind”, as well as the recognition that it’s also a process that will evolve as the different dimensions listed above present themselves at different times. A more broadly aging society led by the massive Baby Boomer cohort is discovering the importance of life balance as the median hits 66 this year – and the oldest are 76. At those ages, our clients (and some of our advisors!) have growing awareness and appreciation for the value of emotional, spiritual and intellectual wellness. Their need for mobility supports physical wellness. Being relevant and engaged keeps many working for occupational wellness. And perhaps most important in later ages is the importance of social and environmental wellness – to be with others and to live safely and independently. If we are paying attention, financial wellness is already teed up for us to hit head on.

And that’s the real point of financial wellness. Financial industry leaders that talk about financial wellness are declaring the path forward for the industry -- the objective of the advisor/client/digital working relationship. They are challenging us to align in support of the clients’ personal peace of mind and the growing, shifting aspects of wellness as they discover more perspective. And it’s the moment of truth for financial advisors, many of whom are challenged to muster the empathy and insight needed to fully support the clients, as well as the flexibility and interest to engage effective technology to help them deliver more effectively across their entire clientele.

Financial wellness is becoming the True North of the wealth management industry, and it’s a journey we are all taking. Together.

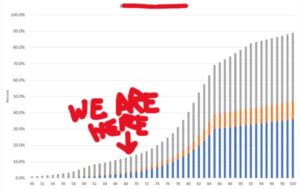

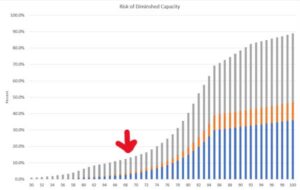

Chart of the Decade

At a recent meeting of top advisors hosted by education innovator Wright State University (where flight was born), I shared this chart under the guise of “opportunity”.

What’s the subject?, I asked. Tesla stock price? Bitcoin projection? Spending on FinTechs? Nearly a perfect S-curve, which favors the early adopters. And the best news, we can catch this one just before the S takes flight – note the arrow.

The big reveal caused a mixed reaction. The majority of the audience reacted thoughtfully, many nodding heads. These advisors see the landscape – every day – through the lives of their clients, their friends and families. The chart is a propensity chart, depicting the likelihood of experiencing some level of incapacity due to one of the three most common health events to cause incapacity – Alzheimer’s, other forms of dementia, myocardial infarction (heart attack).

The savvy advisors know from experience that each of these ailments presents a life change – to the client/patient and to the family. The impact is both immediate and ongoing. Nothing is ever the same. Priorities change. In the world of financial and retirement advice, advisors are needed more than ever and for more complex services.

Our response is critical. We have to react with empathy, engage professionally and with confidence. We become the financial emergency room, transitioning to long-term care. And not just for our primary, affected client – we have to be there for perhaps three generations of family members who are now also affected. Everyone needs to know we have this, we can help.

We don’t have much time before these conditions accelerate in frequency. The current overall propensity rate is 1 in 8 for people age 68 but more than doubles by 78 – and 6X at 88. Over the next ten years, nearly 1 in 3 people we now serve are likely to become incapacitated themselves, and a great many more will be impacted by someone in their life who becomes incapacitated.

For advisors and their firms serving the Baby Boomer age wave of 76 million people, this transition has been looming…but preparation is still light. Every firm and every advisor will need policies, procedures and supportive tools to:

- Identify incapacity for the protection of the client, her family and the firm

- Protect clients and their families from the threats of incapacity, including identity theft, fraud and elder abuse

- Engage families in support of incapacitated clients – as well as clients without family support

- Adjust to the needs of a family of three generations or more and help optimize finances for risk, tax, income and long-term care

Don’t Ignore This Moment

If you are winding down your advisory career, you might be doing the math and saying that in ten years you will be on a beach living the vida mas fina. That’s probably pretty well known by your clients and their families. As Accredited Investor co-founder, Ross Levin said so well at our Next Chapter Rockin’ Retirement event on May 24, top firms are winning clients and keeping clients because they have a “contract” with clients and their families that the firm will be there for them. Another speaker, veteran Tom Bradley of Schwab noted that aging clients – and aging advisors – are now important measures for the valuation of an advisory practice (get the whole program here ADD LINK to NEXT CHAPTER MEMBERSHIP).

One very interesting aspect of this chart is that it is also a good picture of the demand for pretty much everything associated with the historic demographic cohort. If they will need it, you name it and the growth curve will be similar. Demand for in-home caregivers, Medicare counselling, pickleball courts, assisted living facilities…they’re all here at the same time. Consider…..

The Price of Ignorance – Five Risks Ahead

I’ve also spent a lot of time worrying about this issue on behalf of big company clients and I see five significant risks of keeping our heads in the sand:

- We lose current clients and their assets

- We lose the potential consolidation of assets held by our clients elsewhere – that’s a pretty similar number to the total in 1 above

- We lose the client’s family – if we don’t take care of the primary client, the family won’t stick around. Surviving spouses and adult children have no affinity for our failure to act.

- We risk increasing scrutiny as fiduciaries or service providers that do not sufficiently “know your client” – an area of growing interest to state consumer protection regulators. Get ready also for a return of active arbitration in this area as we return to in-person activity after a pandemic slowdown.

- Finally, a firm that does not do well by its aging clients is exposed to significant reputational risk. Poor experiences might be contained in the complaint process, but some of the more colorful cases will doubtless make headlines – electronic or otherwise. I expect a lot of interest in these stories.

Other Than That Mrs. Lincoln, How Was the Play?

Every corner of the financial advice and investment management industry has benefited handsomely, unexpectedly from the historic demographic wave and the power of that wave to lift all economic boats. Now it’s time to repay some of that value by meeting the needs of our loyal clients and their families – all of whom will be encountering their longevity for the first time. Our ability to serve is a function of both will and skill. I’m completely confident we have the skill. Do we have the will?

Steve Gresham is on a mission to improve longevity and “retirement”. He leads an industry initiative, Next Chapter, and is ceo of consulting firm, The Execution Project, LLC. He is also senior educational advisor to the Alliance for Lifetime Income. Formerly head of Fidelity’s Private Client Group, he is the author of five books about wealth management including The New Advisor for Life. He also served for eight years on the faculty of Brown University where he taught the impact of an aging population.

Follow the White Flags – To Success

Streaming one of those endless crime series recently, I watched the lead investigator offer bad news at a press conference - “The rescue mission has now shifted to a recovery effort”. A little dramatic for our mundane world of retirement planning - but maybe not. I wrote awhile back that most of us heading toward our next chapter have made mistakes in our preparation

https://www.fa-mag.com/news/the-oh-sh-t-moments-of-retirement-planning-67066.html

Many of those mistakes are financial miscalculations - I know I will need to seriously restrict my spending. Some are investing errors – taking too little risk or too much. The most impactful seem to involve family and healthcare when the inevitable but still unexpected impacts of longevity take their toll. And even the lucky few not derailed by financial, investment or family issues may be weighed down by the importance of living a meaningful life. That’s a lot of potential planning potholes to navigate. Every family will fall into one or more – and most will need help to recover. The markets are not helping. Neither is the stubborn pandemic or global instability or domestic politics. Most people are worried about a lot of things.

So get ready for the equally inevitable shift in the retirement planning profession from a mission of funding a “next chapter” to recovering a failed retirement plan. Our observations in the Next Chapter industry initiative (https://theexecutionproject.com/community/)

are clear – the industry is not ready for this job. The contrast I’d offer is that we will be shifting from mostly selling new cars to fixing them when they’ve broken down. Complementary roles for sure in my car dealerships, but not the same.

I’ve long advocated for a more realistic view of retirement planning that tracks with the experiences of leading advisors and how they help real clients with real life. Those pros tell us over and over about clients hoping to stretch savings to cover a preferred lifestyle instead of first determining the level of their retirement paycheck. They repeat stories of life events and healthcare “surprises” that are really only surprises if you think you are immune to the impacts of aging. I will never forget an interaction with the ceo of a global financial firm who called wondering if he should be added to the accounts of his father….now that Dad turned 91. I wonder what precautions are used at his company for millions of people vulnerable to mistakes and exploitation in their later years - long before 91 – especially since 25% of people aged 65+ have dementia of some kind. Common sense is a great ally when planning…..

The implications of “retirement recovery” begin with a few very uncomfortable conditions among advisors, their firms, the supporting cast of product companies - and the clients themselves. Each plays a part to right the ship. The inconvenient truth is that of course each has contributed in some way to the problem of unpreparedness. To really help Americans have a fighting chance, each will have to own their role in the current state and prepare recovery tactics. That’s now. Each actor will also have to adjust their approach to younger clients and make sure the lessons learned are applied to the future. This is not about organizational CYA – though too many advisors and firms will worry about this angle and their “liability” for confronting the truth - this is about a genuinely human concern to improve the situation. It is less important to rehash how we got here, it is more important to show our genuine commitment to recovering the plan.

Personal health care offers a good example of this “recovery” pathway. When you have a medical issue, the first step is to deal with the current symptoms - reduce pain, improve comfort. Focus on what to do now. Only then can we look more closely at the cause(s) of the problem. Required skills here are listening and empathy. Are we really good at those?

I’m pretty sure Retirement Recovery will soon become the #1 driver of referrals and new clients. Most of the new opportunities will flow from the wreckage of plans gone off the rails. You will confront more people who are surprised, concerned, mad at their prior advisors, mad at themselves - and embarrassed. Job 1 for us is to acknowledge and normalize their condition. They are not alone - they are actually reflective of the vast majority of retirement plan clients.

Before you dismiss that last line, which will stand in our way if we don’t accept it, is to fully comprehend the full needs of “retirement” (https://www.fa-mag.com/news/where-are-the-retirees--yachts-66565.html)

Three conversations help organize the process of recovery – financial issues, investment decisions and family concerns (mostly about health and care). Back to those top advisors who remind us that retirement is a family affair and that one or more of the family members do not really understand the multiple moving parts. True financial literacy is rare enough – how the sometimes complex and arcane concepts apply to them is even more elusive.

The core strategy of a recovery strategy is simple but not easy, as Buffett famously observed about investing. So channel common sense and consider:

- Empathize to normalize – no matter the client situation, “you are not alone, everyone has issues”. Actually, multiple issues. So let’s first get a complete inventory of what you worry about. We may not be able to solve them all, but let’s get a total checkup of the car and not just fix the flat tire. A top advisor tip – start fixing the “tire” quickly, confidently and at a very reasonable price in order to set the stage for the bodywork and new transmission to follow.

- Educate to remediate – are we confident in the investment choices and solutions – do you know the role of each solution you own and are their better options? A tip – make sure you know where each product came from and who was involved before making any judgments. We don’t need client defensiveness in the way of building trust.

- Is everyone on board? Do all family members understand the plan and the underlying choices that really determine success – such as the choice of where to live and the expectations for providing care when you need it? A tip – probe about those family dynamics – and keep probing. Fewer than half of clients with advisors told a national IWI survey their advisor does not include the spouse in planning, let alone aging parents or adult children. And we wonder why 70% of widows nuke the advisor?

- Keeping the lines of communication open and active as the next chapter unfolds – there will be changes needed and more decisions. That’s life. But this aspect of staying current is where the robos are killing advisors. Failure to keep up with specific, totally predictable life events is probably the most critical need of retiring families and the best entry point for earning referrals. An advisory firm I met with recently sets the stage for what they do by first asking any new prospect about the elections they’ve made for Social Security and Medicare – and what happens to their estate if they (a couple) were hit by a bus tomorrow. No investment or performance discussion, no tax returns – just showing their interest in the decisions that are must-make for us all that reveal their level of preparation. The robo does not forget a date, does not tire of sending reminders (though only by text or email), and will keep getting smarter as it learns more about the client. If Google News, Amazon and Nordstrom can suggest what I want to read or buy with the accuracy I’ve seen so far, the most feared new advisor in town is an avatar.

Only the Outcomes Matter

While many – most – retirement plans will at some point be shifted to a “recovery” effort, we can always share our learnings with other clients. The first opportunity of the “white flags” by clients willing to accept help is the mindfulness of those clients. Saving someone’s retirement plan is not about producing financial rabbits out of a hat – it is mostly about helping the clients accept their condition and making the best of it. As we guide our own children by saying, “You cannot control what happens to you – but you can control your response”, we have a similar moment with white flag retirement realists. And that word will spread rapidly. First to the heirs, and then on to the peers and colleagues. Get ready for the line around the block to your door.

Adoption is the New Innovation

Every day, there are hundreds of news items extolling the virtues of new fintech. There is a dizzying array of tools flooding the advisor market. I am envious of those who can choose wisely among them.

And yet this software doesn’t quite capture the feel and efficiency of the advisor-client experience. Is that a problem with the software? Or with the users?

I don’t want to discourage innovation—bring it on! But I wonder if we have truly learned how to use the amazing apps and software we already have, or if we keep jumping on emerging fintech as if it were the new iPhone version X.X before we’ve figured out half the functionality of the old models.

The center of any technology should be the advisor-client relationship. That’s the utopian vision, anyway, one that should prompt simple and easy solutions. Software providers should be enabling your digital relationships, and thus improving your volume of activity, as well as the consistency of your results. When you can string your software together into a customer experience, you see the potential contribution from tech adoption—and wasteful gaps when the tech is not deployed.

When you’re starting to deploy your technology, start with a daily plan and see how it affects your overall results. Your CRM software should have all your client’s information loaded and your activities log should show that every day you have “calls to action.” The average book for every advisor is 125 families. Your CRM should include three to four nuclear family members but also aging parents and adult children for a total potential “household” of 30 to 40 accounts with several custodians. Without good software, that’s a lot of Post-it notes.

It's time to think of your expectations for the customer experience. How many of those households receive a solid annual review? A midyear review? How many times do you follow up on the actions you’ve taken? If the industry standard is two meetings a year, can you be sure all 125 families got theirs? That’s 250 appointments with just two meetings for three generations and 30 to 50 accounts. What if more meetings were needed? If the accounts are for retired people, would that not mean more complexity?

I remember visiting with one of the country’s top wirehouse advisors a few years after managed accounts became mainstream. One of the pillars of this advisor’s offering was a quarterly performance and holdings report and a quarterly review with the clients. People loved the transparency and accountability—and consistency.

Walking into the advisor’s office, I noticed a flurry of activity in the office next to his. “They’re stacking our quarterly reports,” he explained. “We had to get another office to hold them.”

The advisor’s practice became buried in meetings with clients. He made changes to balance the load—like setting annual reviews by the client’s birthday instead of trying to squeeze everyone into the calendar at the quarter’s end. He also merged some account reviews by inviting multiple family members. Both steps opened additional opportunities, but the initial motive was just to save time.

The discipline required for the regular client meetings was an eye-opener to him. “We had no idea of how little we were talking to clients—and how narrow the conversations were,” he observed.

This is Practice Management 101: Our client communication is lacking, and that means there’s opportunity if we improve it. The average wealth management client is about 67 and has accounts with four to five firms, but no one firm usually has more than half those assets. Until that reality is altered, advice providers are battling each other in a zero-sum game with really significant implications. “Share of wallet” is the new battleground.

As aging clients consolidate their assets, there will be winners and losers among financial services professionals. Morgan Stanley has said for five years that it’s actively seeking the nearly $3 trillion it doesn’t have from the clients already on its books. In pursuit of that goal, the firm booked $438 billion in net new assets in 2021.

This is a big game with a lot on the table. If you think you’ll achieve organic growth that miraculously springs from this aging investor population, forget it.

Keep in mind the reality. Most advisors don’t regularly reach out to clients with tailored information. They just don’t have the time. This applies to RIAs, wirehouse advisors, regional brokerage advisors, independents and direct providers. Ironically, it’s the AI-powered robos that have upped the game for proactive outreach, not the humans. Robots are pretty organized and work 24/7.

Tech tools can indeed help you, however—help you manage opportunity and remember all kinds of important business issues: the clients you haven’t seen for a while and the meetings you meant to set and birthdays and retirement dates and RMDs and bond maturities and graduations and all the stuff clients told you in meetings that they hoped you’d remember.

Tech helps you manage opportunity by managing volume. Most advisors have all the clients they need—especially when you consider each client’s extended family, friends and business associates—but they are not organized well enough to get there.

Remember Warren Buffett’s line: “Investing is simple but not easy.” The same goes for advisors in the business of details—the excruciating details they must remember, like accurate beneficiaries and powers of attorney and cost bases and the names of the children (and pets!) Everybody knows this, you might say. But the industrywide data tell the story—they don’t do it. Otherwise why would the average client have four to five different firms? Are they really meeting a couple times a year with each?

His colleagues were soon consolidating assets, and their work set the stage for the evolution of the business into Merrill Lynch Private Wealth, a new step in client service.

As it was starting up, data again revealed reality. A very simple exercise we did with the top advisors globally showed that there was potential to serve even the best clients even more.

The advisors reviewed their top 20 households against a list of the seven most common financial products (such as managed accounts, for instance) and eight of the most common financial strategies (asset allocation, estate planning, etc.). The gaps found among just the top 20 households were alarming (or exciting, if you like opportunity). Each of those gaps opened a door of access for a competitor—and that became the basis of the wealth management game plan of driving consolidation and referrals (by closing that door to competitors).

Simple, right? It should be. All the best strategies are simple, and understandable to clients. But they require organization and attention to detail, and you cannot achieve that level of efficiency with Excel spreadsheets and Post-it notes. And that is where a lot of the advisory world remains, trapping frustrated clients with them.

Consider that in 1997, the time when Merrill Lynch took that step, there were just a few client households to reach, and the client population was not nearly so close to retirement. The oldest baby boomer was only 51.

Now there are some 10,000 people turning 65 every day. The Great Retirement and Great Resignation together suggest the number leaving the workforce exceeds 12,000.

The good news is that if your marketing and relationship skills haven’t atrophied after 156 months of bull markets, you’ve got a historic chance to win new clients and assets from less ambitious advisors—potentially doubling your business, or more. The flip side of course, is that you are surrounded by competitors who might do the same to you.

Let me know how it’s going—call me on my Razr flip phone or email my BlackBerry.