Stop! Your 2024 Plan Needs These Six Actions

Stop doing these six things now to help pave the way to your future growth

1. Stop the sloppy segmentation.

Start using segmentation that means something - to the segments. Two issues here trip up companies.

First, tighten up your target markets and use a more durable approach including how and why they buy. Research shows that the buying process is now more important to most consumers than the product itself. Make fans of your clients and business partners based on how you treat the process of becoming a client of yours.

Second, clients are not solo. The retiring boomer age wave means every individual client has family members, friends and business associates you will want but they may have very different needs and preferences. Don’t lump them in with the primary client - offer them options.

2. Stop hiding.

Your visibility is invaluable in a world where information is readily available. What consumers and advisors know about you makes a difference. Don’t be the ubiquitous stock fund manager or financial advisor. Show your stuff - have opinions - tell your story. What are your values? Who are your (happy) clients? Why should we do business with you?

With consumers doing more and more of their own research of investment and financial solutions, you want a good reputation, which will also be a benefit to your business partners like financial advisors.

3. Stop measuring only results

Don’t be the lazy manager that just tells people to produce more. Know exactly how the results you want are created and focus your time on improving the ability to drive results. But be thorough - there are probably layers here worth exposing before you isolate the real drivers that matter.

For example, the sales process of managed accounts and life or annuity products include illustrations and proposals - often tracked as drivers. But those are later stage drivers. Look farther upstream to the use of planning capabilities and make those offers more central to client engagement - and capture the added benefits of additional solutions. Replace the target of managed account sales with new assets and referrals that encourage the bigger win of better relationships.

4. Stop serving marginal clients

The historic bull market run and shifting demographics have likely earned you lots of clients - and even more one-time customers. Time to weed the garden, as they say.

Many “clients” are just people who bought a single product or gave you a small portion of their assets. So they are really just partial clients not devoted clients. Pareto knew about this phenomenon - the 80/20 rule. Connect better with the 20 percent of your clients - secure that base against rising competition. Don’t let the 80 percent distract you. But now purposefully design solutions for the 80 percent. Or let them go. The Big Box stores of financial services are perfecting the scale game. Don’t fight a fight you can’t win in favor of building a “moat” of attention around your ideal clients and make them your castle.

5. Stop offering marginal products

Marginal products are easy to find but hard to stop. They make some money, they may have a great history, they may be someone’s baby. But they tarnish your reputation and hold you back from deploying resources and energy into something better. Who wants to be the portfolio manager of your worst performing fund?

Create the space and redirect the resources - including the people - to something worthy of their best efforts.

6. Stop marketing your brand

First, this is not a conflict with #2 above because the important part of marketing is to connect each of your capabilities with the people who value them - without confusing the clients with other capabilities they don’t want. Your overall brand reflects a higher level set of values and strengths - the products and services and service models need laser focus on the ideal consumers. Clients seeking solutions get a “feeling” from a brand - so double down on that effort outlined above, but make equally sure your individual offerings are noticeable, understandable and resonate with the ideal clients you built them for.

Look Out! Four Unstoppable Trends Are Chasing the Financial Industry at Its Zenith

Four Horsemen of the Apocalypse, an 1887 painting by Viktor Vasnetsov. From left to right are Death, Famine, War, and Conquest.

The advice industry is enjoying record profits - but also faces declining organic growth and historic global uncertainty. No matter what you do or how you do it, your world is being rocked by forces out of your control. Leaders are expected to have answers and the best leaders never waste a good crisis.

“Trending” vs Trend – Know the Difference

Popularity and causation are not the same. Especially in our hyper socialized world, leaders have to be careful not to mistake something that is trending for a true causative trend.

Four Unstoppable Trends

I find people remember stories better than data, so I’m framing the trends using the biblical tale of the Four Horsemen of the Apocalypse. The narrative appears in the Book of Revelations of the New Testament, and The Four Horsemen are the harbingers of doom - the end of the world. Each plays a role in that end game - Conquest, War, Famine and Death. I’m retaining the essential meaning but renaming them for better relevance to our financial advice world.

The Horse of Conquest - aka “Lost Ground”

Winners know when they’ve been beaten. They don’t confuse losing a battle with losing the war. They know when to retreat to higher ground so they preserve their resources to fight again.

Huge chunks of the traditional advice industry have been taken over by new competitors. Commissions are free, beta is free and custody is free.

And yet many companies are hanging on to efforts where they will never win. Those efforts have to stop. They waste precious resources, they drag down your associates, frustrate your clients and distract your focus.

For the advice industry that will mean releasing the marginal effort – which is most common to us in two forms:

Marginal products – if it’s not outstanding, it has to go. It hurts your brand, it’s demoralizing for the team. Who wants to be the PM of your worst performing product?

Marginal clients – the full service advice industry earns more than 80% of its profits from fewer than 20% of its clients.

There are actually two paths here – one is the traditional wealth management objective of serving fewer larger clients and securing all of the assets.

The other is to separate the 80% and focus specifically on their needs. The latter strategy – the “reverse Pareto” – is how the Big Box firms (Fidelity, Schwab, Vanguard) most easily undercut “full service”. Clients tell JD Power these firms deliver “full service”, so don’t ignore them. They take pieces of clients – and then get the rest. So end the madness by creating that separate service model or offering designed specifically for the 80% that they will love. Or let them go.

The Path Forward in the Face of “Lost Ground”

First - STOP.

The discipline of stopping something in flight, ending a business, terminating a product, exiting a market – is so unusual in American business history that it’s worth a pause to consider another industry’s losing battle with competition.

Down Go The Big Three

After World War II, the large four door sedan ruled the road for the first 30 years – until the baby boomers started buying cars. GM, Ford and Chrysler executives enjoyed 90% domestic market share at the peak. But their dogged attachment to that car and its margins put two of the three companies on the road to Chapter 11. The other one escaped – narrowly - saved by the F-150 and the Explorer, the first defendable American SUV.

The biggest barrier to your future success is too often your current success.

2. The Horse of War – aka The Battle with the Consumer

“True customer centricity is an act of extreme humility” observed a great colleague of mine years ago. As an industry we say we are client-focused, but as an industry we are struggling. There are exceptions - empathetic and skilled financial advisors serving clients proactively and effectively. But most of the industry is not earning organic growth.

Consumers believe they can have whatever they want and now we are in a race to deliver against those rising expectations. This is the battle being waged across all service industries – the ability to deliver against the promise. Burger King set us on this road with “have it your way”. Now there’s no turning back as other industries further increase client/consumer expectations for product reliability, ease of communications and delivery. And most have overpromised. Consumer expectations for most industries exceed the ability of companies to deliver. We have to be very careful – look at the pickle health care is in now – and about to get much, much worse.

The Path Forward with the Consumer

- Stop worrying about competitors - Fidelity Chairman Ned Johnson used to admonish the team to worry only the customers not the competition.

- Identify your client “personas” - you have ideal clients. Focus there. As noted above, you’ve already lost the marginal client so move on. Find more. Your ideal client is someone else’s failed connection.

- Build individual solutions and service models for each persona - whatever you do has to be separately designed for each client cohort. Most companies here have multiple products, services or capabilities. Each of these has to stand on its own so each persona feels the attention.

- Align the organization to the consumer - The organizations represented here are organized mostly the same way they were decades ago. Re-engineer your organization around the needs of the consumer. Test: if you have not designated a C suite leader to be the Chief Customer Officer, you are already behind. That’s not a soldier, it’s a general. And must have insight, courage and above all humility, because it’s not easy to stay focused on the consumer. It’s not about the consumer always being right, by the way, because they are not, it is about avoiding the pitfalls of pride and believing the company’s agenda can somehow be more important than the consumers’.

This is not so much a war with the consumer as it is a marriage of two type A personalities, both anxious to get their way. Sometimes they agree to disagree, and sometimes they just disagree. Harmony is fleeting.

3. Horse of Famine – aka The Death of the Salesman

Sales is no longer a dirty word, it’s outright profanity. The fear of being sold has replaced the fear of paying too much. Consumers routinely pay more for convenience, perceived authenticity or mission, and even for people and products they just like or believe in. As long as they don’t feel sold.

An illustration helps.

The Alliance for Lifetime Income holds an annual summit in Washington about Protected Income and it’s a terrific gathering of the industry. A year ago, a consumer panel featured three pretty smart and thoughtful clients who together shared a similarly skeptical view of financial professionals, “They are always trying to sell me something”. The panel that followed them to the stage was made of three very strong financial advisors. The first of which was from NWML, still among the front runners for net new assets, who asked to address the previous panel. “You feel like you are being sold something – but that’s because you just might need something”.

The Path Forward with the Death of the Salesman

- Focus on your reputation. What are you saying - and to whom? What do you sound like to business partners and consumers? Are you confident, authentic, capable - or do you sound like you are selling something? As an industry we tend to speak in proprietary tongues – hard to decipher in the context of our jargon and lengthy disclaimers. Nothing screams, “Salesman!” like a half page of small print accompanying a fairly simple idea or product.

- Provide unmistakable value. What ARE you selling? The value must be made so obvious that even the casual shopper can grasp its importance.

- Get ready for more regulation. Clients aren’t the only people who think we are always selling. Compensation and suitability are following us into a future where our products and services are available everywhere and consumers aren’t sure they need help. Expect more scrutiny, take advantage of underlying message of care. Be wary of fighting back - the trend is pretty clear.

4. The Horse of Death – aka The Impact of Longevity

The best for last.

“Retirement” is trending but “longevity” is the causative trend. People do all kinds of things with their longevity - only one of which is “retirement”. We are really helping facilitate that longevity - partnering with clients to fund the time between their active working years and their death.

That’s a more sobering view than the one typically illustrated by our industry, which tends to favor ads with silver haired seniors playing golf, dancing and enjoying international travel. But it’s the view most consumers will eventually see.

Sober Up

“Retirement crisis” earns 69 million hits in a Google search. The “crisis” is real but very uneven in impact.

For most Americans it will be the inability to cope with the simultaneous demands of healthcare and living. And a mix of the cost of those demands as well as the social, mental and family demands – the impact of unprecedented longevity.

I’ve actually heard senior industry execs say the words, “We know retirement is big thing, but we just don’t hear a lot about it from advisors”. I’m sure the passengers on the Titanic had a glorious time – for the first four days. “Retirement” is lived in stages from the initial “vacation mode” on to usually a more serious and limiting existence, the proverbial go-go, slo-go and no-go trimesters of retirement.

I’ve actually heard senior industry execs say the words, “We know retirement is big thing, but we just don’t hear a lot about it from advisors”. I’m sure the passengers on the Titanic had a glorious time – for the first four days. “Retirement” is lived in stages from the initial “vacation mode” on to usually a more serious and limiting existence, the proverbial go-go, slo-go and no-go trimesters of retirement.

Find Your Corner

Clockwise

Clockwise

- You have both health and wealth. And all too common is the unhappiness of a longer life poorly planned. Pickleball alone can’t make this one all better. You can have plenty of money but be completely unfulfilled, without friends or family – all of the ordinary developments that accompany longevity.

- Bottom right. You don’t have a lot money but your poor health gets you off the hook.

- You have health but no money. You have longevity without the resources to fund your ongoing lifestyle. Health is also relative of course. You can also have longevity without great health.

- You have money but not health. You can achieve quality but you’re undermined by poor health and limited “healthspan”.

This is the inherent unevenness of “retirement”, created by the unevenness of longevity. The youngest Boomers are only 59 – most still of working age. The oldest are 77. The difference in that range is night and day. At 77, both of my parents and all four of my grandparents were still alive and active. Both of my in-laws were dead – one of cancer and the other of Alzheimer’s. Why? And who’s ready?

The Next Big Thing

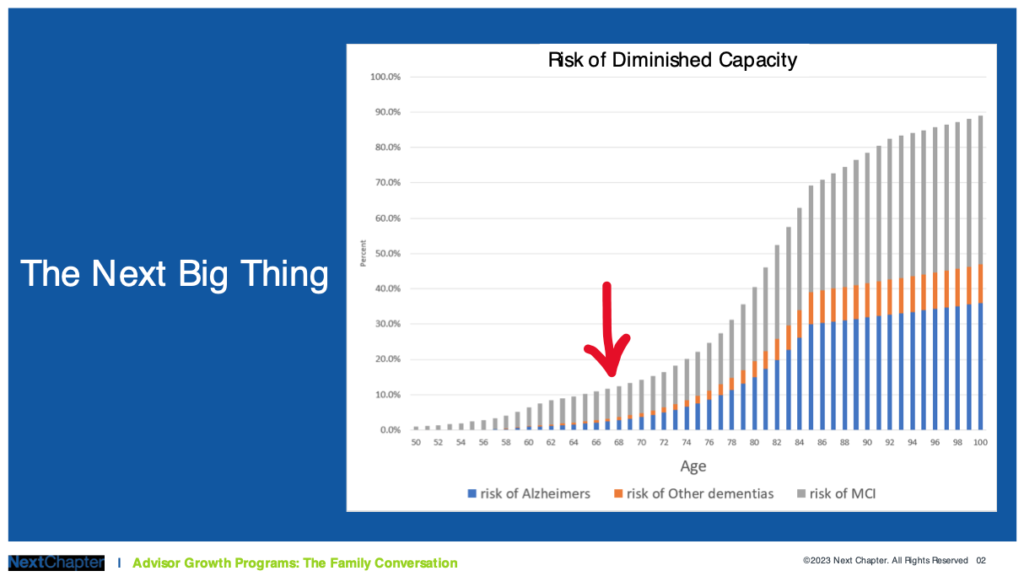

That condition is about to change – with more speed, volume and impact than most families, hospitals, advisors – basically everyone – is prepared for. A picture tells the story – the darker side of “longevity”:

The new S curve ahead is the hockey stick of declining health – the skyrocketing incidence of older people without the ability to make good decisions and live independently.

This fact is a game changer for the society and an important reason why we don’t characterize “retirement” as the trend – it is really longevity.

This curve is also of course a proxy for the demand for anything associated with people’s slo-go, no-go phases of retirement. Health care, assisted living, home health aides, hospital beds, nurses – all will be in unprecedented demand but with little “warning” and even less ability to meet the need. My NextChapter colleague, Tom West of SEIA, calls this the “musical chairs” game of help – you need a spot for when the music stops. And the “planning oriented” people with good advisors have already taken most of the slots. I hear that all the time from otherwise very smart people, “We will age in place with in-home help”. Which you are going to hire and from where? Your neighbor will become your competition for help.

The Path Forward - The Implications of Longevity

1. Define your relationship with the longevity economy - Know what role your company will play in a society increasingly dominated by the issues of aging. Watch the impact on personal health care, with its own COVID-19 wake up call. Capacity constraints and employee shortages will continue to convert healthcare delivery to more and more patient actualization. Scale alone will drown the current offering and you will hear about it from frustrated clients and their families.

2. Prepare for the self-help world – That scale will force more solutions to be digital, virtual and self-service with the help of better interactions facilitated by AI and Chat. Advisory firms are outgunned – they can’t keep up with the demand. We’ve seen this movie before - when Big Pharma got the ability to market directly to consumers. Tired of waiting for doctors to learn new capabilities, the drug companies hopped on the Today Show and everyone’s evening news, extolling the virtues of their new cures. An especially good example is Ozempic, which earned attention first as a treatment for diabetes and then became a weight loss wonder drug promoted on social media. Get ready for “Ask Your Advisor” - a concept we have rolling today at NextChapter.

3. Focus on the certainty of outcomes. The financial industry has to shift focus from “best efforts” to “certainty of outcomes”. Clients in retirement are quite literally trying to survive with confidence and independence until death. Why is that reality so hard for us to grasp? Because like the consumers we serve, we fear the discussion?

- Winners are fully invested in the certainty of outcomes. Look at the rebirth of the annuity industry. Certainty is the antidote for uncertainty, and defined outcomes are the positive side of a bigger trend favoring “protection”. For an industry built to deliver “performance”, this is a fundamental shift that will be as difficult for incumbent players to execute as it was for Detroit to build a decent small car.

- Being committed to certainty of outcomes, eliminating anxiety, increasing protection – these are the design principles that will determine future product market share. Watch the institutional plan market growing in-plan annuities, script flipping products like BlackRock’s LifePath Paycheck – all geared to helping ensure the success of our clients. Giving clients what they want is not an intellectual compromise.

4. Commit to a better Eco-System - when Detroit was sliding off a cliff in the early 1980s, the recovery required contributions from every part of the auto industry world. The government led the financial bailouts and provided protective tariffs, unions took a hit, suppliers pitched in.

Do you have capabilities, people, content, training – any resources that can help your advisory firm partners? What is the additional investment you will make – and that others might not make? This added support is really about locking arms with advisory firms that are under significant stress to maintain a clientele looking for far more than the firms can provide. AT SCALE. With the typical full service advisory book tipping the scales at 150 households, NO ONE advisor can provide solutions to the full complexity of retirement and longevity planning issues. The gear ratio is all wrong.

This is a huge industry transition – the consumer is up a creek, probably didn’t ask enough questions, probably didn’t do a good job of preparation, and probably didn’t help the advisor enough to do a good job. And we share the blame for not engaging deeply enough or candidly enough.

But this is us. We might have made different choices at a different time. And some elite advisors in fact did that. So the question now is “How can we work together to ensure better outcomes for our clients?” And the answer to that question is the path forward. Among the more obvious areas of friction to resolve is that of the truly connected and coordinated eco-system of capabilities. Incompatible stuff is not tolerable and we can do better.

The Good News

Despite their divine mission, the Four Horsemen failed to deliver the end of the world. And while each of my morbidly illustrated mega trends is unstoppable, smart industry leaders will find their path forward in the areas most sustainable for their capabilities. But we will do it together as never before, or one of those horsemen – one of those trends – will get us. And it doesn’t take four – it just takes one.

This article was adapted from the October 11 session held for the Annual Conference of the Money Management Institute.

The Moments That Matter: Seven Questions Will Make - Or Break - Your Advisory Practice

The text message said it all. “Sorry I went dark. My dad has stage three lung cancer and we’ve been scrambling to deal with that.”

I was wondering about a close friend and colleague. We had connected recently and made plans to work on a project together. The text message cleared up the mystery but also created new priorities for us both. Perhaps because I’m getting older, these messages are becoming more frequent – not just about relatives and friends but also age contemporaries like my friend Gavin Spitzner, just 57 when he died.

An Unexpected Health Event is one of The Seven Moments That Matter, the foundational work of our NextChapter project, The Family Conversation.

Working directly with financial advisors this summer, they confirmed the importance of both the topics and the need to prepare. “I’ve had them all”, declared one advisor in St. Petersburg, FL – a hotspot for aging and longevity planning. And while their level of proactivity with the topics varied, all of the advisors acknowledged the need to be available, show concern and have options.

Listening is the First Line of Engagement

Active listening is important. But proactively discussing the Moments with clients is more difficult, according to the advisors. “I’ve had clients tell me they don’t want to think about how they are at risk for a healthcare issue or having to leave their home”, observed another advisor, “They prefer to wait for the event”. Our part-time consultant to the project, my 89 year old mother, goes even further in her observations of age contemporaries. “Most people just don’t plan”, says the refugee from Hurricane Ian back in September 2022. One of our advisors based in suburban Philadelphia countered, “I disagree. I think most people do plan. They just don’t plan well!”.

Listening actively means allowing emotions to flow. All of the Moments are traumatic for the impacted person, as well as for family members. It is nearly impossible to be fully “prepared” for elder fraud, identity theft, a fall – even a divorce late in life. My mother had everything in pretty good shape and had experienced four of the seven moments herself when she lost her home in the hurricane, notching number five on our list. Listen to her talk about “aging in place”: Moments That Matter: Aging in Place with Steve and Phyllis Gresham

Most clients are still processing the Moment when they contact you. The very act of making contact requires courage – especially if the caller is not the primary client. The unengaged spouse or child that connects with you may not know you or know how you will react. A client of my firm years ago had never met her husband’s advisor and had never so much as written a check. Bill took care of all financial affairs and investments and taxes, while his wife, Jackie was the family CEO and chief medical officer. Bill’s diagnosis of multiple myeloma was a body blow to the family and to Jackie. She did not speak at the first meeting with the advisor, who really did not know Bill very well at all. But the advisor, Annemarie, made Jackie feel at ease, taking Jackie under her protective wing. Jackie would tell me months later when we met that Annemarie “saved her life”.

The Shelf Life of a Moment also Matters

A great colleague of mine once said of the Moments we researched together that each had a “shelf life” – much like a carton of milk. If the client came forward with their event, with the courage to engage, we as advisors have to respond appropriately but also timely. We cannot linger or delay – we only increase the concerns of the client. Our response will also be judged by by the client’s family, who may now be in control of the relationship. There are countless studies and statistics across the industry reporting that “70% of widows fire their husband’s advisor” or other indications that intergenerational transfer of wealth is more the exception than the rule. Our experience indicates that failure to respond quickly and with empathy to a Moment is the trigger leading to those departures.

Gender Matters

Because women typically outlive men, they are both the subject of more “Moments” as well as the responsible party for their resolution. In my mother’s life, she has been the caregiver/decisionmaker for two grandparents, her parents and my father, who died of pancreatic cancer. That role spans nearly my entire lifetime and 2/3 of hers. The disruption caused by longevity is one of the greatest but least appreciated costs to our economy. Most families will be engaged in care – and more in depth and for far longer than they expect. We hear from retirement plan sponsors about employees seeking benefits and time off for eldercare. One Fortune 100 firm reports that unexpected demands of eldercare have exceeded employee time off for maternity and paternity leave. And we know anecdotally that the majority of those caregivers are – and will continue to be – women.

The Health Curveball

Health is such a variable that in my own personal life I see an amazing array of care situations that were not foreseen by the people now consumed by the challenges. Unprecedented longevity is the culprit for most – including the role reversal of an 85 year old parents caring for a 57 year old son with terminal cancer. Or the 62 year old widow living with the 95 year old widower father. Or the 80 year old “traveling companions”, who lost their spouses and now one of them is suffering from severe dementia. What role does the “companion” have relative to the other’s family? My mother pipes in again with her observation that most everyone who’s aging has “body complaints” – nagging issues that are chronic but manageable. “And then there’s the BOOM”, she says, “That’s the one you probably didn’t see coming. But that one changes the game.” In her world most recently, a friend was out for a casual bike ride on her three wheeler and suffered a stroke – during the ride. No warning signs. “And down she went”, says Mom. “She will be OK at some level, but her Maine vacation home is no longer an option”.

Reality Bites

Depressing stuff? Sure, but that’s life, as they say. And all of the Moments That Matter are likely to impact every client family you have today, so your preparation will pay you back many times over. And you have a wide open field of play now because competition is generally unprepared. According to a recent survey of clients and advisors conducted by the Alliance for Lifetime Income, 73% of advisors say they discuss “retirement protection” with their clients – but only 33% of clients agree. That disconnect is a gift to the prepared advisor.

The Rest of the Moments

Keep this list handy and use it to ask clients about their level of preparation. Perhaps not all of them, but question what the plan should be if any of these items hit the family. My mother offers a tip, “Don’t tell the story of another person who had something happen to them. Most older people think mostly about themselves as they age – you can be direct and personal but make it about them”.

- An unexpected family health event – what would you do if your wife suffered a stroke?

- Having trouble making financial decisions – what should we do if your dad can’t manage his account?

- Recently widowed client with adult children – if something happened to Gary, would your kids be able to help you?

- “Gray divorce” creating financial insecurity – how are your assets titled today? Would your kids and his kids be treated fairly?

- Retirees worried about paying for healthcare – what Social Security and Medicare elections have you made? Do you have long-term care insurance? Do you know what a CCRC is?

- Older adults want to age in place – how have you secured your home in the event you cannot climb the stairs? Do you feel safe at night alone?

- Elder financial abuse, fraud and identity theft – how do you protect your account passwords? Do you pay bills online? Do you subscribe to any protection services?

Aging is the New Normal

All of the Moments are common – even daily occurrences among advisory firms. As the population continues to age (the oldest boomers are now 77), the media will be swamped with stories and examples of good planning – and train wrecks. Read mine here. And the media will be training our clients about the risks ahead. So it will be less and less difficult for you to start these Family Conversations with a provocative question about how prepare and protect your client. And their family will be appreciative.

Mom gets the parting shot, “Sometimes fate makes the tough decisions for you”. Onward!

Minding the Trimesters of Retirement

Don’t be fooled by the early stages - longevity has implications.

I’m often challenged by advisors and industry executives, “We don’t hear a lot of complaints from retirees. So why do you say most retirements will be a trainwreck??”

It would be in very poor taste to observe there were very few complaints from the passengers of the Titanic – during the first four days of their voyage.

“Retirement” is a terribly misleading concept. To many people, it is a destination – a long awaited moment to cast off a job they don’t love, a boss they despise or customers that are too demanding. Now it’s their time – time to travel, time to relax, time for hobbies, family or just do nothing. The most popular phrase I hear is “freedom”. And well deserved at that.

But the cruise ship of retirement faces icebergs. And those icebergs are typically life events created by longevity. The longer you live, the more you cruise the SS Retirement, the more chances you have to hit an iceberg.

Never Say “Unsinkable”

The Titanic’s Captain Edward Smith infamously ignored warnings by other ship captains on his course and was on record for years before the tragedy extolling the virtues of modern shipbuilding to the point where he “could not imagine any condition which would cause a ship to founder”. Sounds like a devotee of Monte Carlo simulations who doesn’t acknowledge the statistical reality that 70% likelihood is not a guarantee of success.

But what if the Titanic’s passengers had been told there was only a 35% chance of success – albeit with a short sidetrip in a lifeboat. Would John Jacob Astor IV, a billionaire in today’s dollars, have bought that ticket for himself – and his pregnant wife? She survived – the child was born – he drowned at 47 along with 65% of the passengers and crew.

Mind the Trimesters – Go-Go, Slow-Go, No-Go

Way back when I was an advisor to families, I met a couple who had already quit their jobs. At 61 and 60, Dick and Ginny were active, true go-go retirees. They had his pension and were financially secure. From me, their first ever advisor, they were looking more for validation of their choices. Most of my perspective about retirement was learned watching my older relatives – four grandparents and three great-grandparents ( see more: https://nextchapterinnovation.com/my-family-made-me-do-it/ ).

“Tell me about your plans”, I asked. They enthusiastically described winters of skiing and summers of sailing their boat along the coast of Nova Scotia. “Wow – that sounds great”, I agreed, “So what’s next – when one of you may not be up for that effort?”. I went on to share how it’s very common to have great plans but that Mother Nature has her own and longevity can be a spoiler. There are strategies and location choices that can help ease the transitions.

The look on their faces said it all – I’d overstepped their expectation for the meeting. And just that quickly, they thanked me. And left my office. And that was my first encounter with the downside of being candid about retirement planning.

A few weeks later they called and asked for another meeting. “We’ve made some decisions”, they shared. “First, we really appreciate what you said – we weren’t ready to hear it”. They went on to say they listened and had taken steps. They scrapped the Nova Scotia plan in favor of Lake Champlain in Vermont where they could store their boat year round and also buy a condo in the same town as their “most responsible” child, who welcomed the idea. They also wanted to supplement the pension with a more protected form of income and liked the idea of an annuity in lieu of some of their mutual funds. Like a paycheck, they reasoned.

Reality Check, Paycheck and Checking Out

All good – but there was more. The “slow go” phase of retirement was daunting to them, but they really disliked the “no go” vision. “We have a plan for that” Dick shared with some mystery…

Rolling the story forward, Dick and Ginny campaigned successfully for what became only the second assisted suicide bill in the nation. The governor of Vermont signed the bill on his father’s birthday with Dick standing over his shoulder. Death with Dignity Vermont was born of their dedication to doing things their way in retirement and reflected the determination and energy that defined them both. I was so proud to see them on the front page of the New York Times.

Reconnecting with Ginny upon Dick’s death nearly thirty years after our first meeting, she recalled that day. Even how much they appreciated the “reality check and the paycheck” – and she volunteered, “I still have that annuity – it’s been great”.

Real Retirement Planning Takes Courage

The facts are stubborn – most of our clients are not prepared. Nearly half of people with more than $100k in a retirement plan have no advisor, no financial plan and – we know – not enough money to retire and maintain their lifestyle.

You can say, “Not my clients”, but are they ready to finance 30-40 years of additional longevity? How do you know? How do they know? Most people still underestimate their longevity so what plans do you have for them to hedge that risk?

What about those trimesters of retirement? Have you had the conversation with every client close to retirement age or already in retirement about the second and third trimesters? What does “slow go” imply for their plan – including where they will live? And what about “no go” when one partner or spouse is gone. My mom’s in that phase now with very different circumstances from the other two trimesters.

You Can’t Fake Retirement Planning

The advisors who sell a sunny retirement funded by a balanced investment portfolio fit only with multimillionaire clients who can keep their spending in check. And that is a tiny percentage of the population. For all of the other clients and advisors, there is real work to be done with trade-offs and pivots as the inevitable challenges of longevity pop up. Professional imposters won’t last and naïve clients will fail. The real advisors will protect their clients – and earn both unprecedented growth and the feeling of achievement. Do good and feel good.

The Retirement Opportunity is Staring Us in the Face - Can You See It?

Most retirement plans will fail. So who will tell the clients?

In 1965, a Harvard-trained lawyer working for the Department of Labor published a book warning Americans that their cars could kill them. Unsafe At Any Speed by Ralph Nader rocked the Detroit auto industry, and its damning revelations prompted the federal government to act with uncharacteristic energy to implement the National Traffic and Motor Vehicle Safety Act the next year. Nader’s message was that car manufacturers know of their vehicles’ defects and in fact designed them, choosing profits over safety. The subtitle of his book is “The Designed-in Dangers of the American Automobile.” His moral observation: You can’t trust the maker of the car you drive.

Now let’s take another industry that’s likely to face trust issues. Tens of millions of Americans believe they are going to be OK in retirement. But those of us in the financial advice industry know better. Most of these retirees will fail. Many will run out of money. They’ll have significant health issues. Many will be unable to manage the care they need.

But have we warned consumers about this? If we cannot ensure that they thrive in their longevity, aren’t we responsible for telling them?

If it is our responsibility, we cannot hide from it. The truth is starting to come out. People know there’s a problem.

What We Know

Consider that “retirement savings crisis” is noted 69 million times when you search Google. We also know who will be affected. The vast majority of our clients are baby boomers, the generation first born in 1946. That group is still 70 million strong, and together with their children and aging parents represent more than a third of the U.S. population. They own half the nation’s wealth and do 70% of its consumer spending.

According to an Alliance for Lifetime Income report, 43% of consumers believe the 2022 market setback represents a longer-term change that negatively alters their retirement outlook. And they are facing a different economy: 53% of consumers say one of the three reasons why they retired were circumstances of health, job loss, mandatory age requirements and the impacts of COVID-19.

We also know baby boomers are living longer. During boomers’ lifetimes, their life expectancy at birth has increased 17% to a blended 78.8 years, and their life span at 65 has increased 44%. That longevity will demand more resources from them after they retire. Yet at the same time, the workforce supporting Social Security recipients has declined. The number of workers per beneficiary was more than 50 in 1946. Now that ratio has fallen to 2.8 workers. Meanwhile, by 2040, the number of Americans 65 and older will have doubled since 2000, and the population of 85 and older will have doubled since 2020.

We also know that people are vulnerable. The National Council on Aging says 80% of households with an older adult are financially struggling today, or they’re at risk of economic insecurity as older adults age.

Those of us in financial services also know what most clients don’t know: Most Americans say they want to live independently in place as they age, but 60% can’t afford more than two years of in-home care, while 45% of people 60 and older don’t have enough income to cover basic living costs (these were also findings of the National Council on Aging).

A Warning To Advisors

The warning here is not just about doing the right thing, it’s about good business.

You are probably thinking my clients aren’t ordinary, spendthrift boomers. They are frugal savers. They have dealt with the health issues of parents and in-laws. More recently, they’ve seen contemporaries in their fifties who thought they were financially set for life and quit their jobs during the Great Resignation only to realize it was a mistake.

Even if your clients remain financially secure and independent, they are likely to be surrounded by a lot more friends and family who aren’t. That’s a bad look for both the advisory profession and the financial services industry at large.

Detroit’s problem wasn’t just the safety of its cars. It was also a pervasive and persistent indifference to consumer preferences. At their peak, the Big Three of Chrysler, Ford and GM controlled more than 90% of the U.S. auto market. Their share is now only 44%, and 23 different companies around the world now sell cars in the United States. The consumers always win in the end, and if you don’t listen to them, they won’t argue with you. They’ll just go elsewhere.

The lesson here is that current success is often the biggest obstacle to future success. Another lesson is that there are perils in complacency and the unwillingness to innovate.

My mother and father got their first car in 1965. It was a VW Beetle with a stick and no air conditioning. Their parents, both sets, each had a version of the big four-door sedan that was the No. 1 selling car design in America from 1946 to 1976. But my parents could not afford one, so their choice was simple. Volkswagen was the No. 1 selling import car brand in the U.S.

Fast-forward 60 years and VW is now No. 1 in the world while the Big Three have tanked. My parents bought American only when they needed room for four kids and a dog. When the kids were gone, the station wagon was gone and they were lured back to the superior value of the imports because of their sticker price, reliability and better gas mileage. The Big Three still weren’t getting it.

Now consider the retirement planning industry. Do consumers have choices and new innovations to choose from? Yes, they do. Will they turn on trusted advisors if those advisors aren’t meeting their needs? Yes, they will. The technology exists to replace most of the financial advice industry. The only question now is when. Really big scale investors are eyeing the retirement industry for disruption. They see the failing consumers, the rising anxiety, and the incumbent players’ complacency. Just like VW and Honda and Toyota and BMW and (more recently) Tesla stole trillions from Detroit, financial disruptors are waiting in the wings to provide what traditional advice givers aren’t giving them.

So what are those consumers saying they want? Consider what they’ve told the Alliance for Lifetime Income, which recently released a study of consumers and their advisors. It reveals consumers’ retirement planning anxiety, and the ways many advisors are innovating to quell those concerns.

According to the alliance, 51% of consumers age 45 to 75 feel they don’t have enough in retirement savings to last their lifetime. Nearly a third are not confident they will have enough to cover basic monthly expenses. In response, eight of 10 advisors have changed their retirement planning approach in the past year. Forty percent of advisors who did put more client assets into annuities. Ninety-seven percent of consumers say having guaranteed lifetime income in addition to Social Security in retirement is valuable. Fifty-four percent of advisors believe their clients could spend more money if they added the protection of an annuity to the retirement income plan. Ninety-three percent of consumers who protected their portfolio with an annuity in 2022 are satisfied with their investment choices for 2022 and 44% are extremely satisfied.

But there’s also, apparently, a communication gap between advisors and clients. Consider these issues:

- Seventy-three percent of advisors say they raise the topic of retirement protection with clients, but only 33% of investors agree.

- Nearly half of investors say they are extremely interested in owning an annuity, but only 19% of advisors believe their clients have this level of interest.

- Fifty-one percent of consumers are uncertain that the 60/40 stock/bond model remains viable, while 28% say it is outdated and other asset classes should be added. About half of advisors, meanwhile, say the model is valid.

If we ignore these gaps, we ignore the power of the consumer to change our business if we don’t change it ourselves.

The baby boomers don’t just dominate the financial industry. If we continue to ignore their very clear preferences for financing retirement—they will be the facilitators of whatever and whomever replaces us. They have the power.

How the Best Advisors are Getting Better

Meet the Top Advisors Built by Their Clients — New research confirms three new winning growth strategies

The best advisors are getting better – by following the changing needs of their best clients. The top 100 wealth management teams ranked by Barron’s increased client assets by an average 10% over 2021 – a strong performance in a challenging environment. But much more impressive is the average revenue gain of 48%.

How?

New industry data shows that clients want help with complex issues of retirement planning and the implications of longevity. Advisors listening carefully to their clients are adapting – winning new assets and new clients.

Here are the three big growth ideas – with the underlying “why”, the tactical action steps and the research solidifying the trend:

1. Adapting to New Client Priorities

What the Clients Said:

- Advisors are from Mars – mostly still managing portfolios and touting investment solutions, and clients are from Venus – increasingly concerned about the risks in retirement of inflation, health and healthcare.

- Retirement is a family affair. Too often, spouses, parents and adult children have not been involved in planning – and have different priorities and concerns.

What the Advisors Did:

- Engaged the family. The top advisor teams know the family members, especially aging parents with immediate needs as well as adult children who are nextgen clients.

- Lead with planning. Planning is first organizing a jumble of accounts and products, and then provides the foundation for more specific solutions needed in retirement.

- Adopt protection strategies in addition to investing. Good planning is also good preparation for expected and unexpected events. Advisors are asking the tough questions about health and family history and a lot of “what if…”

Why It’s Working:

Most of the industry claims to be client focused, but too many clients say they don’t see it – or feel it. A terrific new study by Morningstar1 reveals a complex array of reasons why clients leave their advisors, and the central thread is poor communication. Nowhere in the business is that communication more off target than in retirement planning.

Piling on to the disconnect between investing services and planning advice is the newest J.D. Power annual investor study2, now in its 21st year, that reports investor satisfaction with full service advisors continues to slide - to 727 out of 1,000. Power says the culprit is the “systemic problem” in wealth management of focusing on investments while clients want more comprehensive advice. The study shows 42% of advisors deliver transactional advice, 47% deliver goals-based advice and only 11% provide comprehensive advice. The leaders stand out because the competition isn’t delivering what clients are asking for.

2 Solving for the Trimesters of Retirement

What the Clients Said:

- “Retirement” is not an event, it’s a journey with new developments and challenges. And every retiring client is a brand new traveler.

- The stage is a long-awaited vacation -- clients enjoy the best health and the most money they will have in retirement.

- That vacation can change quickly to a “staycation” if a spouse or family member becomes incapacitated, but many clients haven’t planned for this “slo-go” phase.

- The third trimester is the “no-go” period when the client may be alone. Clients pondering retirement have typically not considered all three phases.

What The Advisors Did:

- Longevity is inevitable but also manageable – if you prepare. Most clients know but have chosen to avoid the blunt truth of potential incapacity or disability. And most know older parents, relatives and friends who have grappled with the often sudden issues of health. New to them, but not to top advisors.

- Mastered the moments that matter. The seven most critical life events are often calls to the practice from clients who don’t know what to do. Top advisors make sure they have a prepared response because the moments are brand new to most clients. And no amount of money can insulate a family from failing health or cognitive ability.

Why It’s Working:

- Retirees shift the priority of their concerns as they age. Money worries give way to health and healthcare worries as the physical impact of longevity grows.

- In the Longevity and the New Journey of Retirement Survey by Age Wave for Edward Jones3 , author Ken Dychtwald contrasts longevity – lifespan – with “healthspan”. Life expectancy for Americans overall is 78.5 years, but most people will suffer with multiple chronic ailments for the final 12 years. 2/3 of people 65+ suffer from at least two chronic conditions. Physical health and cognitive health are critical determinants of the ability of older retirees to live safely and securely. The “slo-go” phase. The same study reveals that at age 85, nearly three quarters of women are widows, and 36% of men are widowers. The “no-go” or “solo” retirement stage.

- Advisors don’t like to talk about longevity and health. Preliminary findings from a new survey of clients and financial professionals from the Alliance for Lifetime Income4 reveals that 75% of financial advisors do not discuss the risks of cognitive decline with their retirement planning clients. It’s not an easy topic, but it’s reality and clients expect advisors to anticipate potholes in the road ahead.

- Managing Retirement Solutions is a Different Business

What the Advisors Realized:

- The complexity and customization of retirement solutions cannot be delivered at the same scale as selling investments. A solitary advisor, no matter how loyal the clients, cannot fly solo with a retiring family.

What the Advisors Did:

- They built a team of professionals. An advisor who is great at investing may not have the empathy needed to talk about cognitive health. A planning pro may not have the time to learn the fine points of protected income products. A lot of help is available. And they can more easily recruit younger advisors to an existing, successful team to improve breadth of solutions.

- They plan for succession. Advisors are aging right along with their clients and the best want to ensure continuity for clients and a graceful exit for themselves. The team approach tops the list of solutions for many top advisors committed to their clients and their colleagues.

- They get paid for what they do. Retirement is not an added-value service to investment solutions. Top advisor don’t typically charge only through investments. Many charge for plans, for their time and for complex solutions. Full transparency. And most expect to see all their clients’ assets and retirement plans and other existing investments.

Why It’s Working:

- Better scale means better success. Millions of clients with trillions of dollars have accounts with full service financial advisors trying to keep track of an average 150 clients – alone. That math just doesn’t work for delivering real retirement planning and solutions. Top advisors promote the value of their teams and frequently include different team members to assist a family.

- Planning, protection and solutions is a cleaner value proposition of “advice”. Too many clients have no idea what’s involved in retirement planning and even fewer seem to know what financial advisors really do. Top advisors don’t shy away from the complexity, and make sure clients have a healthy appreciation for the work. A leading advisory firm says advisors engaging protection strategies drive 4X the new client assets as other advisors and have double the revenue growth.

- Family rewards. There is a virtuous loop working with multiple generations. For a boomer-aged client, the assistance with aging parents may be a top priority today, but it provides an opportunity to reinforce the advisor’s value for creating a similar strategy for the client. And previously unengaged spouses and adult children participate in the process, creating a relationship with the advisory team that secures their assets for the future.

Are Wealth Management Advisors Really Growing?

Faking growth ... Wealth management advisors aren’t really growing. But there is a way forward.

RIP, organic growth.

Most of today’s wealth management offerings are built for a business that no longer exists and for clients that are moving on (not moving in). Why is that so?

Let’s look at wealth management following that train of thought (and anticipating the ultimate derailment):

1. For one thing, the products are free. Investment beta and trading commissions are now free at leading direct providers. So if you aren’t free, what is the value you’re offering for what you charge? If you say, “It’s for advice,” then what’s your advice about?

2. That’s important to ask, because a lot of clients say they don’t want advice, or at least they don’t want to pay for it. During a consumer panel at a recent national industry event, I heard three consumers on the panel say they don’t have an advisor. They said things like “You can do everything at Fidelity,” or “Advisors always sound like they are selling me something.” Forty-six percent of retirement plan participants in a survey said they don’t have financial advisors and aren’t looking for one.

3. Now let’s look at the clients we do have. Most of them are unengaged, and that’s because they have multiple financial services providers, and distant relationships with them at that. Look at the national stats. If you blend all the coverage models, from the small RIAs to the private banks up to the largest direct providers, you get an average ratio of 150 households per advisor. Most “clients” (outside small, intimate firms) are really just fractional clients. You’ll see them as whole clients only until they leave you when they’ve started consolidating accounts.

4. “Retirement” will eventually replace “accumulation” as the reason people are turning to you for advice, and that will determine whether your advice is profitable. Twelve thousand Americans are retiring every day. They have very different needs and require much more attention and complex solutions than they did when they were just saving. This cohort is providing more than 75% of advice industry profits through 2030.

So if we have all these things throwing us off, how do we get this growth train back on the tracks? And what is your definition of “growth”?

If your objective is to sell your organization, you can achieve impressive growth by acquisition, ride rising markets and buy more scale on the dips. Yours is a market share play with a revenue bogey and it’s more of a trade than a business. And when it works, it works—if you can sell at the right time.

But for the rest of the industry, especially those companies responsible to shareholders (as well as clients and employees), the solution is organic growth. And organic growth is measured by net new assets and client share of wallet. It’s also not measured by how well the top 10% are doing, but what the median advisor is doing and what his or her median relationship is. If you are consistent, that will make you a winner in enterprise value.

An executive in our NextChapter community says it very well: “Net new assets indicate the health of the business, and household share of wallet indicates the value the clients place on their relationship with their advisor and the firm.”

Accept The Consumer And Act Your Scale

Wealth management firms seeking a recipe for success will achieve organic growth by providing the clients with what they want now and what they want in the near future. If you are one of the advisors following the 75% of assets under management riding off into retirement, here’s what you need to know about clients and what they want:

- They have declared that “planning” and “relationships” are their evaluation standards.

- They are afraid of inflation, they’re worried about being able to fund healthcare and they don’t want to exhaust their assets

- They need a certain amount of liquidity to achieve not just their large expenses in retirement but their peace of mind.

There is no way to solve for these issues if you’ve got 150 clients per advisor (if you plan on using only human beings in those advisory roles). You would need to employ a lot of humans.

The path forward is to first design for your scale—and be clear-eyed about what you are and what you are not. And then you must make sure you declare your value proposition to your associates and clients. The days of being a “financial advisor” are over. It is time to be crystal clear about what you do since most clients seem not to know what we do or why they need us.

Every advisor and practice is different, so there is less value in providing “the answer” than in asking the right questions to help determine your appropriate scale:

- What do you really do? Maybe you can manage a book of 150 clients with investments, but you can’t do it with retirement planning. Our research of top planning advisors reveals a coverage ratio closer to 25 households to every one professional. And virtually all successful retirement planning practices are teams with multiple professionals with different specialties.

- Who are our clients? The more variety in your clientele, the less efficient you are. And what percentage of a client’s assets under administration do you need for what you do well? Scale favors bits of clients and single decision-makers per household. Planning benefits from having the entire family involved.

- What are we solving for? Our assets under administration may have driven profits but the aging clients now want you to shift from investing to protecting these assets. Have you? Liquidity, credit, liability management, long-term care, premature death protection, longevity protection—these are the new benchmarks, not the S&P.

The Inertia Of Success Is The Enemy Of Growth

Now is a good time to remember the old saw: “The primary obstacle to future success is your current success.” The U.S. stock market has rocketed to 37 times its value during the reign of the baby boomer, starting in 1982. The unprecedented lift from markets will not carry the industry forward from here. It’s time to reinvest some of those gains into a market offering incredible opportunities—and we’re overdue for change to meet the new demands of our current clients, who are now expecting more.

The opportunity is even bigger for first movers, because the inertia of success will trap many current industry leaders. We’ve seen this movie before—in the movie business, as it happens: when consumers left theaters, first for Blockbuster, then for Netflix. Wealth management might be a similar victim, but only if we try to hold on to a business fundamentally changed by the consumer and if we invite the innovations and competition that will defeat us.

Of course wealth management is not dead. But it is being dramatically transformed by the consumers who need it to be different from the way it works today. And not every provider is assured a spot in that new, multifaceted consumer world.

It's a choice.

Sue and Ben

Sue and Ben could be the ideal clients. They do their homework. They plan. They actually like to plan. They have investments, life insurance. They work well with financial professionals. Their $2 million in savings seems like a home run now that they are on the “starting line” of retirement at 66 and 67. But….

What About Dad?

Sue and Ben also have a lot of questions - really concerns - based on recent developments with Ben’s father, who is suffering from the early stages of dementia. Ben’s dad is a force - the patriarch - and his disability has shaken the entire family.

A great advisor I know - Patrick - says often to his clients that planning is a two part process. The first part is planning with all available information according to the standard path of the planning software. Typically exhausting for the clients but they get a victorious high five from Pat who is genuinely proud of them for the commitment.

Planning for Potholes

The second part requires his tee-up. “That was terrific and congratulations for completing the process”, he leads, “Now we are going to stress test your retirement house”. Uh-oh.

Sue and Ben are becoming aware of that “uh-oh” perspective. Their plan has focused on THEIR needs and they have not considered the impact of demands from the care of their aging parents. “It hit us like a truck”, says Sue, “Here we have been saving and planning for ourselves and we never fully understood that we have family not as prepared”.

The Retirement Planning Stress Test

Wow. Now what, right? The “stress test” planning reveals some significant potential risks and costs for Sue and Ben. Ben’s dad and his dementia diagnosis was a wake up call - with implications. Not unlike many Baby Boomer clients, Sue and Ben are retiring with aging parents. Longevity is a relatively new phenomenon for many families and good advisors know it’s the spoiler of many a well planned retirement.

Patrick presses his case. “Better to prepare for what doesn’t happen than to just hope it doesn’t happen”. But it’s still difficult for Sue and Ben. They are conflicted, they admit. They have taken care of themselves. But they also recognize their obligation to family. Patrick empathizes with their dilemma. “You work all your life and you provide for this moment - and the reality is that people you love have not prepared as well. Now what??”

All Set - On the Surface

The main reason Sue and Ben are “hidden in plain sight” is that they appear to be all set. Compared to most clients, they have followed the planning path and have invested well. Looking at their ages and accounts would make most advisors proud.

The typical Baby Boomer retiring couple has 2-3 aging parents. Many of those parents are surprised by their longevity. “Surprised” may include the failure to plan for that longevity - especially for the portion that requires medical care. Thought leader Ken Dychtwald of Age Wave talks about “healthspan” instead of lifespan. What is that timeframe in which you are able to live independently? For many retirees like Sue and Ben, the potential support for aging parents is an unforeseen condition requiring both considerable time and potential financial support.

How Do We Say No?

In addition to their parents, Sue and Ben have three adult children - two are married with kids of their own. The couple has provided some support to the new families and would like to do more. “Education is very important to us”, says Ben. He and Sue had hoped to provide financial support of their grandchildren’s education but now those hope are diminishing. Raising a family in an uncertain economic climate is challenging and they want to help.

Look for Sue and Ben - They Want to be Found

These are tough issues for any family and typically difficult to sort out alone. The conditions are also changing with the health and longevity of the family members. Sue and Ben look ok at first glance but face significant family concerns. Where can they turn for help?

The Alliance for Lifetime Income has identified through research six opportunities to better engage with clients, including tips for understanding the clients’ current concerns about retirement, which may have changed since first working with their advisor. Please see more at https://resources.protectedincome.org/pdf/New-Client-Profile-2-Sue-Ben-ALI.pdf

My Family Made Me Do It

I was fortunate to know all of my grandparents and three great grandparents - and to see all of them battle significant and scary events in their latest years. All of my older relatives were tough, independent people who lived on their own as long as they could. Here are their stories of retirement wreckage.

The Bear Market

One of my grandfathers was a chemist - analytical by nature. He saved for retirement and left early at 62 in 1970. A wealthy executive friend turned him on to stocks. He never talked about any of it with me - just a young teen - but he couldn’t hide when the 1973-73 market crash slammed his account. Adding to his misery was the Arab oil embargo and gas rationing, keeping his new boat on the dock.

Fortunately the house appreciated somewhat and after my grandmother died, my grandfather sold their dream home and moved closer to family in North Carolina. Upon arrival, he was befriended by a very nice younger lady at church. It took some time for my mother and my aunt to wise up to Mary’s con game and my grandfather moved again to a nursing home in New Jersey.

The Home Invasion

My other grandparents lived in the small West Virginia college town where my grandfather had been president for nearly 20 years. Small and safe, they thought, until the day someone kicked in their front door and made off with all of their silver and jewelry.

Crime was the last thing they feared in Bethany, WV, so they also headed South to an independent living community on a golf course in North Carolina. My grandfather continued to speak and serve on boards until he passed away in 1994.

My grandmother was a great putter, ballroom dancer and concert pianist. She hosted a birthday party every year for herself and everyone in the community aged 90+. The local newspaper provided lavish coverage. She eventually became blind from glaucoma and moved to a nursing facility in Pennsylvania nearby her daughter and granddaughter. She lived to 101 - no one more surprised than her.

Losing Your Mind - And Your Body

My father-in-law was a big personality and a golfing fanatic, eyeing a retirement on the links in Hilton Head after unwinding his business. The melanoma diagnosis was a surprise, though his twin had pre-deceased him.

He was a fighter but when doctors told him more surgery would end his mobility, he gave in with his customary purposeful attitude. One of his final instructions to my wife was, “I’m worried about your mother - something isn’t right”. He was only 75.

That something was Alzheimer’s disease, diagnosed a short time after my mother-in-law burned a pot cooking lemons on her stove. At age 74. My wife and her sisters shuttled back and forth, trying out home care aides and managing schedules around jobs and young kids. My wife visited so often we violated the limit of days we could be in New York State and paid a significant penalty in state taxes.

A fall broke her femur and set off a scramble to find a facility. Costs were outrageous but more alarming was the shortage of acceptable facilities and open beds. Only through tears of frustration did my wife secure a spot in a Westchester assisted living and nursing pavilion - for $20k/month.

Unable to remember the names of any family, my mother-in-law lived in a shrinking world with heightened fear until she died. Everyone remembers her for her poise and pride and generous heart. Her final years cannot eclipse that view.

People talking about aging long before it’s real often speculate about whether they want to be of sound mind or body when they are old. Neither path offers a good ride - and good luck talking Mother Nature out of her plan for you.

The Hurricane

My Florida grandparents lived on Sanibel Island for 18 years without a single hurricane. When Andrew crushed the Miami area, more refugees headed West - to the Gulf Coast.

My parents never spent much time in Florida and I was surprised when they decided to relocate to Sanibel in 2004. They had a small house up North but ultimately found one place simpler and easier. The week after they finished renovations, the first hurricane in a long time, Charley, struck Sanibel and Captiva. Their house was ok, my condo at South Seas was knocked flat.

My father hated Florida. My mother loved it and was soon involved in everything. My father was increasingly isolated - his work had been his identity. Always a great author and editor of medical texts, he penned a novel in hopes of growing a new passion. It was rejected by a publisher - a fact I learned only when I cleaned out his office after he died in 2016. I always wondered why he stopped writing.

Around 2014-15, my parents and I had a tough conversation about long term care costs. They owned retirement annuities from my dad’s employment, more than adequate to cover their modest living expenses. They paid off their home.

It was a battle with my mom, but we settled on buying a unit at a large continuous care retirement facility just off the island in Fort Myers. Mom declared she would never take residence, but the decision proved a godsend when my father was diagnosed with pancreatic cancer in the fall of 2015. He checked in to the nursing pavilion in October and passed away in February. He never went home.

Mom settled in to her new life, motivated by close friends and her many responsibilities. She traveled some, including trips to Scotland and Alaska with family in tow.

Fast forward to September 28, 2022 and the assault of Hurricane Ian. Evacuating at the last minute amid an uncertain forecast, Mom hunkered down with my sister on the mainland.

When the terror ended, Sanibel had been destroyed by 150 mph winds and a tidal surge as high as 18 feet. With an average height of just three feet, Sanibel was overwhelmed.

With her friends, her annuities, her activities and the manageable pace of an island with a 30 mph speed limit, Mom had it all. Until she didn’t.

Just Plan That the Plan Will Fail

It’s impossible to predict what will actually happen and the best financial advisors don’t do that. They help clients plan for the best, most reliable path. And then the really good advisors run that plan again with as many “what ifs” as they can think of. And none of these “what ifs” are good surprises with positive outcomes. They don’t expect a winning lottery ticket. They plan for bad news or bad developments so they can help protect clients and their families from those most feared situations. Because they happen to more people than you think - and very often to people you know.

Steve Gresham is the managing partner of Next Chapter, a community of 60+ financial service organizations dedicated to improving retirement outcomes for all.

Pick Up the Phone - It’s Older (and Wiser) You Calling

Most people are not prepared for retirement. And most people are not prepared for a natural disaster. Is there a connection?

- More than 20 million houses in the U.S. are at risk from serious flooding. Fewer than 5 million have flood insurance.

- One in 10 Americans aged 65+ suffers from Alzheimer’s and more than 20% have some form of dementia. 3.3% of the population has long-term care insurance.

Retirement stress and natural disasters both pounce on people who think they might be OK, but aren’t really sure and haven’t really taken precautions. And besides, the “forecast” is never right…right?

Our Brains Don’t Plan

Blame our brains. We have trouble with abstract concepts. We can’t process “odds” – we process only what we can see or feel or deposit or fear. Clients get in big trouble with retirement planning because they hear the numbers but don’t really “see” themselves forward. Really good advisors close the gap.

It is ironic that the designer of our planning deficient brains is the same Mother Nature who is most often the culprit when we fail the worst. The real risk in retirement is not running out of money, it’s running out of options.

But There’s Never Been a Big Storm Before

Take my mom’s neighbor, call her Marcie. Marcie and her husband moved to Florida for retirement and had all their bases covered. He died a couple of years ago with their home fully paid for and modest but adequate savings.

Mom, Dad, Marcie and her husband made it through Hurricane Charley in 2004, which slammed their island and completely deforested the historic canopy along Periwinkle Way. Charley was mostly wind so damage was minimal at both homes. Irma in 2017 was different and loomed more threatening. My mom evacuated to the mainland and spent a couple nights sitting in a folding chair in a school gym with no air conditioning. At age 83.

Again, the storm was forecast to be worse than it turned out. Local preparation for the evacuation was uneven and led to public recriminations.

When Hurricane Ian hit the island on September 28 last year, a wavering forecast and last minute evacuation orders confused many residents. Too many recalled the pure discomfort and inconvenience of Irma and didn’t gird themselves for the disaster to follow. 1,000 people stayed on the island and were hit with 150 mph winds and storm surge as high as 18 feet – on an island an average three feet about sea level.

Mom was slammed. Four months later we are still working with the insurance companies to determine her compensation. The auto insurance company was awesome - paying cash for her car and removing it fast. The flood company low balled an offer.

One Storm, Two Levels of Preparation

Nearby, Marcie has no flood insurance. With her home free and clear, Marcie let the homeowner’s insurance lapse, “reasoning” that it wasn’t required anymore by a lender.

Mom has both flood and wind coverage. But not Marcie. She cannot afford to rebuild. She has two adult children who both live modest lives in modest homes with kids. Neither the kids nor Marcie want to live with each other in those conditions.

My wife and I are empty nesters with extra bedrooms. Mom was able to stay with us for weeks and grind through the endless paperwork with help.

Hey You, It’s Me – I Mean, You

One of my favorite advisors over the years focused on life insurance and retirement income – “protection” strategies. His greeted every new client with “bad news”. “I know what is ahead for you, it’s my job”, he would start, “And I will have advice from you that you will wish you accepted. To make it easier, I’m going to be someone you don’t know but who knows YOU very well. That person is you, at age 75. And every time we have a disagreement about the steps I suggest for your plan, you will be arguing not with me, but with you”. He always got a kick out of saying it that way.

Simple but effective. Makes it real.

The Powerball winner in Maine beat odds of 292 million to one. Why does the scratch off have more traction than the 401(k)? It’s real, in your hand. And those three golden crowns just might be hiding there. Why not, right??

Ask your older self for the two bucks.