The Chart of the Decade

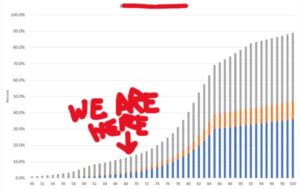

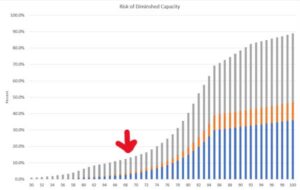

At a recent meeting of top advisors hosted by education innovator Wright State University (where flight was born), I shared this chart under the guise of “opportunity”.

What’s the subject?, I asked. Tesla stock price? Bitcoin projection? Spending on FinTechs? Nearly a perfect S-curve, which favors the early adopters. And the best news, we can catch this one just before the S takes flight – note the arrow.

The chart is a propensity chart, depicting the likelihood of experiencing some level of incapacity due to one of the three most common health events to cause incapacity – Alzheimer’s, other forms of dementia, and mild cognitive impairment (early onset dementia).

The savvy advisors know from experience that each of these ailments presents a life change – to the client/patient and to the family. The impact is both immediate and ongoing. Nothing is ever the same. Priorities change. In the world of financial and retirement advice, advisors are needed more than ever and for more complex services.

Our response is critical. We have to react with empathy, engage professionally and with confidence. We become the financial emergency room, transitioning to long-term care. And not just for our primary, affected client – we have to be there for perhaps three generations of family members who are now also affected. Everyone needs to know we have this, we can help.

We don’t have much time before these conditions accelerate in frequency. The current overall propensity rate is 1 in 8 for people age 68 but more than doubles by 78 – and 6X at 88. Over the next ten years, nearly 1 in 3 people we now serve are likely to become incapacitated themselves, and a great many more will be impacted by someone in their life who becomes incapacitated.

For advisors and their firms serving the Baby Boomer age wave of 76 million people, this transition has been looming…but preparation is still light. Every firm and every advisor will need policies, procedures and supportive tools to:

- Identify incapacity for the protection of the client, her family and the firm

- Protect clients and their families from the threats of incapacity, including identity theft, fraud and elder abuse

- Engage families in support of incapacitated clients – as well as clients without family support

- Adjust to the needs of a family of three generations or more and help optimize finances for risk, tax, income and long-term care

Don’t Ignore This Moment

If you are winding down your advisory career, you might be doing the math and saying that in ten years you will be on a beach living the vida mas fina. That’s probably pretty well known by your clients and their families. As Accredited Investor co-founder, Ross Levin said so well at our Next Chapter Rockin’ Retirement event on May 24, top firms are winning clients and keeping clients because they have a “contract” with clients and their families that the firm will be there for them. Another speaker, veteran Tom Bradley of Schwab noted that aging clients – and aging advisors – are now important measures for the valuation of an advisory practice (get the whole program here ADD LINK to NEXT CHAPTER MEMBERSHIP).

One very interesting aspect of this chart is that it is also a good picture of the demand for pretty much everything associated with the historic demographic cohort. If they will need it, you name it and the growth curve will be similar. Demand for in-home caregivers, Medicare counselling, pickleball courts, assisted living facilities…they’re all here at the same time. Consider…..

The Price of Ignorance – Five Risks Ahead

I’ve also spent a lot of time worrying about this issue on behalf of big company clients and I see five significant risks of keeping our heads in the sand:

- We lose current clients and their assets

- We lose the potential consolidation of assets held by our clients elsewhere – that’s a pretty similar number to the total in 1 above

- We lose the client’s family – if we don’t take care of the primary client, the family won’t stick around. Surviving spouses and adult children have no affinity for our failure to act.

- We risk increasing scrutiny as fiduciaries or service providers that do not sufficiently “know your client” – an area of growing interest to state consumer protection regulators. Get ready also for a return of active arbitration in this area as we return to in-person activity after a pandemic slowdown.

- Finally, a firm that does not do well by its aging clients is exposed to significant reputational risk. Poor experiences might be contained in the complaint process, but some of the more colorful cases will doubtless make headlines – electronic or otherwise. I expect a lot of interest in these stories.

Other Than That Mrs. Lincoln, How Was the Play?

Every corner of the financial advice and investment management industry has benefited handsomely, unexpectedly from the historic demographic wave and the power of that wave to lift all economic boats. Now it’s time to repay some of that value by meeting the needs of our loyal clients and their families – all of whom will be encountering their longevity for the first time. Our ability to serve is a function of both will and skill. I’m completely confident we have the skill. Do we have the will?

Hidden Struggles: The Challenges Faced by Caregivers

Written by: Suzanne Schmitt

“The last few years really challenged me to keep two things in perspective: caring for the people I love most—with the toll it takes emotionally, physically and financially.”

As a three-time caregiver, Lisa would know.

Parenting

Lisa, a former colleague of mine at a brokerage firm, became a parent a few years ago. She assumed she could keep her job when she became a mother, and she and her husband, Jeff, secured a slot for their son, Jake, in a daycare near her office.

Things worked well, until they didn’t.

Lisa earned more than Jeff, but she had an unpredictable schedule. A couple of times, the school needed someone to pick up Jake, but nobody was around. Lisa wondered if they could keep it up, and after a few heart-to-hearts with Jeff, she left her job and stayed out of the workforce until Jake started school.

Reversing Roles

After a few years, Lisa went back to work, Jeff was promoted, and Jake went to preschool. Things seemed normal.

But then one morning Lisa got a call that her dad was in the ER after what was suspected to be a heart attack. Her mother let her know he was stable but needed cardiac rehab. Could she come? Lisa gave her team a heads-up that she’d be gone for a week. One week turned into several. After she’d exhausted her vacation time, she took a leave so she could help Mom see Dad successfully through rehab.

Aging Alone, Together

Her father’s heart attack was a wake-up call for both parents. They decided it was time to retire, albeit earlier than planned, and enjoy life. To help compensate for their retirement savings shortfall, they downsized and moved to a state with lower costs of living. While Lisa was happy to see them thriving, she missed them. And neither family anticipated the costs of traveling to see each other. On a visit, shortly after her dad’s death, it was clear the house was too much for her mother to handle. Lisa talked her into moving back to their home state. Since buying was cost prohibitive, Lisa and Jeff converted their basement into an apartment for her mother.

The Real ‘Costs’ Of Caregiving

Lisa’s laborious experience is increasingly common.

- The National Alliance for Caregiving has come up with some unsettling figures:

- The alliance says 19% of Americans provide unpaid care to an adult, and 24% of caregivers look after more than one person.

- Caregiving affects more women than men. Sixty-one percent of woman say it affects them while only 39% of men do.

- The need for caregivers cuts across the wealth management and demographic groups among your clients, with boomers, Gen Xers and millennials all being called upon for unpaid care.

- It’s also expensive to care for others. Forty-five percent of unpaid caregivers experience at least one financial impact: meaning they must stop saving, deplete their emergency funds or take on debt.

- Their work is also affected when they take on care for others. Sixty-one percent of unpaid caregivers have also experienced at least one work-related shock, meaning they have to reduce hours or pass up on a promotion.

- Caregivers’ own health is on the line, too. Twenty-three percent of caregivers say their efforts have made their health worse. If health is wealth, unpaid caregivers face additional threats to their social, emotional and physical well-being in the forms of increased healthcare costs, higher premiums, reduced retirement savings and the depletion of wealth.

A When, Not An If

For many of us, like Lisa, caregiving is a role we’ll take on repeatedly over the course of our lives.

So what can advisors do to prepare and protect their clients—and their books?

- Understand who might depend on your clients. This could include older loved ones, children, spouses, extended family, pets, even friends. Your clients’ plans are only as solid as the least prepared person in their circle.

- Get to know the people they might depend on, too. While we all hope to live happily, healthfully and independently, life happens. Do you know whom your clients would call from the ER? Have you met their trusted contacts?

- Ask about key documents. Do your clients have current and complete powers of attorney, living wills, healthcare proxies, wills, etc.? Do the people named know they are?

- Monitor your clients’ life events. When people move, change jobs or experience a serious change in their health, these things rarely occur in a vacuum. Consider asking your clients this simple question: “What’s changed in your life since we last talked?”

- Get to know their family health history. What conditions are in your clients’ family trees? How long have older relatives lived? How well? When you unpack their health issues, you can build new relationships and deepen existing ones by addressing a key financial stressor.

- Raise the subject of workplace benefits whenever it’s appropriate. Do your clients have access to caregiving support services at work, including emergency/backup care, eldercare or (increasingly) paid caregiving concierge services? Be aware that many of these workplace benefits, including most financial well-being programs, come with access to advisors.

If you don’t raise these issues with clients and their families, someone else will.