Look Out! Four Unstoppable Trends Are Chasing the Financial Industry at Its Zenith

Four Horsemen of the Apocalypse, an 1887 painting by Viktor Vasnetsov. From left to right are Death, Famine, War, and Conquest.

The advice industry is enjoying record profits - but also faces declining organic growth and historic global uncertainty. No matter what you do or how you do it, your world is being rocked by forces out of your control. Leaders are expected to have answers and the best leaders never waste a good crisis.

“Trending” vs Trend – Know the Difference

Popularity and causation are not the same. Especially in our hyper socialized world, leaders have to be careful not to mistake something that is trending for a true causative trend.

Four Unstoppable Trends

I find people remember stories better than data, so I’m framing the trends using the biblical tale of the Four Horsemen of the Apocalypse. The narrative appears in the Book of Revelations of the New Testament, and The Four Horsemen are the harbingers of doom - the end of the world. Each plays a role in that end game - Conquest, War, Famine and Death. I’m retaining the essential meaning but renaming them for better relevance to our financial advice world.

The Horse of Conquest - aka “Lost Ground”

Winners know when they’ve been beaten. They don’t confuse losing a battle with losing the war. They know when to retreat to higher ground so they preserve their resources to fight again.

Huge chunks of the traditional advice industry have been taken over by new competitors. Commissions are free, beta is free and custody is free.

And yet many companies are hanging on to efforts where they will never win. Those efforts have to stop. They waste precious resources, they drag down your associates, frustrate your clients and distract your focus.

For the advice industry that will mean releasing the marginal effort – which is most common to us in two forms:

Marginal products – if it’s not outstanding, it has to go. It hurts your brand, it’s demoralizing for the team. Who wants to be the PM of your worst performing product?

Marginal clients – the full service advice industry earns more than 80% of its profits from fewer than 20% of its clients.

There are actually two paths here – one is the traditional wealth management objective of serving fewer larger clients and securing all of the assets.

The other is to separate the 80% and focus specifically on their needs. The latter strategy – the “reverse Pareto” – is how the Big Box firms (Fidelity, Schwab, Vanguard) most easily undercut “full service”. Clients tell JD Power these firms deliver “full service”, so don’t ignore them. They take pieces of clients – and then get the rest. So end the madness by creating that separate service model or offering designed specifically for the 80% that they will love. Or let them go.

The Path Forward in the Face of “Lost Ground”

First - STOP.

The discipline of stopping something in flight, ending a business, terminating a product, exiting a market – is so unusual in American business history that it’s worth a pause to consider another industry’s losing battle with competition.

Down Go The Big Three

After World War II, the large four door sedan ruled the road for the first 30 years – until the baby boomers started buying cars. GM, Ford and Chrysler executives enjoyed 90% domestic market share at the peak. But their dogged attachment to that car and its margins put two of the three companies on the road to Chapter 11. The other one escaped – narrowly - saved by the F-150 and the Explorer, the first defendable American SUV.

The biggest barrier to your future success is too often your current success.

2. The Horse of War – aka The Battle with the Consumer

“True customer centricity is an act of extreme humility” observed a great colleague of mine years ago. As an industry we say we are client-focused, but as an industry we are struggling. There are exceptions - empathetic and skilled financial advisors serving clients proactively and effectively. But most of the industry is not earning organic growth.

Consumers believe they can have whatever they want and now we are in a race to deliver against those rising expectations. This is the battle being waged across all service industries – the ability to deliver against the promise. Burger King set us on this road with “have it your way”. Now there’s no turning back as other industries further increase client/consumer expectations for product reliability, ease of communications and delivery. And most have overpromised. Consumer expectations for most industries exceed the ability of companies to deliver. We have to be very careful – look at the pickle health care is in now – and about to get much, much worse.

The Path Forward with the Consumer

- Stop worrying about competitors - Fidelity Chairman Ned Johnson used to admonish the team to worry only the customers not the competition.

- Identify your client “personas” - you have ideal clients. Focus there. As noted above, you’ve already lost the marginal client so move on. Find more. Your ideal client is someone else’s failed connection.

- Build individual solutions and service models for each persona - whatever you do has to be separately designed for each client cohort. Most companies here have multiple products, services or capabilities. Each of these has to stand on its own so each persona feels the attention.

- Align the organization to the consumer - The organizations represented here are organized mostly the same way they were decades ago. Re-engineer your organization around the needs of the consumer. Test: if you have not designated a C suite leader to be the Chief Customer Officer, you are already behind. That’s not a soldier, it’s a general. And must have insight, courage and above all humility, because it’s not easy to stay focused on the consumer. It’s not about the consumer always being right, by the way, because they are not, it is about avoiding the pitfalls of pride and believing the company’s agenda can somehow be more important than the consumers’.

This is not so much a war with the consumer as it is a marriage of two type A personalities, both anxious to get their way. Sometimes they agree to disagree, and sometimes they just disagree. Harmony is fleeting.

3. Horse of Famine – aka The Death of the Salesman

Sales is no longer a dirty word, it’s outright profanity. The fear of being sold has replaced the fear of paying too much. Consumers routinely pay more for convenience, perceived authenticity or mission, and even for people and products they just like or believe in. As long as they don’t feel sold.

An illustration helps.

The Alliance for Lifetime Income holds an annual summit in Washington about Protected Income and it’s a terrific gathering of the industry. A year ago, a consumer panel featured three pretty smart and thoughtful clients who together shared a similarly skeptical view of financial professionals, “They are always trying to sell me something”. The panel that followed them to the stage was made of three very strong financial advisors. The first of which was from NWML, still among the front runners for net new assets, who asked to address the previous panel. “You feel like you are being sold something – but that’s because you just might need something”.

The Path Forward with the Death of the Salesman

- Focus on your reputation. What are you saying - and to whom? What do you sound like to business partners and consumers? Are you confident, authentic, capable - or do you sound like you are selling something? As an industry we tend to speak in proprietary tongues – hard to decipher in the context of our jargon and lengthy disclaimers. Nothing screams, “Salesman!” like a half page of small print accompanying a fairly simple idea or product.

- Provide unmistakable value. What ARE you selling? The value must be made so obvious that even the casual shopper can grasp its importance.

- Get ready for more regulation. Clients aren’t the only people who think we are always selling. Compensation and suitability are following us into a future where our products and services are available everywhere and consumers aren’t sure they need help. Expect more scrutiny, take advantage of underlying message of care. Be wary of fighting back - the trend is pretty clear.

4. The Horse of Death – aka The Impact of Longevity

The best for last.

“Retirement” is trending but “longevity” is the causative trend. People do all kinds of things with their longevity - only one of which is “retirement”. We are really helping facilitate that longevity - partnering with clients to fund the time between their active working years and their death.

That’s a more sobering view than the one typically illustrated by our industry, which tends to favor ads with silver haired seniors playing golf, dancing and enjoying international travel. But it’s the view most consumers will eventually see.

Sober Up

“Retirement crisis” earns 69 million hits in a Google search. The “crisis” is real but very uneven in impact.

For most Americans it will be the inability to cope with the simultaneous demands of healthcare and living. And a mix of the cost of those demands as well as the social, mental and family demands – the impact of unprecedented longevity.

I’ve actually heard senior industry execs say the words, “We know retirement is big thing, but we just don’t hear a lot about it from advisors”. I’m sure the passengers on the Titanic had a glorious time – for the first four days. “Retirement” is lived in stages from the initial “vacation mode” on to usually a more serious and limiting existence, the proverbial go-go, slo-go and no-go trimesters of retirement.

I’ve actually heard senior industry execs say the words, “We know retirement is big thing, but we just don’t hear a lot about it from advisors”. I’m sure the passengers on the Titanic had a glorious time – for the first four days. “Retirement” is lived in stages from the initial “vacation mode” on to usually a more serious and limiting existence, the proverbial go-go, slo-go and no-go trimesters of retirement.

Find Your Corner

Clockwise

Clockwise

- You have both health and wealth. And all too common is the unhappiness of a longer life poorly planned. Pickleball alone can’t make this one all better. You can have plenty of money but be completely unfulfilled, without friends or family – all of the ordinary developments that accompany longevity.

- Bottom right. You don’t have a lot money but your poor health gets you off the hook.

- You have health but no money. You have longevity without the resources to fund your ongoing lifestyle. Health is also relative of course. You can also have longevity without great health.

- You have money but not health. You can achieve quality but you’re undermined by poor health and limited “healthspan”.

This is the inherent unevenness of “retirement”, created by the unevenness of longevity. The youngest Boomers are only 59 – most still of working age. The oldest are 77. The difference in that range is night and day. At 77, both of my parents and all four of my grandparents were still alive and active. Both of my in-laws were dead – one of cancer and the other of Alzheimer’s. Why? And who’s ready?

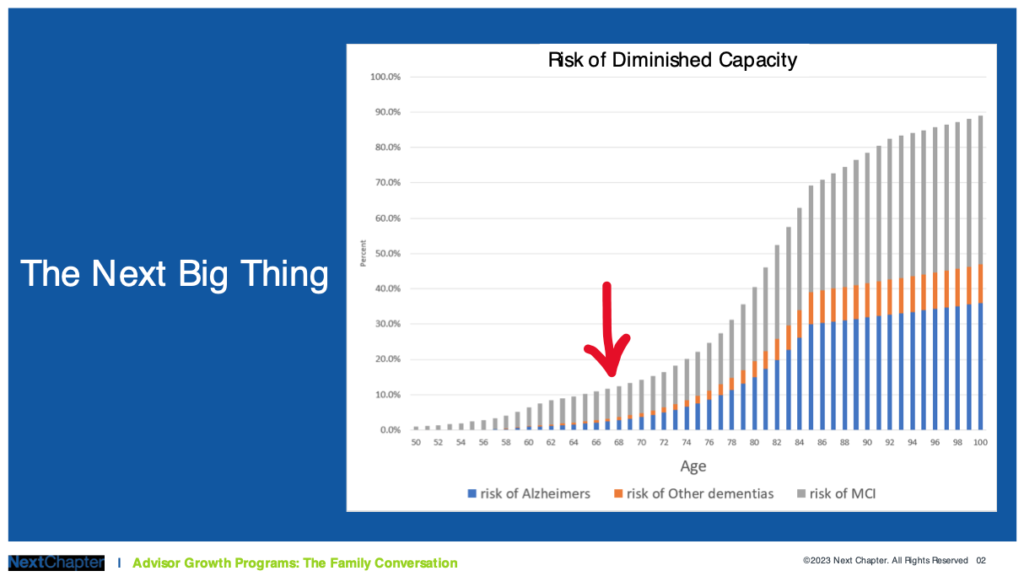

The Next Big Thing

That condition is about to change – with more speed, volume and impact than most families, hospitals, advisors – basically everyone – is prepared for. A picture tells the story – the darker side of “longevity”:

The new S curve ahead is the hockey stick of declining health – the skyrocketing incidence of older people without the ability to make good decisions and live independently.

This fact is a game changer for the society and an important reason why we don’t characterize “retirement” as the trend – it is really longevity.

This curve is also of course a proxy for the demand for anything associated with people’s slo-go, no-go phases of retirement. Health care, assisted living, home health aides, hospital beds, nurses – all will be in unprecedented demand but with little “warning” and even less ability to meet the need. My NextChapter colleague, Tom West of SEIA, calls this the “musical chairs” game of help – you need a spot for when the music stops. And the “planning oriented” people with good advisors have already taken most of the slots. I hear that all the time from otherwise very smart people, “We will age in place with in-home help”. Which you are going to hire and from where? Your neighbor will become your competition for help.

The Path Forward - The Implications of Longevity

1. Define your relationship with the longevity economy - Know what role your company will play in a society increasingly dominated by the issues of aging. Watch the impact on personal health care, with its own COVID-19 wake up call. Capacity constraints and employee shortages will continue to convert healthcare delivery to more and more patient actualization. Scale alone will drown the current offering and you will hear about it from frustrated clients and their families.

2. Prepare for the self-help world – That scale will force more solutions to be digital, virtual and self-service with the help of better interactions facilitated by AI and Chat. Advisory firms are outgunned – they can’t keep up with the demand. We’ve seen this movie before - when Big Pharma got the ability to market directly to consumers. Tired of waiting for doctors to learn new capabilities, the drug companies hopped on the Today Show and everyone’s evening news, extolling the virtues of their new cures. An especially good example is Ozempic, which earned attention first as a treatment for diabetes and then became a weight loss wonder drug promoted on social media. Get ready for “Ask Your Advisor” - a concept we have rolling today at NextChapter.

3. Focus on the certainty of outcomes. The financial industry has to shift focus from “best efforts” to “certainty of outcomes”. Clients in retirement are quite literally trying to survive with confidence and independence until death. Why is that reality so hard for us to grasp? Because like the consumers we serve, we fear the discussion?

- Winners are fully invested in the certainty of outcomes. Look at the rebirth of the annuity industry. Certainty is the antidote for uncertainty, and defined outcomes are the positive side of a bigger trend favoring “protection”. For an industry built to deliver “performance”, this is a fundamental shift that will be as difficult for incumbent players to execute as it was for Detroit to build a decent small car.

- Being committed to certainty of outcomes, eliminating anxiety, increasing protection – these are the design principles that will determine future product market share. Watch the institutional plan market growing in-plan annuities, script flipping products like BlackRock’s LifePath Paycheck – all geared to helping ensure the success of our clients. Giving clients what they want is not an intellectual compromise.

4. Commit to a better Eco-System - when Detroit was sliding off a cliff in the early 1980s, the recovery required contributions from every part of the auto industry world. The government led the financial bailouts and provided protective tariffs, unions took a hit, suppliers pitched in.

Do you have capabilities, people, content, training – any resources that can help your advisory firm partners? What is the additional investment you will make – and that others might not make? This added support is really about locking arms with advisory firms that are under significant stress to maintain a clientele looking for far more than the firms can provide. AT SCALE. With the typical full service advisory book tipping the scales at 150 households, NO ONE advisor can provide solutions to the full complexity of retirement and longevity planning issues. The gear ratio is all wrong.

This is a huge industry transition – the consumer is up a creek, probably didn’t ask enough questions, probably didn’t do a good job of preparation, and probably didn’t help the advisor enough to do a good job. And we share the blame for not engaging deeply enough or candidly enough.

But this is us. We might have made different choices at a different time. And some elite advisors in fact did that. So the question now is “How can we work together to ensure better outcomes for our clients?” And the answer to that question is the path forward. Among the more obvious areas of friction to resolve is that of the truly connected and coordinated eco-system of capabilities. Incompatible stuff is not tolerable and we can do better.

The Good News

Despite their divine mission, the Four Horsemen failed to deliver the end of the world. And while each of my morbidly illustrated mega trends is unstoppable, smart industry leaders will find their path forward in the areas most sustainable for their capabilities. But we will do it together as never before, or one of those horsemen – one of those trends – will get us. And it doesn’t take four – it just takes one.

This article was adapted from the October 11 session held for the Annual Conference of the Money Management Institute.