Out With The Old Bull, In With A New Bull

Bull markets are like rivers, the saying goes. Most begin small, quiet trickles that build to a stream long before bursting open with impressive size and power. Go with the flow, we also say. I am no market sage, but I’m seeing one bull running out of steam while another river is building. And I’m on mission to ride that wave…..

The epic bull of 2009-2022 flooded portfolios with gains unlike anything in modern time. Rushing out of the gloom following the Financial Crisis, the early flows were strong – a sign perhaps of the historic gains ahead.

Stock Prices: The Bigger They Are, The Harder They Fall

On March 6, 2009, the Dow Jones bottomed at 6,469.95. Here at Labor Day 2022, that familiar market index rests above 31,000 – a 5X gain even after the inflation correction from 36,952 in the first week of this year…and whatever is happening now. That first correction was about 20% across the market – a “normal” event in our capital markets bible – and we have a nice bounce this summer that has restored some confidence the bull has room to run.

Top advisors know better. They have seen this movie before – 1987 in bonds, then stocks, the shock to the 10 year in 1994, the Tech Wreck in 2000-2001. And the Financial Crisis, when values fell in half.

Protect My Income Please

If you were contemplating retirement in 2007, exiting the market at the same time would have been a good short/intermediate term call. Waiting a few months crushed your account value. And this is the moment we often misunderstand as an industry. We are quick on the trigger to say, “Stay the course, you have decades to live!”. And that may be true, but it’s a tough call for someone not in our world who may not believe they have that generous time horizon. When you are no longer drawing a paycheck, a 50% drop in your retirement account is financially and emotionally devastating.

Chances are you know one of the lucky ones – and also one of the less fortunate. My late father surprised me by saying he had fully annuitized his modest retirement account when the Dow hit 13,000 – with no knowledge or expertise. He thought it was just “enough”. He passed away in 2016 never regretting his move – as well as the decision to convert all of his retirement annuities (he was an academic physician) to two life annuities that my mother relies on today at 88. His primary objective was to protect – to protect his family, his lifestyle, my mother. No amount of potential opportunity was worth the risk. He shared stories with me about friends of his with far more assets that were investors and loved the “action”. He never had any interest – neither does my mom.

A Little Empathy Goes a Long Way, and it Starts with Clarity

Regular readers know that I rail about our industry’s obtuse language, awkward procedures and regulation-driven communications. Our Executive Board at Next Chapter recently met and the directors unanimously accepted the challenge posed by Ken Dychtwald and seconded by John Thiel that we have to clean up our act – and language matters. More to follow for sure, because the admonition is not just to deal with current friction points, it is to help the industry prepare for the future. A glorious one at that – if we can pivot.

There’s A New Bull Market in Town

The OBM (Old Bull Market) was a historic opportunity to grow assets. The New Bull Market (NBM) is about protecting those gains. The winners in the OBM ignored market volatility and rode on. Many of the top OBM advisors kept clients invested to max out the market’s advance.

In the New Bull Market, many of the winners will have to ignore the anxiety of retirement and live on. The best advisors will now keep clients on track to max out their accumulated assets. In the Old Bull Market, you could get away with leveraging bullishness with options and margin. In the New Bull Market, you need to explore protecting client assets with insurance, annuities and credit.

The Old and New Bulls require a different perspective. In the Old Bull, you focused on the future. In the New Bull, you focus on today—and maybe tomorrow. In the Old Bull, you were a guide and a coach, leading the team. In the New Bull, you are still leading, but now you are more of a problem solver and a therapist. And the clients are mostly the same clients, though the typical one is now surrounded by three generations of family members you need to include.

A New Bull Market for a New World of Advice

The opportunities of the New Bull Market were created by the changing priorities, objectives and concerns of today’s investors. You know about the age wave of retiring baby boomers departing the workforce at 13,000 per day. They tell researchers they worry about five things:

- Paying for healthcare

- Outliving their money

- Falling markets

- Unexpected big bills

- Remaining independent (with a healthy brain and body)

These concerns form the basis of a New Bull Market advisory practice. In the old market, you were helping clients grow assets for unknown future costs. In the new market, the costs are increasingly known and you may have to stretch clients’ assets to meet those costs. In the OBM, you made investments and hoped they worked out. In the NBM, you create solutions that have to work out.

The winning advisors in the new market will earn their success. There are new tools they need to use to help clients through those five worries. New Bull Market winners will know the answers. They will be able to rattle off their most common solutions quickly and with confidence. That confidence will be a welcome contrast to advisors stuck in the Old Bull Market mindset. The leaders are now sharing their perspective with clients—on retaining assets, consolidating assets and earning referrals.

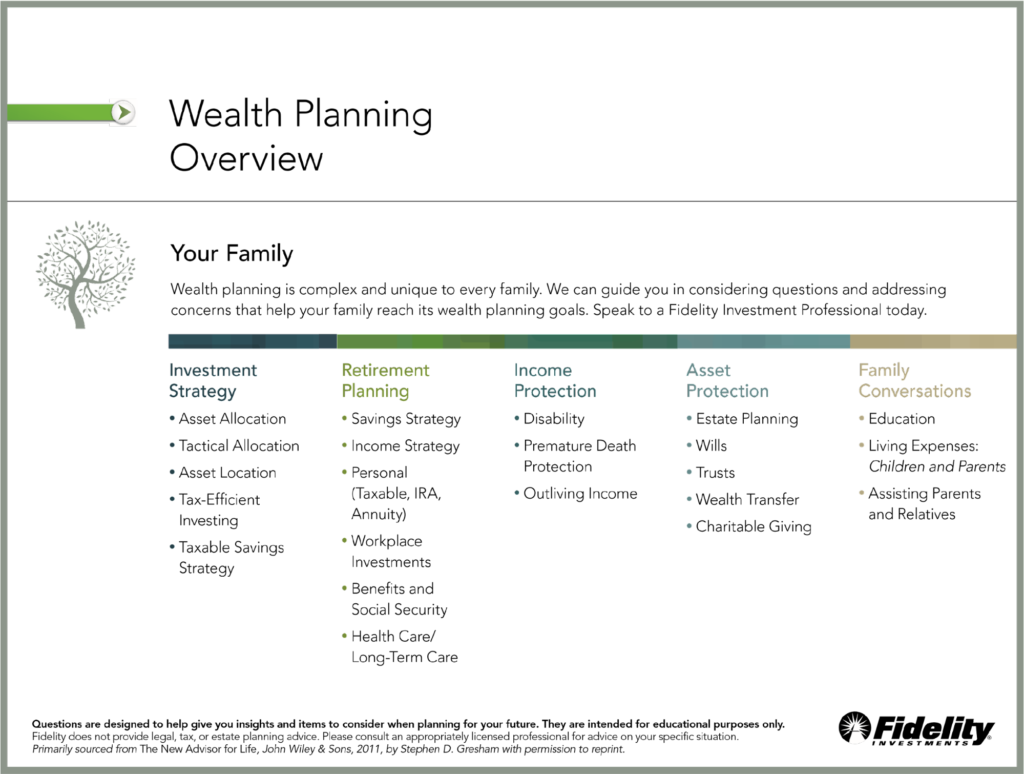

Industry veteran Tim Seifert, head of Retirement Solutions Distribution at Lincoln Financial Distributors, makes the business case for protection. He points out that we look to “planning” to establish the basis for a relationship with clients and their families. And that is the bedrock for sure. So much easier to confront falling account values in the context of their actual impact on a retirement plan. Seifert quotes data showing dramatic increases in asset consolidation for advisors that plan.

Don’t Underestimate the Value of a Good Protection Plan

Seifert’s point – echoed by top advisors I have interviewed recently – is that adding “protection” to that financial plan is a critical, additional step to locking in those relationships. The bull market in retirement is creating a new bull market in strategies designed to protect clients by leveraging their assets to better meet the as yet unknown demands of stuff that just happens – to most everyone. And protection pays, according to Seifert, who again shows data proving that “protection” added to “planning” is near fool proof practice management to retain and grow client relationships, assets and referrals.

With a protection focus, you will be talking about these opportunities – and solutions:

- long-term care strategies

- Longevity protection

- Protected income sources

- Liquidity through security-based lines of credit

- Financial wellness

Advisors who solve for the five needs will then face a second dimension of opportunity created in part by the bull market—scale. The Pareto principle is alive and well in financial advice: Fewer than 20% of clients will receive “full service” and even fewer will get complete financial plans. Clients are typically scattered across four to six providers—another outcome of the Old Bull Market. I’m betting that some clients really like their investment advisor. And why not? A 5x gain investment gain? Woo-hoo!

I have an even more sure bet that both clients and their families whose advisors also offer protected income, protection of liquidity, protection of long-term wellness and stay vigilant about those concerns will love their advisors and reward them with their assets, their family assets and their referrals. And that is a Bull Market I’d like to see!

The Business of “Wellness”

Supreme Court Justice Potter Stewart famously remarked about pornography, “I know it when I see it”.

Unfairly perhaps, “financial wellness” - or just “wellness” to her friends – is suffering a similar condition by defying consistent description by a notoriously analytical financial services industry anxious to connect better with clients. “Wellness” is fancied by CMOs and some CEOs for its promise of delivering enduring client value, but how do you introduce a concept that many clients might already be expecting – and not receiving?? I mean, isn’t the point of our advice and solutions to make clients financially “well”?? Awkward…

Nail That Jello to the Wall

The squishiness of “wellness” lies in the highly subjective benefits of being well. Not surprising when you consider the nearly infinite array of client situations and family dynamics where healthcare issues alone often disrupt even the most detailed financial plans. There are foundational elements – health, finance, security, wealth transfer – but no easy map to follow, no standardized answer. And that makes trouble for advice providers that don’t listen well or that cannot be both empathetic and purposeful in providing the needed guidance and solutions. “Wellness” doesn’t fit in a product box.

Peace of Mind

“Wellness” is most basically “peace of mind”. That’s how Frank McAleer of Raymond James defines it - he’s the leader of their effort with plenty of experience translating “wellness” into a business plan. That peace of mind includes financial, health and family needs that require preparation. More clearly, “What is the list of stuff you most worry about or that could go wrong as you live longer?” And what about family members for whom you could become responsible? Those lists are different for a 26 year old DC plan participant than they are for a 60 year old pre-retiree or a 75 year old with dementia. Or any of their family members. But the concerns are very tangible to all. Though the inevitable issues of longevity are tough to confront, there is a calm achieved by being ready.

Get Ready for the Wellness Experience

Wellness is the objective of planning - it is both a noun and a verb. An assessment at a single point in time of conditions that are guaranteed to change. Issues of wellness so pervade real life that calling out “wellness” as a concept separate from a plan, even in addition to a plan, seems superfluous. Do clients and retirement plan participants really need to be told we are working to help you achieve “wellness”? Or are we talking to ourselves again, to our advisors and product teams and marketers that we now have a higher calling than investing?

This is the conclusion reached by our Next Chapter study group on Financial Wellness. Wellness is a more catchy, benefit-sounding label than “success”, which is the presumed objective of planning. But clients don’t benefit from the words, they expect the results. I get the same weird feeling when I fly and a flight attendant calls out today’s opportunity to have the Airline X “Experience”. The what? Can we just land on time please? There is nothing outside of a first class pod that is worth calling out as an in-flight “experience”. Marketing overreach.

I’ll Take a Little Empathy with that Investment Portfolio, Please

“Wellness” and in particular “financial wellness” are internal design directives given to financial companies and advisors to make sure they don’t overlook the requirements of “wellness” in the solutions being created for and delivered to plan participants and advisory clients. To wit, the Next Chapter team, including the RJ longevity program leader, Amanda Stahl, named “empathy” as the leading design principle of “wellness”.

A Slogan in Search of a Business Plan

Integrating “wellness” into financial services is necessary to establish and sustain the value of the product/service offering. If the end beneficiaries don’t achieve peace of mind from their retirement plan, benefits offering or the services and solutions offered by their financial advice provider, they can be lured away by an offering that promises that peace of mind. Nothing motivates action more than fear – and there is genuine fear that manifests when you think you will run out of money or have to sell your home and move into assisted living. The reality of this vulnerability is becoming of greater concern to advice firms and plan sponsors who are not actively engaged with most of their clients (see Pareto’s Revenge https://theexecutionproject.com/paretos-revenge/ ).

The Business of Wellness – Five Levers Drive Results

My research and business experiences (successes and many failures) suggest that the most common and most impactful business growth objectives of broker/dealers - net new assets, consolidated assets and client household share of wallet - can be achieved with these actions based in “wellness”. Five levers in rough order of max impact/min effort. Intermediate measures like NPS (we used at Fidelity) can provide earlier confirmation of momentum:

Lever One: Words Matter – The Value of Common Sense Language

even very analytical services like asset allocation and investment policy can be made much more user friendly when rewritten from the perspective of conveying “peace of mind” instead of purely technical concepts and - essential - compliance disclaimers (Big fund companies are the frequent violators here). Language use is the fastest way to change perceptions of a firm, plan sponsor or advisor. Our Next Chapter Executive Board has been adamant on this perspective of improved language – stay tuned.

Lever Two: Design for Better Outcomes instead of “Best Efforts”

Most retirement solutions in place today are market dependent. Results can be impacted by market risks well known to the designers but not so familiar to the investors. The designers rely on their knowledge of capital markets research and the known risks are further mitigated by assuming a long-term time horizon to smooth variations. That’s a rationale, objective approach intended to work across a broad population – and generally it does.

But even the brainiacs will admit to “terminal point risk” that awaits unsuspecting retirees rolling out or annuitizing after a significant correction. Today’s retiring clients and plan participants have seen down markets – big ones – in 1987, 2000-01, 2007-09 and some sharp corrections in between. My late father knew nothing about markets or investing, but he knew when the stakes were too high for his peace of mind. He worked for universities his entire career and earned the negotiated benefits of retirement annuities. He surprised me by sharing that he had converted his 50-50 plans to 100% annuities with my mother as second life. He never looked again at the market. He cashed the checks, and she does to this day at 88. My parents’ definition of “financial wellness” was not having to worry about the markets, their income level, their ability to finance healthcare and the ability to age in their home. Done.

Once again, we are in the way of “wellness”. The best efforts approach undermines peace of mind by not providing a certainty of outcome. A risk matrix offering a percentage likelihood of success is great for analytical clients whose peace of mind is satisfied by data, but I don’t believe that represents more than a fraction of clients - especially when “client” is defined as a retiring couple and their family. In most client households there is someone who values protection and guarantees over potential returns or capital market theory, so why not at the same time (go to #3..)

Lever Three: Redefine the Client as a Family and a Household..and Engage

Most advisor engagement remains with a typically male and financially confident head of household. Firms are aware but not yet effective in providing (requiring??) more direction to advisors for supporting the family across today’s most common HNW construct of three generations - aging parents and adult children surrounding a Baby Boomer couple. This demographic sandwich will drive more than 80% of advice industry profits through at least 2030 and success is dependent on retaining existing clients and consolidating their not-held assets from competitors gearing up to mount a similar effort.

At Fidelity we sought the identity of other family members and developed simple communications to be more inclusive of less financially savvy relatives. We created a specific design target - a Baby Boomer wife and mother - to guide the design of the branch office right down to the furnishings and colors. But the operationalizing of “family” means some serious additions to CRM and data stores as well as some much needed training and coaching of associates that talk to clients. Peace of mind is different for different age groups and levels of financial literacy. Today’s Boomer retirement plans are providing real time education for their children and grandchildren. Some positive, some not so much.

Lever Four: Service Models for Everyone

Fresh off the summer vacation season, we are reminded of the challenges of bringing everyone together. Each family member has their quirks. Separately identifiable service models provide family members with options for engagement - especially with respect to communications, pricing and product options. “Separate” provides space and identity and satisfies each individual’s peace of mind. And that’s financial wellness. Because peace of mind for one client may be the reliability of a paper account statement - for another it may be the immediate transparency of a mobile app. The ability of an advisory firm, plan sponsor and plan administrator to offer a choice of service models - including in-plan advice and fiduciary wealth management (including trust) is fast becoming the expectation of HNW families - and history indicates those expectations roll “downhill” quickly to the mass affluent and beyond. Separate service models allow the advisor/firm/sponsor/platform owner to more easily and consistently focus on improvements for unique cohorts. Each needs to know we care enough to know and deliver against their preferences.

Lever Five: Adoption is the New Innovation

Last for a reason, “adoption” here refers to the integration of “wellness” principles into the delivery of services and solutions. There is both a “will” and a “skill” perspective to adoption. Financial advisors may or may not have the skill to help clients plan with the full empathy needed to anticipate the needs of an aging parent or pay off a child’s college loan. That’s a management problem for an advisory firm to make sure empathetic advisors are in place. Bull market success further reduces the incentive to engage - the “will” - as well as the energy to reach all of the clients in a given advisory practice. This failure to engage creates real risk for firms with low share of wallet - as we saw with Fidelity in 2009. Especially if their engagement is wholly dependent on the will of the human advisor and does not - as we did at Fidelity - complement busy advisors with consumer outreach in support of advisors to drive warm leads. But wait a minute, Merrill Lynch did the same with Total Merrill 20 years ago. The future of large scale client engagement is to provide some level of lead generation and direct-to-consumer outreach on behalf of advisors and not rely on human advisors to fully shoulder the burden of optimizing the opportunity of the full client roster.

Discovery: We Can Design for Adoption

Adoption is also a challenge to the operational eco-system of the advisory firm or plan administrator. Call it “ethos” or values or customer centricity, the issue of wellness adoption by the eco-system is simultaneously an issue of empathy and humility and the willingness to invest. Removing friction from systems benefits consumers and delivering associates. But it needs a vigilant champion empowered to take action. And budget to improve system effectiveness.

The reality of adoption is that it is seldom achieved because of either will or skill. Adoption of the complex array of anything - including the myriad “wellness” measures needed to produce human peace of mind - is most often the product of DESIGN. The most adopted products and procedures lend themselves to adoption because adoption was one of their creators’ key design principles. In the popular consumer view, if I need an owner’s manual to understand a product, I might not want it. Financial firms seeking better and more comprehensive engagement of plan participants and advice clients will increasingly have to facilitate that engagement, not hope that if they build “wellness”, people will clamor for it.

The Business of Wellness: The State of Mind to Create Peace of Mind

The bad news for companies is that “wellness” is not a widget they can attach to their existing offering. That approach has been attempted with the best of intentions by retirement income product providers who developed myriad riders and benefits aimed at specific consumer objectives and concerns, like combatting inflation or funding long-term care. In the hands of good advisors during the planning process, these products and their capabilities can provide invaluable peace of mind. But complexity of the products and their sometimes inconsistent availability (and pricing) are barriers to more consistent use in planning - and adoption by more advisors. These barriers are beginning to fall as demand for peace of mind – protection, security – rises and firms respond.

“Wellness” Requires Technology, Humans Alone Can’t Ensure Peace of Mind

To achieve its true potential as the True North of retirement solutions, “wellness” has to be integral to the language and the systems and the solutions of the firm. Despite the good intentions of many service contacts and financial advisors, the human resources of the industry don’t have the capacity to accurately record and maintain full engagement with clients, participants and their families. There are too many people to track, to proactively provide information and to be available to help establish and maintain “peace of mind”. I will never forget the call from a seasoned advisor who had completed his outreach to a HNW family, with the help of the head of household. “I now have nine clients instead of one!” He was only partially kidding. It’s a lot of work to track the needs of families and you don’t want to be the advisor who missed a Medicare election, a life event or the 21st birthday of a beneficiary. The solution is a combination of proactive systems leveraging data, simple tools that can be accessed by consumers and help self-actualize their needs, along with old school training, coaching and learning for all human associates for how they can best succeed in a company dedicated to “peace of mind”. This is the Village of Adoption needed to establish human leaders and delivery champions, DIY options for consumers and data-based processes to ensure the reach and consistency of engagement. And that is the #1 job of today’s financial firm CEOs, creating peace of mind – aka “wellness” – for BOTH their clients and associates.

Three Blind Wealth Management Execs and the Demographic Elephant

“Uncertainty” is an interesting condition that vexes human beings. Most of us like certainty – we want to know what’s going to happen. Young adults heading off to colleges right now run the emotional gamut from excitement to fear. Politicians are anxious – what about those mid-terms? Investors are anxious – is the bull ending? Investors hate uncertainty.

And yet uncertainty – or more accurately, the reaction to uncertainty – is the stuff that real leadership is made of. The adage remains that we share with those college-bound kids, “You cannot control what happens to you, but you can control your response”. That’s what growing up is all about – learning to cope, learning to take advantage, learning to take control of what you can control.

The Uncertain Future of the Financial Advice Industry

The advice industry faces an uncertain future. A retiring age wave of Baby Boomers built the industry into its current form, focused primarily on investing. And wow, what a run – boosted by historic gains in both stocks and bonds.

But now that demographic wave wants to spend their gains, live their lives in different and more relaxed ways – and the industry stumbles to provide the solutions with a level of clarity and certainty our clients seek. But what exactly does that mean for each company, each advisor? What are those steps each has to take now to ensure client retention as competitors home in on our blind spots??

The famous parable of the elephant and the blind men is worth revisiting. The narrative depicts three men confronting an elephant for the first time. Being blind, each man feels for clues about the enormous creature. They share their perceptions, but their accounts are wildly different for each has grabbed a different part of the elephant. One feels a leg and “sees” a tree. One feels the massive body and “sees” a wall. Another feels the trunk and “sees” a snake. The differing accounts and the ensuing acrimony about the “truth” spurs a fight among the men. In “Coping with Negative Life Events,” authors C.R. Snyder and Carol Ford explain the moral of the parable as the tendency for humans to claim absolute truth based on their limited, subjective experience as they ignore other people’s limited, subjective experiences, which may be equally true. Sounds like 2020 presidential politics to me.

Take Off Your Blindfolds – Elephant Approaching!

New conditions challenge everyone. The tendency is for managers and leaders to depend too heavily on the experiences and perspective they earned on their way to the top. But in times of unprecedented change and uncharted waters, all that “experience” can be a blindfold. The three men in the Hindu parable aren’t stupid – they just can’t see. What they all have in common is the inability to see the total picture and to fully understand what is – literally – right in front of them. And the fact that all three are stuck on their separate perceptions makes it impossible for them to work together.

For leaders of the wealth management industry, the aging demographic is our elephant. It is planted right in front of us, everywhere and every day. And yet it is hard to see it, as well as all of its implications for our business, in its entirety. Depending on the primary focus of your day job, you may have one perception of “aging” that is quite different from that of another leader whose primary focus is elsewhere.

It's 1946: Your Warning is Here

For example, if your firm manages separate accounts and mutual funds, your portfolio managers can be happily beating the market while you might be frustrated by redemptions. Upon closer examination, the redemptions are skewed to clients over 70. We hear a lot about 10,000 baby boomers turning 65 every day. Some of them have been investing for retirement – and that retirement has arrived. Surprised? Really?

More subtle are some other “parts” of the elephant. Stay with the daily flow of boomers but now focus farther downstream on the 9,500-plus who turn 74 every day. Nine years deeper in that classic retirement zone come more problems – dementia, other forms of diminished capacity and death. Thousands of clients are losing their ability to safely manage their accounts every day. And more and more clients are dying every day. Clients know about these conditions – there is no reason to tip toe.

Compliance is On The Phone – It’s About Those Aging Clients…Again

Ask the compliance department of any big firm about the growing challenge of protecting aging clients. Ask the investor services groups about the spike in reregistrations due to death or disability. Check in with sales teams, advisers and customer service reps about the scramble to locate responsible family members because clients haven’t shared that information (or we haven’t asked). What does legal see on the litigation and arbitration calendar? Government affairs can tell you a lot about growing regulatory scrutiny – especially from the states.

There are lots of legs and tails and tusks on the demographic elephant that have been there all along. What has changed is the size of the animal. For years, the aging demographic wasn’t an elephant, it was a poodle. Or a golden retriever. It had legs and a tail, but it was smaller and softer, and more friendly. But now we have an elephant in the room. Adjustments have to be made.

Grab A Tusk, Any Tusk

And we cannot fully enjoy the parable without pointing out that not only has the size of the animal changed but so has the environment. All of these elephant parts were solidly attached before the market correction. Stretching our story a bit, imagine the blind men trying to identify the elephant during a stampede. The guy holding the trunk might have a grip but the one on the leg is a casualty. Hang on tight, the “stampede” makes all these issues more acute, and more complicated, and harder to resolve under the pressure of rising volumes.

Unfortunately, we’re not going to cage this elephant anytime soon. There is a reason great friend and Next Chapter colleague, Ken Dychtwald coined the term “age wave” (in 1989!) – this phenomenon is still in the early stage. Its roughest effects are growing and will continue to grow at an increasing pace through 2035. That time period captures pretty much all of the current wealth management industry leadership, so best we get started. Future industry leaders are the ones who will pull off their blindfolds and demand the same of their colleagues. They will understand their business just might be defined by how they respond to the elephant…and the stampede.

Pareto’s Revenge

25 years ago in Indianapolis a simple question asked by a 21 year old sales assistant awakened an at-scale industry to the benefits of high touch - and set the stage for that scale opportunity to return in 2022.

Way way back in 1997, I met a terrific Merrill Lynch advisor and his young sales assistant who found that 88% of their practice’s revenues were created by just 12% of their clients. “Why do we do so much for people who don’t pay us?”, was her naïve query.

Sharing their discovery with supportive local management, the pair shrunk their book to just 35 households while increasing proactive engagement with each family. The results were staggering. Share of wallet soared as assets were consolidated, significantly boosted their revenues and driving a crazy level of referrals. I captured the story in a 2001 book with Evan Cooper, Attract and Retain the Affluent Investor. But the real traction occurred with the practice management concept of Supernova, followed by a new service model I was privileged to help build - Merrill Lynch Private Wealth.

High touch with fewer clients was not a new concept. Goldman Sachs and most private banks were already reaping the benefits, including high share of wallet, intergenerational wealth transfer and valuable referrals of similar clients. The nuance was acceptance at a “scale” player known at the time for bringing “Wall Street to Main Street”. At the time the average Series 7 registered representative had 500 accounts scattered across 125 households. Applying that 88/12 - or the more familiar 80/20 Pareto principle - meant that most of an advisor’s revenue was earned from just 25 of those households. Skeptics demanded more data - but the facts confirmed the harsh reality.

The march continued - wealth management was an exclusive offering and personal attention was available - to the wealthiest clients.

Fast forward to Fidelity in late 2009. Net outflows to competition spurred analysis that revealed to our new team that even longtime clients were looking for “planning” and “relationship” - and willing to pay more. SOW of high value clients had slid below 50%. A bold new strategy to turn the tide was ultimately successful, driving AUA from $850 billion to now well over $4 trillion and establishing Fidelity’s retail division as the largest Fidelity business unit.

But what about Pareto?

A closer look at the Fidelity retail engagement strategy shows the firm actually embraced Pareto by separating clients by service model. A new advice offering was provided to clients seeking high touch (and willing to pay), while enhanced DIY digital tools created the industry’s biggest robo. In the middle floated the ad hoc offering, the Private Client Group, with the on-call availability of human advisors. So there was respect for 80/20 - at both ends.

The key of course was client segmentation - with service models to match client preferences. Target client personas humanized efforts to better connect with clients. Having an Active Trader offering and a High Net Worth Bond Desk drove more self-directed client engagement and recaptured assets that had decamped for other firms. Buying a bond online became as easy as picking a stock. Many client households had accounts in multiple service models for different purposes and often for different family members.

Results tell the story. Net flows turned positive as Fidelity’s Private Client Group net promoter score soared from 8 to 63. Advice and guidance efforts expanded to include retirement plan participants.

Fast forward again to today. Bull market confidence has helped scatter client assets across the industry to an array of providers. We see wire house numbers averaging 50% SOW - with higher rates among top advisors but the same stubborn 80/20 rule across the board. The “moveable middle” advisor population tops 60% in many firms, according to one IBD CEO and confirmed by others. Typical HNW households are working with 4-6 providers.

Money is on the move - still seeking more “relationship” and “planning” - and the inevitable post-bull consolidation. Add in the march to retirement by the Boomer age wave and you have the makings of a serious battle for assets. Without a better strategy for segmenting and servicing clients, the lack of industry capacity to engage with human advisors will lead to serious losses among “scale” firms dependent on human advisors for coverage.

The biggest players are on it. Morgan Stanley and UBS acquired robo/DIY capabilities. Empower is angling in from the plan participant side, plus Personal Capital and Morgan bought Soliam and also offers Graystone advisors. Merrill is now a bank and touts Merrill Direct. All great additions with significant long-term promise. And therein lies Pareto’s revenge.

80% of financial industry consumers are unaware of these innovations because they don’t see the benefits. They are waiting and wondering - increasingly anxious about their retirement accounts. Annuity sales in the second quarter of 2022 were the highest ever. Securitized lending has soared. Peace of mind, wellness, protected income, certainty - all great objectives but hard to achieve if you don’t have a lot of dough. Add a historic level of advisor retirements and you have even fewer available trusted professionals.

The parts are there, the execution is not. Buying a capability is not the same business as integrating and connecting the capability, aligning it with the delivery mechanisms and then driving adoption among both advisors and consumers. Imagine your new big screen TV without a power cord…..

Meanwhile, Pareto’s Revenge awaits the firms that cannot reach the unengaged clients. FinTech entrepreneurs are salivating over the gaps they can fill with capabilities that work 24/7/365. Imagine the fate of the human advisory firm that misses a client’s window for selecting their Medicare plan, and the robot gets there on time.

Digital journeys, next best actions, client data mining and better segmentation are all in flight, but the number of impacted clients indicates we are still in the very early innings of a long game. At The Execution Project, this is our world. At-scale engagement using client segmentation, advisor coaching, scale plays with targeted offerings using both advisors and direct-to-consumer lead generation in support of advisors. The upside is extraordinary but the work of adoption is dullingly old school. Companies holding on to bull market profits hope the 20% can keep producing but Pareto is on the rise.

Steve Gresham is ceo of The Execution Project, LLC, a consulting firm driving adoption of wealth management innovations, and managing partner of Next Chapter, an industry effort to reimagine “retirement” across 60 affiliated companies. From 2009-2017, he was executive vice president and head of Fidelity’s Private Client Group.