This is Us

Mention “financial wellness” to 10 attendees of a FinTech conference and you might get 15 definitions. Ask 10 clients and you might have the same result. The label is intriguing and appealing, but there’s an onion here that needs peeling. Leave out the “financial” angle for a moment and consider that wellness can be evaluated through the different dimensions of:

- Physical wellness

- Emotional wellness

- Social wellness

- Intellectual wellness

- Spiritual wellness

- Environmental wellness

- Occupational wellness

Credit: blog.bestself.co

“Wellness” is a noun – but also a verb. Webster says that wellness is “the state of being in good health, especially as an actively pursued goal (emphasis mine), …as in.. “measures of a patient’s progress toward wellness”. So wellness is also a process in pursuit of the goal of wellness.

When we combine these perspectives, “financial” wellness is easier to define, but harder to accomplish. Money is relevant to all seven of the dimensions listed above. Having money can help fund solutions and opportunities to improve most aspects of wellness. In addition, wellness is dynamic – changing as we age, rising and falling in importance. What jumps out to me is the complexity of achieving “wellness” – and the opportunity to employ both digital and human support to finance wellness.

Many top advisors – and clients -- characterize financial wellness as “peace of mind”. And when you unpack the headline you locate the dimensions listed above, as well as the process of ongoing contact, review and reinforcement that describes the best advisor/client working relationships in wealth management. At minimum, the industry needs to support a holistic approach to clients’ new found longevity to help them discover and address their growing and changing needs for “peace of mind”. It is critical to appreciate that we are all traveling together on a journey none of us has completed before – growing awareness of our own longevity and how our world view is changing. “Aging” clients and advisors are not abstract population cohorts – they’re us!

So the key to “financial wellness” is the entirely subjective definition of “personal peace of mind”, as well as the recognition that it’s also a process that will evolve as the different dimensions listed above present themselves at different times. A more broadly aging society led by the massive Baby Boomer cohort is discovering the importance of life balance as the median hits 66 this year – and the oldest are 76. At those ages, our clients (and some of our advisors!) have growing awareness and appreciation for the value of emotional, spiritual and intellectual wellness. Their need for mobility supports physical wellness. Being relevant and engaged keeps many working for occupational wellness. And perhaps most important in later ages is the importance of social and environmental wellness – to be with others and to live safely and independently. If we are paying attention, financial wellness is already teed up for us to hit head on.

And that’s the real point of financial wellness. Financial industry leaders that talk about financial wellness are declaring the path forward for the industry -- the objective of the advisor/client/digital working relationship. They are challenging us to align in support of the clients’ personal peace of mind and the growing, shifting aspects of wellness as they discover more perspective. And it’s the moment of truth for financial advisors, many of whom are challenged to muster the empathy and insight needed to fully support the clients, as well as the flexibility and interest to engage effective technology to help them deliver more effectively across their entire clientele.

Financial wellness is becoming the True North of the wealth management industry, and it’s a journey we are all taking. Together.

Chart of the Decade

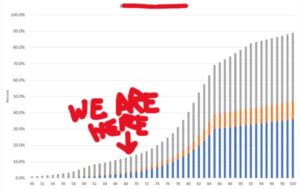

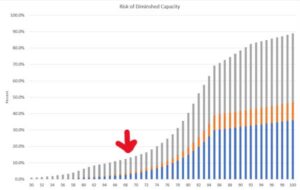

At a recent meeting of top advisors hosted by education innovator Wright State University (where flight was born), I shared this chart under the guise of “opportunity”.

What’s the subject?, I asked. Tesla stock price? Bitcoin projection? Spending on FinTechs? Nearly a perfect S-curve, which favors the early adopters. And the best news, we can catch this one just before the S takes flight – note the arrow.

The big reveal caused a mixed reaction. The majority of the audience reacted thoughtfully, many nodding heads. These advisors see the landscape – every day – through the lives of their clients, their friends and families. The chart is a propensity chart, depicting the likelihood of experiencing some level of incapacity due to one of the three most common health events to cause incapacity – Alzheimer’s, other forms of dementia, myocardial infarction (heart attack).

The savvy advisors know from experience that each of these ailments presents a life change – to the client/patient and to the family. The impact is both immediate and ongoing. Nothing is ever the same. Priorities change. In the world of financial and retirement advice, advisors are needed more than ever and for more complex services.

Our response is critical. We have to react with empathy, engage professionally and with confidence. We become the financial emergency room, transitioning to long-term care. And not just for our primary, affected client – we have to be there for perhaps three generations of family members who are now also affected. Everyone needs to know we have this, we can help.

We don’t have much time before these conditions accelerate in frequency. The current overall propensity rate is 1 in 8 for people age 68 but more than doubles by 78 – and 6X at 88. Over the next ten years, nearly 1 in 3 people we now serve are likely to become incapacitated themselves, and a great many more will be impacted by someone in their life who becomes incapacitated.

For advisors and their firms serving the Baby Boomer age wave of 76 million people, this transition has been looming…but preparation is still light. Every firm and every advisor will need policies, procedures and supportive tools to:

- Identify incapacity for the protection of the client, her family and the firm

- Protect clients and their families from the threats of incapacity, including identity theft, fraud and elder abuse

- Engage families in support of incapacitated clients – as well as clients without family support

- Adjust to the needs of a family of three generations or more and help optimize finances for risk, tax, income and long-term care

Don’t Ignore This Moment

If you are winding down your advisory career, you might be doing the math and saying that in ten years you will be on a beach living the vida mas fina. That’s probably pretty well known by your clients and their families. As Accredited Investor co-founder, Ross Levin said so well at our Next Chapter Rockin’ Retirement event on May 24, top firms are winning clients and keeping clients because they have a “contract” with clients and their families that the firm will be there for them. Another speaker, veteran Tom Bradley of Schwab noted that aging clients – and aging advisors – are now important measures for the valuation of an advisory practice (get the whole program here ADD LINK to NEXT CHAPTER MEMBERSHIP).

One very interesting aspect of this chart is that it is also a good picture of the demand for pretty much everything associated with the historic demographic cohort. If they will need it, you name it and the growth curve will be similar. Demand for in-home caregivers, Medicare counselling, pickleball courts, assisted living facilities…they’re all here at the same time. Consider…..

The Price of Ignorance – Five Risks Ahead

I’ve also spent a lot of time worrying about this issue on behalf of big company clients and I see five significant risks of keeping our heads in the sand:

- We lose current clients and their assets

- We lose the potential consolidation of assets held by our clients elsewhere – that’s a pretty similar number to the total in 1 above

- We lose the client’s family – if we don’t take care of the primary client, the family won’t stick around. Surviving spouses and adult children have no affinity for our failure to act.

- We risk increasing scrutiny as fiduciaries or service providers that do not sufficiently “know your client” – an area of growing interest to state consumer protection regulators. Get ready also for a return of active arbitration in this area as we return to in-person activity after a pandemic slowdown.

- Finally, a firm that does not do well by its aging clients is exposed to significant reputational risk. Poor experiences might be contained in the complaint process, but some of the more colorful cases will doubtless make headlines – electronic or otherwise. I expect a lot of interest in these stories.

Other Than That Mrs. Lincoln, How Was the Play?

Every corner of the financial advice and investment management industry has benefited handsomely, unexpectedly from the historic demographic wave and the power of that wave to lift all economic boats. Now it’s time to repay some of that value by meeting the needs of our loyal clients and their families – all of whom will be encountering their longevity for the first time. Our ability to serve is a function of both will and skill. I’m completely confident we have the skill. Do we have the will?

Steve Gresham is on a mission to improve longevity and “retirement”. He leads an industry initiative, Next Chapter, and is ceo of consulting firm, The Execution Project, LLC. He is also senior educational advisor to the Alliance for Lifetime Income. Formerly head of Fidelity’s Private Client Group, he is the author of five books about wealth management including The New Advisor for Life. He also served for eight years on the faculty of Brown University where he taught the impact of an aging population.

Follow the White Flags – To Success

Streaming one of those endless crime series recently, I watched the lead investigator offer bad news at a press conference - “The rescue mission has now shifted to a recovery effort”. A little dramatic for our mundane world of retirement planning - but maybe not. I wrote awhile back that most of us heading toward our next chapter have made mistakes in our preparation

https://www.fa-mag.com/news/the-oh-sh-t-moments-of-retirement-planning-67066.html

Many of those mistakes are financial miscalculations - I know I will need to seriously restrict my spending. Some are investing errors – taking too little risk or too much. The most impactful seem to involve family and healthcare when the inevitable but still unexpected impacts of longevity take their toll. And even the lucky few not derailed by financial, investment or family issues may be weighed down by the importance of living a meaningful life. That’s a lot of potential planning potholes to navigate. Every family will fall into one or more – and most will need help to recover. The markets are not helping. Neither is the stubborn pandemic or global instability or domestic politics. Most people are worried about a lot of things.

So get ready for the equally inevitable shift in the retirement planning profession from a mission of funding a “next chapter” to recovering a failed retirement plan. Our observations in the Next Chapter industry initiative (https://theexecutionproject.com/community/)

are clear – the industry is not ready for this job. The contrast I’d offer is that we will be shifting from mostly selling new cars to fixing them when they’ve broken down. Complementary roles for sure in my car dealerships, but not the same.

I’ve long advocated for a more realistic view of retirement planning that tracks with the experiences of leading advisors and how they help real clients with real life. Those pros tell us over and over about clients hoping to stretch savings to cover a preferred lifestyle instead of first determining the level of their retirement paycheck. They repeat stories of life events and healthcare “surprises” that are really only surprises if you think you are immune to the impacts of aging. I will never forget an interaction with the ceo of a global financial firm who called wondering if he should be added to the accounts of his father….now that Dad turned 91. I wonder what precautions are used at his company for millions of people vulnerable to mistakes and exploitation in their later years - long before 91 – especially since 25% of people aged 65+ have dementia of some kind. Common sense is a great ally when planning…..

The implications of “retirement recovery” begin with a few very uncomfortable conditions among advisors, their firms, the supporting cast of product companies - and the clients themselves. Each plays a part to right the ship. The inconvenient truth is that of course each has contributed in some way to the problem of unpreparedness. To really help Americans have a fighting chance, each will have to own their role in the current state and prepare recovery tactics. That’s now. Each actor will also have to adjust their approach to younger clients and make sure the lessons learned are applied to the future. This is not about organizational CYA – though too many advisors and firms will worry about this angle and their “liability” for confronting the truth - this is about a genuinely human concern to improve the situation. It is less important to rehash how we got here, it is more important to show our genuine commitment to recovering the plan.

Personal health care offers a good example of this “recovery” pathway. When you have a medical issue, the first step is to deal with the current symptoms - reduce pain, improve comfort. Focus on what to do now. Only then can we look more closely at the cause(s) of the problem. Required skills here are listening and empathy. Are we really good at those?

I’m pretty sure Retirement Recovery will soon become the #1 driver of referrals and new clients. Most of the new opportunities will flow from the wreckage of plans gone off the rails. You will confront more people who are surprised, concerned, mad at their prior advisors, mad at themselves - and embarrassed. Job 1 for us is to acknowledge and normalize their condition. They are not alone - they are actually reflective of the vast majority of retirement plan clients.

Before you dismiss that last line, which will stand in our way if we don’t accept it, is to fully comprehend the full needs of “retirement” (https://www.fa-mag.com/news/where-are-the-retirees--yachts-66565.html)

Three conversations help organize the process of recovery – financial issues, investment decisions and family concerns (mostly about health and care). Back to those top advisors who remind us that retirement is a family affair and that one or more of the family members do not really understand the multiple moving parts. True financial literacy is rare enough – how the sometimes complex and arcane concepts apply to them is even more elusive.

The core strategy of a recovery strategy is simple but not easy, as Buffett famously observed about investing. So channel common sense and consider:

- Empathize to normalize – no matter the client situation, “you are not alone, everyone has issues”. Actually, multiple issues. So let’s first get a complete inventory of what you worry about. We may not be able to solve them all, but let’s get a total checkup of the car and not just fix the flat tire. A top advisor tip – start fixing the “tire” quickly, confidently and at a very reasonable price in order to set the stage for the bodywork and new transmission to follow.

- Educate to remediate – are we confident in the investment choices and solutions – do you know the role of each solution you own and are their better options? A tip – make sure you know where each product came from and who was involved before making any judgments. We don’t need client defensiveness in the way of building trust.

- Is everyone on board? Do all family members understand the plan and the underlying choices that really determine success – such as the choice of where to live and the expectations for providing care when you need it? A tip – probe about those family dynamics – and keep probing. Fewer than half of clients with advisors told a national IWI survey their advisor does not include the spouse in planning, let alone aging parents or adult children. And we wonder why 70% of widows nuke the advisor?

- Keeping the lines of communication open and active as the next chapter unfolds – there will be changes needed and more decisions. That’s life. But this aspect of staying current is where the robos are killing advisors. Failure to keep up with specific, totally predictable life events is probably the most critical need of retiring families and the best entry point for earning referrals. An advisory firm I met with recently sets the stage for what they do by first asking any new prospect about the elections they’ve made for Social Security and Medicare – and what happens to their estate if they (a couple) were hit by a bus tomorrow. No investment or performance discussion, no tax returns – just showing their interest in the decisions that are must-make for us all that reveal their level of preparation. The robo does not forget a date, does not tire of sending reminders (though only by text or email), and will keep getting smarter as it learns more about the client. If Google News, Amazon and Nordstrom can suggest what I want to read or buy with the accuracy I’ve seen so far, the most feared new advisor in town is an avatar.

Only the Outcomes Matter

While many – most – retirement plans will at some point be shifted to a “recovery” effort, we can always share our learnings with other clients. The first opportunity of the “white flags” by clients willing to accept help is the mindfulness of those clients. Saving someone’s retirement plan is not about producing financial rabbits out of a hat – it is mostly about helping the clients accept their condition and making the best of it. As we guide our own children by saying, “You cannot control what happens to you – but you can control your response”, we have a similar moment with white flag retirement realists. And that word will spread rapidly. First to the heirs, and then on to the peers and colleagues. Get ready for the line around the block to your door.